1)

A Thread on Investing in Holding company

Should one consider investing in a holding company?

#holdingcompany

A Thread on Investing in Holding company

Should one consider investing in a holding company?

#holdingcompany

2)what is Holding company?

A Holdco is a type of company which holds a controlling interest in other companies called subsidary companies, which may or may not carry out business operations.

Valuation of holdco is done using sum-of-parts of the investments that the holdco holds

A Holdco is a type of company which holds a controlling interest in other companies called subsidary companies, which may or may not carry out business operations.

Valuation of holdco is done using sum-of-parts of the investments that the holdco holds

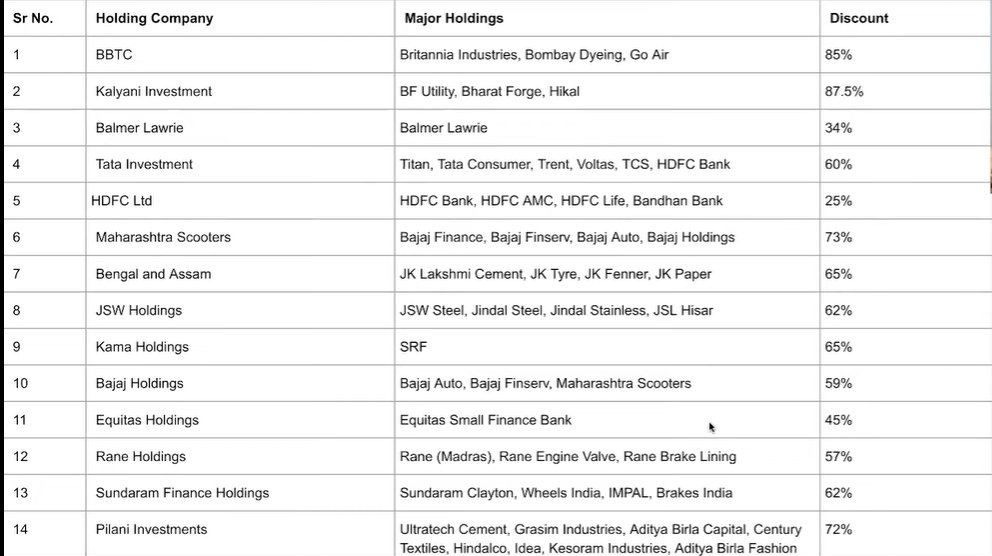

4)why to invest in holdco?

- avaiable at discounted value

- relatively cheaper valuations vs underlying investmest

- access to multiple group companies thorugh one co

- more dividends

- if discount narrows,one can except multi-bagger retunrs

- avaiable at discounted value

- relatively cheaper valuations vs underlying investmest

- access to multiple group companies thorugh one co

- more dividends

- if discount narrows,one can except multi-bagger retunrs

5) Why Holdco's trade at a discount ?

- dividend taxes

- Poor capital allocation

- indirect control

- Leakages due to expensse on holdco

- dividend taxes

- Poor capital allocation

- indirect control

- Leakages due to expensse on holdco

6) how much money can be by investing in holdco?

For eg, if holdco is trading at a discount of 90% & if this discount narrows to 80% & the investee company gives a return of 50% ,

Holdco will be valued at 3x its current value, meaning a 3x return in the same period.

For eg, if holdco is trading at a discount of 90% & if this discount narrows to 80% & the investee company gives a return of 50% ,

Holdco will be valued at 3x its current value, meaning a 3x return in the same period.

7)its better to invest in holdco otherthen investing in standalone entity,also we get oppuruntity to invest in group cos indirectly.

here's what Rajeev Thakkar of @PPFAS @RajeevThakkar says about returns in holdco and underlying co

here's what Rajeev Thakkar of @PPFAS @RajeevThakkar says about returns in holdco and underlying co

8) things to consider before investing in holdco

-quality of holdco

-dividend yield

-discount to underlying asset

-prefer big group holdcos like TATA, bajaj etc

-quality of holdco

-dividend yield

-discount to underlying asset

-prefer big group holdcos like TATA, bajaj etc

10)conclusion

its better to invest in rally good holdco as and when the discount narrows the return could be multi-bagger

end of thread

its better to invest in rally good holdco as and when the discount narrows the return could be multi-bagger

end of thread

Tagging for wider reach

@LearningEleven @aditya_kondawar

@AI_Feb21 @tushar9590 @AdityaD_Shah @sagarbandodkar2

@sahil_vi @Confident_AA @ParveenBhansali @Ajaya_buddy

@Vineet_invstor @Jai0409 @DrdhimanBhatta1 @ishmohit1

@LearningEleven @aditya_kondawar

@AI_Feb21 @tushar9590 @AdityaD_Shah @sagarbandodkar2

@sahil_vi @Confident_AA @ParveenBhansali @Ajaya_buddy

@Vineet_invstor @Jai0409 @DrdhimanBhatta1 @ishmohit1

https://twitter.com/amithv_gowda/status/1584545810276286464?t=fxR-BtpEtQMN8v3brVJKZg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh