Sunday Stocks catch up with Janak.. Let's go 🧵

Disc: Not a reco

Disc: Not a reco

(1/N) Auto industries focused, #KPIT Technologies’ Q2 profits surged 28%. The Company has guided for yearly profits to be higher by around 32%.

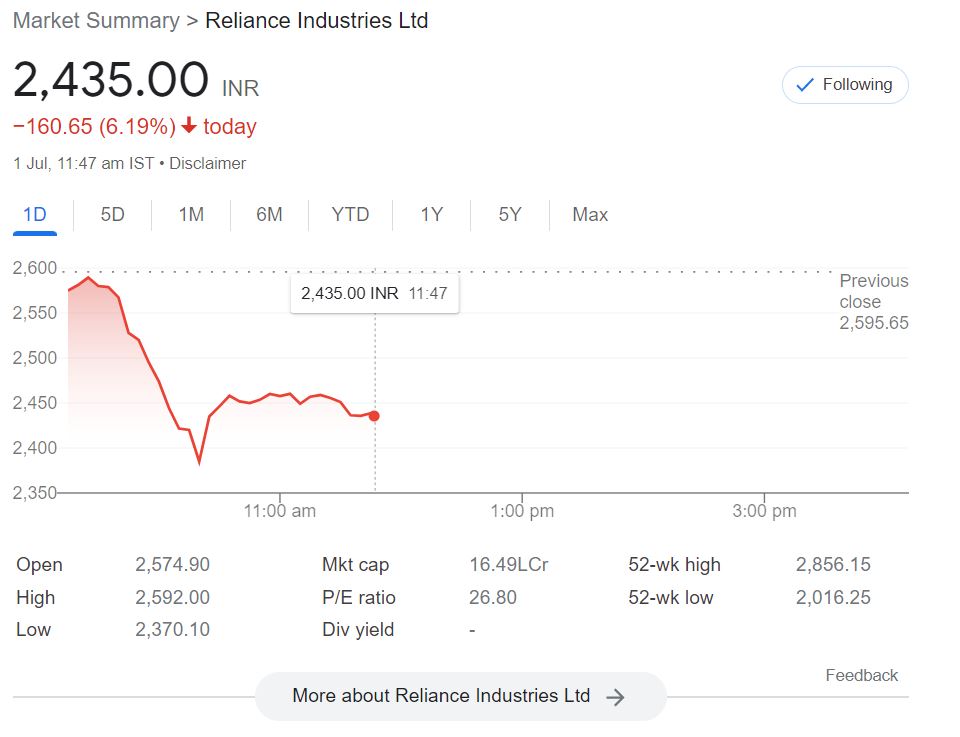

(2/N) #RIL’s Q2 profit was flat despite a 32% rise in revenue. Jio business going strong thought

(3/N) Divestment candidate #IDBI BANK posted 46% higher Q2 NP of Rs. 828 cr.

(4/n) FMGC major HUL’s Q2 sales rose 16% while NP rose around 20%. One of the defensive bets in FMCG

(5/n) At the recent Defence exhibition at Gandhinagar, #HAL won a contract to make 40 trainer aircrafts worth Rs. 6800 cr. for the IAF

(6/n) #Dodla Dairy’s Q2 NP surged 34.2% to Rs 39.45 crore on the back of higher demand & selling price, declining costs and taxes.

(7/n) Microfinance lender #CreditAccess Grameen’s Q2 income jumped 31.6% to Rs 814.31 cr. with PBT of Rs 229.01 cr., triple that of last year.

(8/n) #Coal India is rallying on the back of rising Capex as Q1 capex jumped 65% to Rs. 3034 cr. With higher production to meet the rising demand, a higher NP & dividend hopes

(9/n) #AstraMicro is developing vital defense-related products (radio frequency and microwave solution) for the Indian armed forces along with DRDO.

(10/n) #Dabur has acquired 51% stake in Badshah Masala, manufacturer and exporter of spices, for Rs 587 crore and the balance 49% stake will be acquired after five years.

(11/n) #Meghmani Organics, a multi products chemical major, is setting up a 33,000 TPA White Pigment Titanium Dioxide at Dahej at Rs 600 cr. to be completed by Q3FY24 in two phases raising its capacity from 16,500 to 49,500 TPA.

(12/n) #Gokaldas Exports has done well in spite of adverse expectations. Consistent performance on the back of proposed capex

Like/Retweet/Follow for regular updates

• • •

Missing some Tweet in this thread? You can try to

force a refresh