Hey #CardanoCommunity!

Under the banner of our new weekly series of threads called #ThisWeekInCardano

we will have a #FeaturedProject section,

deep-diving into one project within the #Cardano ecosystem.

This week's #FeaturedProject is @liqwidfinance 👇🔥

Under the banner of our new weekly series of threads called #ThisWeekInCardano

we will have a #FeaturedProject section,

deep-diving into one project within the #Cardano ecosystem.

This week's #FeaturedProject is @liqwidfinance 👇🔥

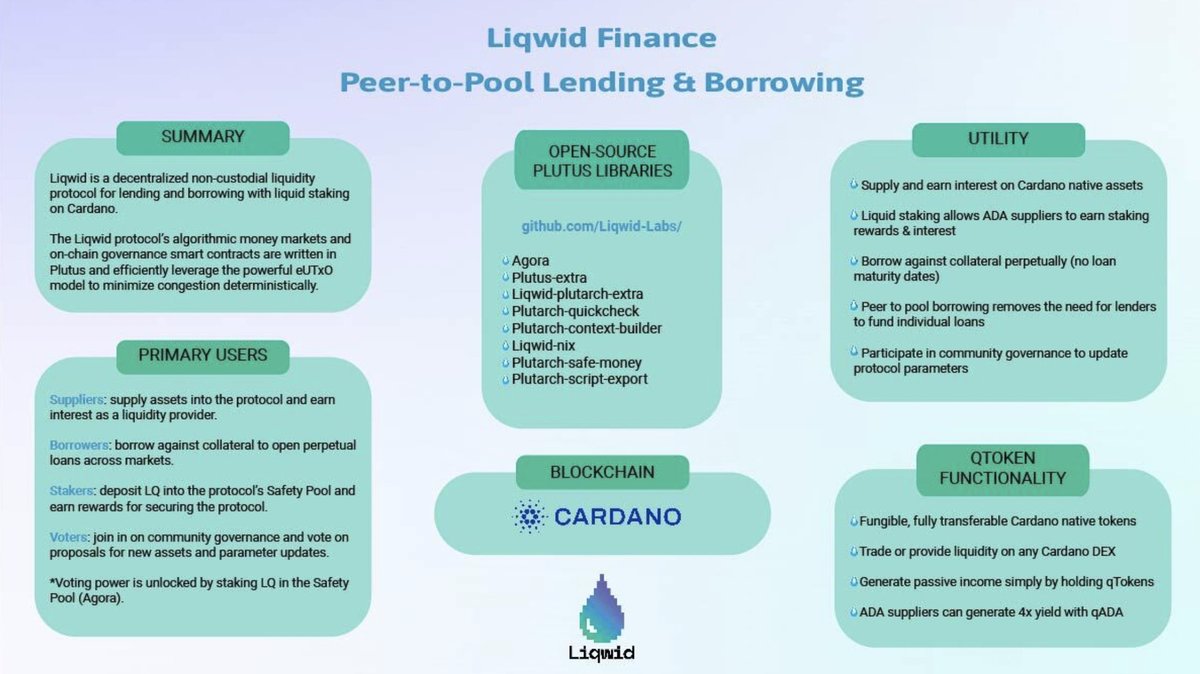

@liqwidfinance is a decentralized lending & borrowing platform on #Cardano

Users participate in the protocol as lenders or borrowers

Lenders supply liquidity to the Market to earn interest on deposits.

Borrowers are able to open perpetual loans in an overcollateralized manner

Users participate in the protocol as lenders or borrowers

Lenders supply liquidity to the Market to earn interest on deposits.

Borrowers are able to open perpetual loans in an overcollateralized manner

@liqwidfinance If you wanna know more about DeFi Lending/Borrowing check out this thread:

https://twitter.com/1489265845666816001/status/1582655246861537281

Project Team

Liqwid has been founded in 2020 by

@DCdoso

@proofofakpan

Tashoma Vilini &

Florian Volery

Together with highly qualified team.

Additionaly, many respected Cardano builders act as partners & advisors.

Liqwid has been founded in 2020 by

@DCdoso

@proofofakpan

Tashoma Vilini &

Florian Volery

Together with highly qualified team.

Additionaly, many respected Cardano builders act as partners & advisors.

How does Liqwid work – put simply

In General:

In decentralized Lending & Borrowing, the user is borrowing against a collateral

that consists of volatile assets aka crypto assets.

In General:

In decentralized Lending & Borrowing, the user is borrowing against a collateral

that consists of volatile assets aka crypto assets.

If the price of the collateral goes up:

The borrower had received liquidity

while continuing to capture the increase of the locked asset’s value.

The borrower had received liquidity

while continuing to capture the increase of the locked asset’s value.

If the price of the collateral goes down:

The DeFi lending protocol will start liquidating (part of) the collateral

as its value approaches the value of the loan to either

repay the loan or maintain an acceptable loan-to-value (LTV) ratio.

The DeFi lending protocol will start liquidating (part of) the collateral

as its value approaches the value of the loan to either

repay the loan or maintain an acceptable loan-to-value (LTV) ratio.

At Liqwid:

Instead of pairing lenders and borrowers,

Liqwid protocol combines the user assets into a liquidity pool.

This is called peer-to-pool lending/borrowing.

Instead of pairing lenders and borrowers,

Liqwid protocol combines the user assets into a liquidity pool.

This is called peer-to-pool lending/borrowing.

To utilize the Liqwid protocol,

users first supply any of the available Cardano native assets e.g. #ADA.

The supplied #ADA is used as collateral backing for the loan.

users first supply any of the available Cardano native assets e.g. #ADA.

The supplied #ADA is used as collateral backing for the loan.

The supplied ADA can be borrowed against so-called qTokens

e.g. in the case of ADA--> qADA

to earn interest.

The user then earns interest from qADA.

e.g. in the case of ADA--> qADA

to earn interest.

The user then earns interest from qADA.

Each lender is given a ratio of qTokens when they deposit their asset into the market.

The interest rates are calculated algorithmically based on the existing market conditions.

Each supported asset on the protocol has an individual supply and demand market with its own APY.

The interest rates are calculated algorithmically based on the existing market conditions.

Each supported asset on the protocol has an individual supply and demand market with its own APY.

Next to borrowing your ADA (or any other Cardano native token),

there are 5 other streams of yield:

- Minting qADA

- Staking qADA

- Staking LQ

- Staking LP

- Providing Liquidity with LQ + ADA to DEXes

Assets are not locked - they can be withdrawn or traded at any time.

there are 5 other streams of yield:

- Minting qADA

- Staking qADA

- Staking LQ

- Staking LP

- Providing Liquidity with LQ + ADA to DEXes

Assets are not locked - they can be withdrawn or traded at any time.

qTokens:

qTokens are interest bearing tokens.

- They are supplied (minted) at the current exchange rate when you supply assets to a market contract.

- They are burned when you demand (redeem) assets.

qTokens are interest bearing tokens.

- They are supplied (minted) at the current exchange rate when you supply assets to a market contract.

- They are burned when you demand (redeem) assets.

qToken holders earn interest through the qToken to the underlying asset exchange rate,

which increases in value when borrowers repay loans plus accrued interest.

which increases in value when borrowers repay loans plus accrued interest.

By holding crypto assets as tokenized qToken balances you gain several benefits:

1. Earn interest on the underlying assets,

2. Keep your keys,

3. Stay long,

4. Borrow against qToken collateral.

1. Earn interest on the underlying assets,

2. Keep your keys,

3. Stay long,

4. Borrow against qToken collateral.

Liqwid DAO Token (LQ)

LQ represents the governance token of the Liqwid protocol.

LQ is used to

- propose upgrades,

- vote

- and implement changes

based on the outcome of Liqwid Improvement Proposals (LIPs)

LQ represents the governance token of the Liqwid protocol.

LQ is used to

- propose upgrades,

- vote

- and implement changes

based on the outcome of Liqwid Improvement Proposals (LIPs)

Liqwid's LQ token is one of the top trading pairs in Cardano.

https://twitter.com/1393007027698298881/status/1588199322482446336

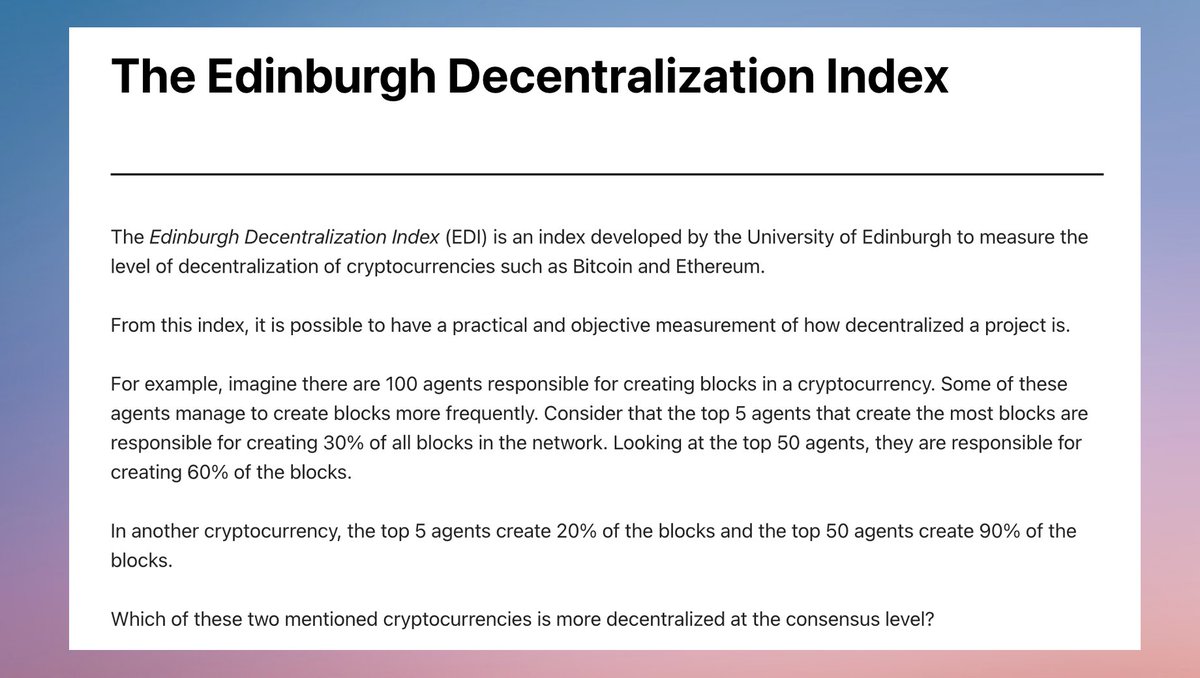

What makes the project stand out compared to others?

- Liqwid is one of the earliest decentralized, non-custodial lending/borrowing projects on #Cardano

- Liqwid is building the Agora on-chain governance module

- Liqwid is one of the earliest decentralized, non-custodial lending/borrowing projects on #Cardano

- Liqwid is building the Agora on-chain governance module

Status Quo of the project

Liqwid is in a public testing phase since October

- UI/UX of the App tested by end-users

- The Oracle is implemented to fetch external pricing data

- Agora audit is ongoing (anticipated completion by end of November)

Liqwid is in a public testing phase since October

- UI/UX of the App tested by end-users

- The Oracle is implemented to fetch external pricing data

- Agora audit is ongoing (anticipated completion by end of November)

Token distribution (LQ Token) of the Project:

LQ had a fair token launch with 75% of total tokens in hands of the community

- 70% of total LQ allocated for community distribution

- 5% seeded to the DAO Treasury contract

LQ had a fair token launch with 75% of total tokens in hands of the community

- 70% of total LQ allocated for community distribution

- 5% seeded to the DAO Treasury contract

Why did the project choose Cardano?

For the team #Cardano provides the best of both worlds:

Ethereum's programmability and Bitcoins ledger model

through Cardano's innovative eUTXO model and secure functional programming environment

For the team #Cardano provides the best of both worlds:

Ethereum's programmability and Bitcoins ledger model

through Cardano's innovative eUTXO model and secure functional programming environment

they saw the opportunity that Cardano would eventually play a major role in the broader #blockchain landscape

Here's an interview of the founder @DCdoso by @hashoshi4 👇

Here's an interview of the founder @DCdoso by @hashoshi4 👇

Contributions to the Cardano Ecosystem:

The major contribution supposedly is the Agora on-chain governance module.

Agora aims to bring together the tools for Cardano DAO development,

and serve as a single governance library for decentralized projects.

The major contribution supposedly is the Agora on-chain governance module.

Agora aims to bring together the tools for Cardano DAO development,

and serve as a single governance library for decentralized projects.

The Agora project is not a DAO.

It’s a Plutus library providing a standard framework for on-chain governance

which can be used by other dApps as well.

It is modeled after the Compound Governor Apha design pattern which is the premier governance module used in Ethereum DeFi.

It’s a Plutus library providing a standard framework for on-chain governance

which can be used by other dApps as well.

It is modeled after the Compound Governor Apha design pattern which is the premier governance module used in Ethereum DeFi.

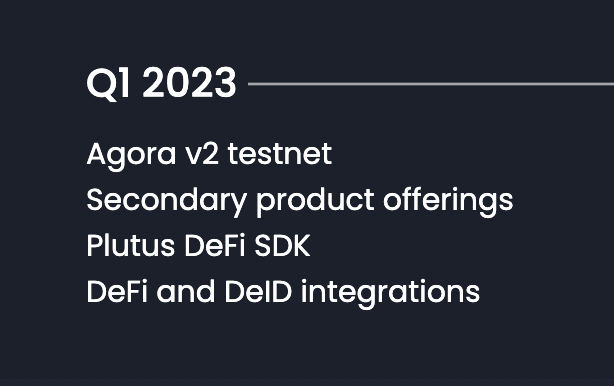

Roadmap of the Project

Liqwid Labs are planning to launch the v1 mainnet beta in December 2022

This comes after the long-awaited Vasil upgrade of #Cardano

The current roadmap shows the most anticipated events in Q4 2022 and Q1 2023

Here's the description👇

Liqwid Labs are planning to launch the v1 mainnet beta in December 2022

This comes after the long-awaited Vasil upgrade of #Cardano

The current roadmap shows the most anticipated events in Q4 2022 and Q1 2023

Here's the description👇

That's a wrap!

If you enjoyed this thread:

1. Follow me @DiMoneymindset for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @DiMoneymindset for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1489265845666816001/status/1589339774141321216

@liqwidfinance If you like Tweets like this, you might enjoy our weekly newsletter: Just The Metrics.

A 5-minutes, easy-to-understand newsletter about crypto fundamentals to stay up to date & be better crypto investors 📈

Subscribe here👇

…st-the-metrics-newsletter.beehiiv.com

A 5-minutes, easy-to-understand newsletter about crypto fundamentals to stay up to date & be better crypto investors 📈

Subscribe here👇

…st-the-metrics-newsletter.beehiiv.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh