🧵What happens with FTX?

The ongoing #FTX & #binance drama draws the attention of the whole market.

0xScope gives you a real-time monitor of what is happening with @FTX_Official based on the most powerful Ethereum on-chain tracking ability.

Hold tight, you are gonna like it👇:

The ongoing #FTX & #binance drama draws the attention of the whole market.

0xScope gives you a real-time monitor of what is happening with @FTX_Official based on the most powerful Ethereum on-chain tracking ability.

Hold tight, you are gonna like it👇:

Before we start, we have created entities of related parties, you can use the ID to see the dashboard or you can set custom alerts on @0xWatchers:

Alameda Research#RE5UBiNg (627 addresses)

Binance Exchange#xLrHRwpe (74 addresses)

FTX#5ZDQkT62(3 addresses)

#TrustIn0xScope

Alameda Research#RE5UBiNg (627 addresses)

Binance Exchange#xLrHRwpe (74 addresses)

FTX#5ZDQkT62(3 addresses)

#TrustIn0xScope

First of all, @FTX_Official is experiencing a panic withdrawal period. The balance of USDT/USDC drops 95%📉 in 7 days and ETH drops 50%.

On the other hand, parties like Alameda keep filling holes for FTX. For now, the stablecoin share keeps around 0.2%.

On the other hand, parties like Alameda keep filling holes for FTX. For now, the stablecoin share keeps around 0.2%.

For the past 7 days, massive capital(around 600M) left @FTX_Official. That's not a good sign.

If you are currently eager to withdraw from FTX, try those altcoins as they still have more than $30M in value.

Such as:

$PAXG

$BOBA

$BIT

$SRM

$LINK

If you are currently eager to withdraw from FTX, try those altcoins as they still have more than $30M in value.

Such as:

$PAXG

$BOBA

$BIT

$SRM

$LINK

Another potential problem is that most of the current FTX assets are in $FTT.

Right now, FTX holds about $2.2B on Ethereum, and $1.1B (about 😬50%) is in $FTT!

Right now, FTX holds about $2.2B on Ethereum, and $1.1B (about 😬50%) is in $FTT!

Let's see the status of $FTT.

Based on our stats, in 7 days, the $FTT balance of FTX increase massively ($600M in value) while the ETH balance drops about 50%.

People are withdrawing ultra-sound money from FTX and depositing FTT to FTX.

Based on our stats, in 7 days, the $FTT balance of FTX increase massively ($600M in value) while the ETH balance drops about 50%.

People are withdrawing ultra-sound money from FTX and depositing FTT to FTX.

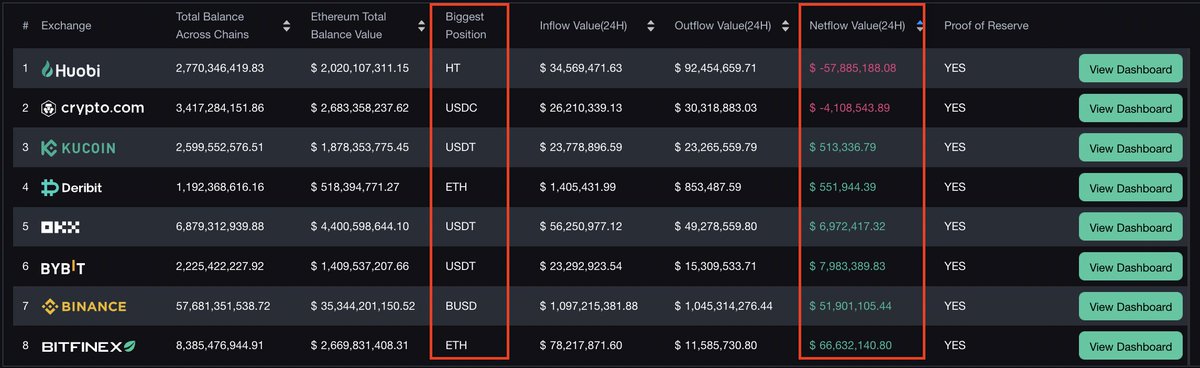

But what about @binance, as the starter of this drama, is Binance benefiting from it?

The answer is yes, there are $1.3B transferred from FTX to Binance for the past 7 days (16.40% in total Binance inflow) and 390M for today (43.16%).

The answer is yes, there are $1.3B transferred from FTX to Binance for the past 7 days (16.40% in total Binance inflow) and 390M for today (43.16%).

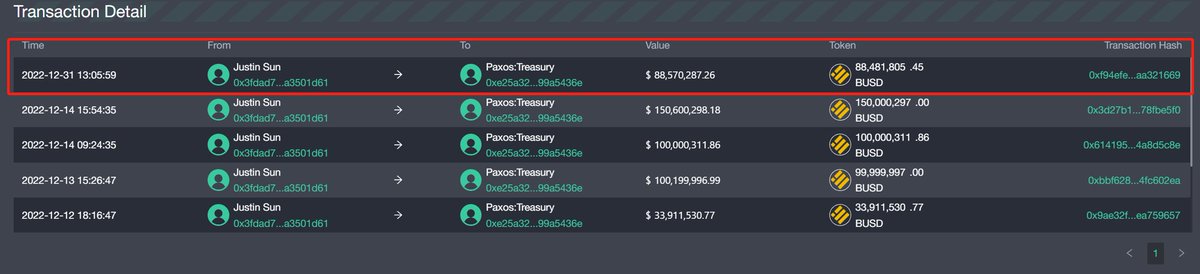

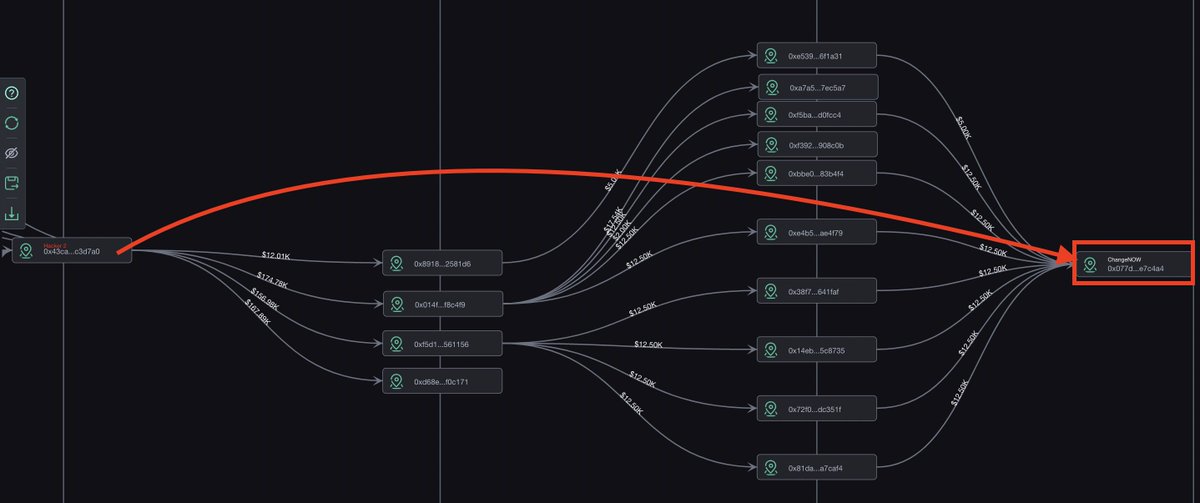

At last, here is an entity of FTX "Knight", they have been adding funds especially stablecoins to FTX.

Funds are from exchanges like @kucoincom or @binance.

Check the entity dashboard to track where the funds at.

ID: FTX Knights#rZ49e6RL

Funds are from exchanges like @kucoincom or @binance.

Check the entity dashboard to track where the funds at.

ID: FTX Knights#rZ49e6RL

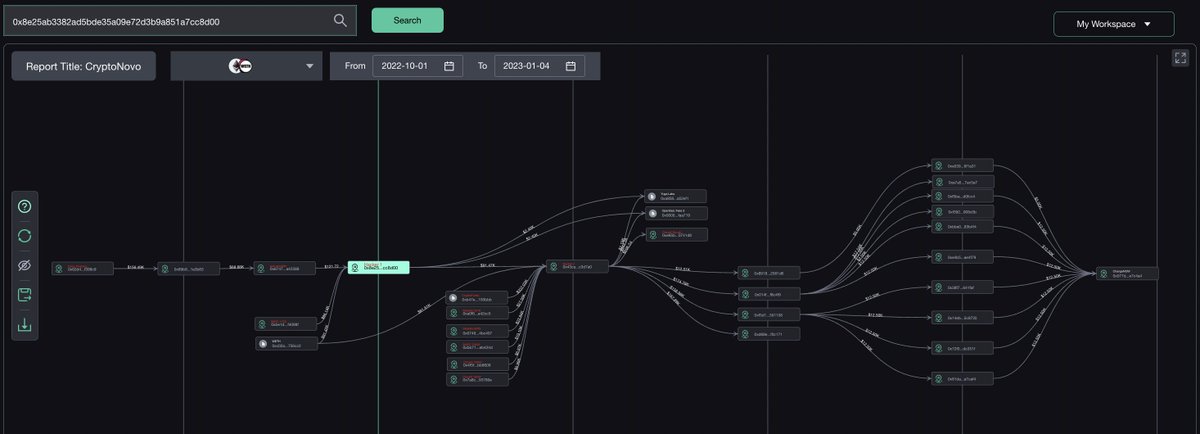

Also, here is an Overview chart of today's FTX capital inflow, @okx & @bitfinex & @gate_io are on the list too.

The form:

Source -> Deposit Address -> FTX

The form:

Source -> Deposit Address -> FTX

See all the table data here:

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh