Gass points out that the technology business management journey is just beginning even after 10 years #tbmc22

Gass introduces Apptio CEO Sunny Gupta, who establishes that every company is digital & tech is core to business #tbmc22

Gupta looks back at 15 years of Apptio gatherings and how executives now ask how technology is creating fundamental value in the enterprise. #tbmc22

The first decade of Apptio was focused on technology consumption, not necessarily immediate action #tbmc22

Gupta states that there were clients who were recalculating tech budgets several times a week in 2020 as scenarios and company needs changed #tbmc22

2021 were the good times for spending: unprecedented access and cash #tbmc22

And now 2022, a time of volatility, crisis, and pulling back #tbmc22

Gupta brings up two fundamental trends around the cloud and productization #tbmc22

Love how Gupta is bringing up the obsolescence of annual planning and the need for continuous planning supported with visibility and automation #tbmc22

The @targetprocess acquisition was about adding work management to budget and cost management #tbmc22

Ken Rogers, who manages over $3 billion in spend, takes the stage to discuss the value of Apptio over the past couple of years. #tbmc22

Rogers first thanks the audience for their willingness to spend on expedited passport renewal fees, a big money maker for the Department of State! #tbmc22

More seriously, Rogers brings up the challenge of making everyone go remote while having to defend his budget to the House and Senate. Gives example of having 48 hours to respond to a $120 million budget cut proposal #tbmc22

Gupta brings up the operational and innovation arms of technology management along with challenges that this two sided approach brings #tbmc22

Technology is not just a challenge of demand-driven cloud, but a productization and business context challenge #tbmc22

Gupta introduces Richard Phillips of Legal & General, a veteran of three Apptio deployments across different companies #tbmc22

Phillips discusses how tech management has shifted over the past decade from getting to chargeback/showback to demonstrating more holistic front office business value with TBM #tbmc22

Gupta shows the evolution of TBM capabilities from IT to business value #tbmc22

Gupta brings up the importance of bringing in data once and having a variety of capabilities as a result #tbmc22

Now taking the stage, Larry Blasko to discuss IT management with UPS #tbmc22

Ken Finnerty and Jim McGrath of UPS take the stage to discuss how they manage their $6 billion of tech to support business innovation #tbmc22

Interesting to hear about UPS’ investments in AI and logistics while dealing with disruptive technologies that both help UPS and allow startups to nibble away at the edges of UPS value prop #tbmc22

Finnerty brings up 4 key investment areas:

Cloud native composable software

Data and analytics

Agile delivery

DevSecOps automation

#tbmc22

Cloud native composable software

Data and analytics

Agile delivery

DevSecOps automation

#tbmc22

McGrath brings up the need for discipline in managing IT and defining relevant KPIs

Finnerty adds interest in cloud FinOps and the challenge of aligning IT cost to business architecture

#tbmc22

Finnerty adds interest in cloud FinOps and the challenge of aligning IT cost to business architecture

#tbmc22

Jason Byrd of Accenture shows up as a 10 yr veteran to discuss what is new in TBM & what is raising the bar #tbmc22

Byrd shares recent research results that a majority of companies struggle to achieve expected cloud computing results #tbmc22

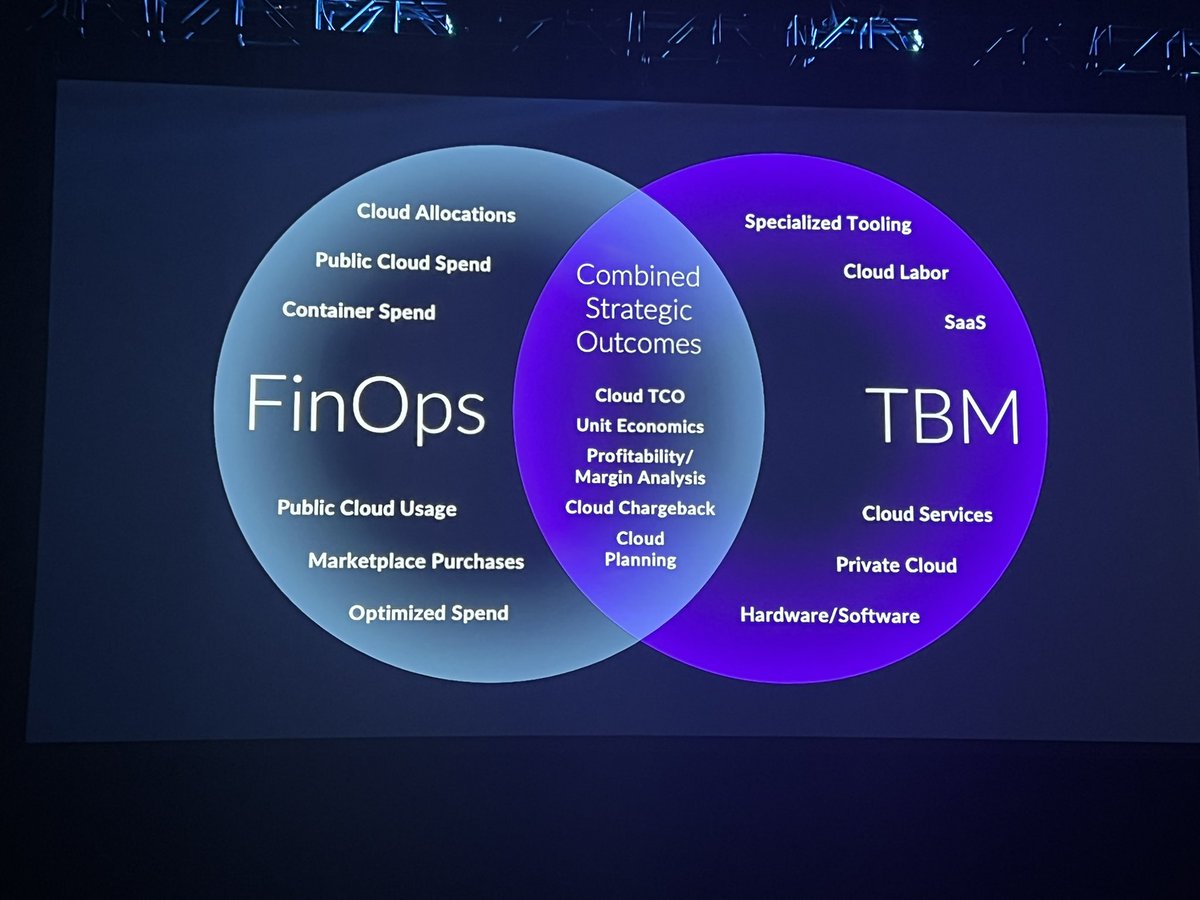

I love this intersection. I started an analyst firm 9 years ago focused on this intersection and it has been the center of my work ever since #tbmc22

Spend priorities for tech enabling CxOs: cloud, modernization, & AI #tbmc22

Accenture’s survey of cost transformation goals are led by decision making and defining optimal organizational cost structure: areas often ignored in IT #tbmc22

Keith Barthelmeus, Brinks’ CFO, discusses their TBM program to bridge tech consumption with business drivers #tbmc22

Duncan Wardle takes the stage, gets the audience on their feet, and splits them into groups of two, giving each roles as experts in esoteric fields #tbmc22

Wardle points out that if you say that your organization calls itself a consumer and client focused company and judges itself on quarterly results, you’re not in a consumer and client focused firm. #tbmc22

@threadreaderapp please unroll!

• • •

Missing some Tweet in this thread? You can try to

force a refresh