😬Rumor has it that @SBF_FTX has been moving users' funds around. We dived in for a hell lot of time and here's what we found:

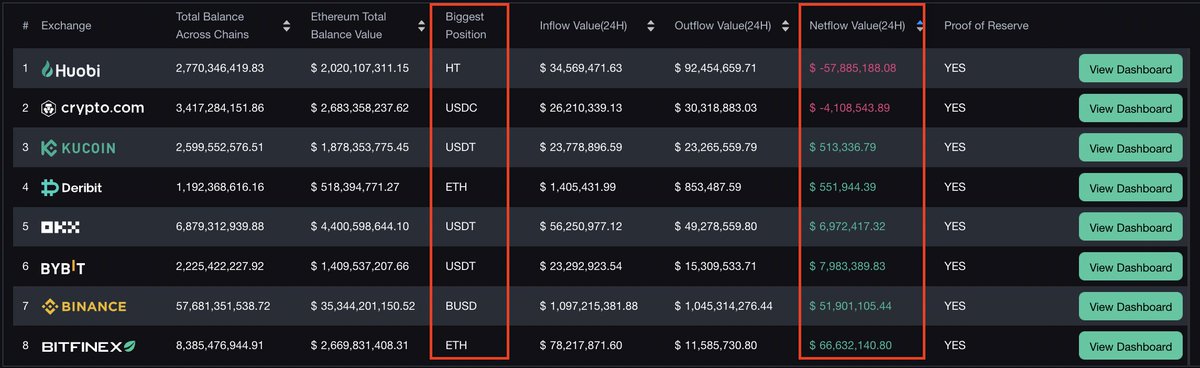

🚨We found that @SBF_FTX and @AlamedaResearch have been SHARING the same funding and lots of exchange accounts for a long time 🫡.

Proofs👇:

🚨We found that @SBF_FTX and @AlamedaResearch have been SHARING the same funding and lots of exchange accounts for a long time 🫡.

Proofs👇:

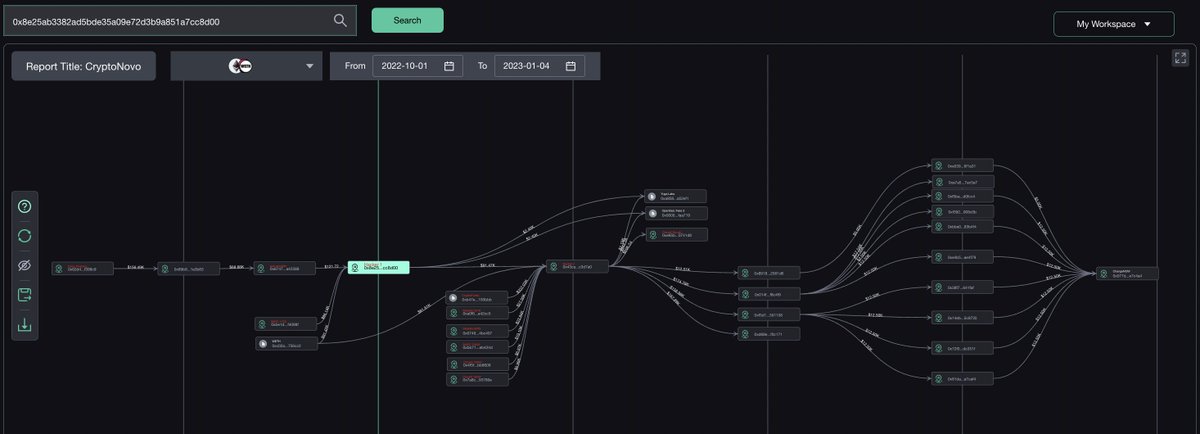

First of all, we applied address clustering to all the @SBF addresses we can find, and one of them is highly connected with a tagged #Alameda's address.

SBF's: 0xD57581D9e42E9032e6f60422fA619b4A4574Ba79 (0xD5)

Alameda's:

0xf108a465a5dafb51bb48615b1a4f5e00401ff90d (0xf1)

SBF's: 0xD57581D9e42E9032e6f60422fA619b4A4574Ba79 (0xD5)

Alameda's:

0xf108a465a5dafb51bb48615b1a4f5e00401ff90d (0xf1)

Why do we say address 0xD5 is @SBF_FTX?

Okay, first of all, he admits himself.

And we also find this is one of the multi-signer of @sushiswap, which SBF is.

panewslab.com/en/articledeta…

Okay, first of all, he admits himself.

And we also find this is one of the multi-signer of @sushiswap, which SBF is.

panewslab.com/en/articledeta…

Okay here we go:

Proof 1:

#Alameda address 0x f1 provides initial gas funding to Sam and transfers 12710 $ETH to Sam in Sep. 2020.

Proof 1:

#Alameda address 0x f1 provides initial gas funding to Sam and transfers 12710 $ETH to Sam in Sep. 2020.

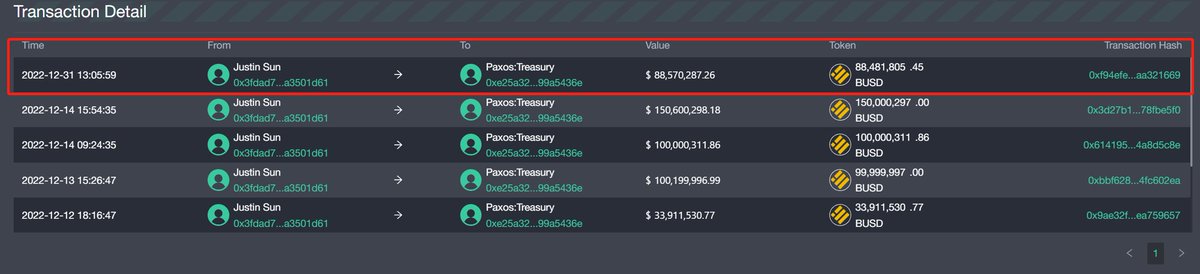

Proof 2:

Go further, we find that #Alameda 0xf1 and Sam share the same #FTX and #Binance deposit addresses!

Go further, we find that #Alameda 0xf1 and Sam share the same #FTX and #Binance deposit addresses!

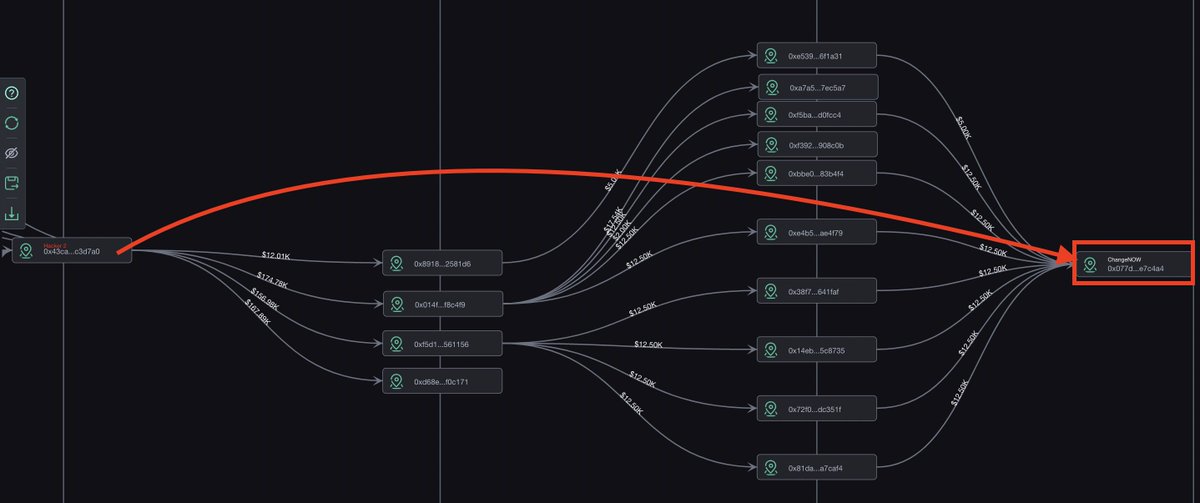

Proof 3:

Expand to the 3rd level, and more #Alameda addresses pop up, it shows Sam sharing #FTX & #Binance deposit addresses with at least 7 #Alameda addresses.

🚨We have reasons to believe that those deposit addresses are the company's account.

Expand to the 3rd level, and more #Alameda addresses pop up, it shows Sam sharing #FTX & #Binance deposit addresses with at least 7 #Alameda addresses.

🚨We have reasons to believe that those deposit addresses are the company's account.

What's also interesting is that Sam's last transaction was sent all 12 ETH to #FTX on 2022/07/12, so maybe the problem already existed at that time.

⏲️All of the proofs happened on Nov. 2020.

Rumor has it that @SBF_FTX controlled all #Alameda's addresses, we can't verify it.

But we strongly believe 🫡that at least at this time period, @SBF_FTX used the company's funds and accounts to finish some individual business.

Rumor has it that @SBF_FTX controlled all #Alameda's addresses, we can't verify it.

But we strongly believe 🫡that at least at this time period, @SBF_FTX used the company's funds and accounts to finish some individual business.

🚀Follow us for more about the recent events and other on-chain insights:

The product shown above: @0xWatchers watchers.pro

FTX incident Dashboard:

watchers.pro/#/report

The product shown above: @0xWatchers watchers.pro

FTX incident Dashboard:

watchers.pro/#/report

@SBF_FTX Edit:

All of the proofs happened on Sep. 2020.

All of the proofs happened on Sep. 2020.

@0xWatchers Okay, I know you all hate @SBF_FTX but don't get bots🤖 to boost the stats🤣

Now we look like a scam🤣🤣🤣

Now we look like a scam🤣🤣🤣

• • •

Missing some Tweet in this thread? You can try to

force a refresh