I’ve had a few questions on the revenue impact of Barcelona’s exit elimination from this season’s Champions League after the group stage. As is often the case, the answer depends on how you look at it #FCBarcelona

As per my model, #FCBarcelona have earned €70.2m from this season’s Champions League, comprising participation fee €15.6m, prize money €7.0m, UEFA coefficient €34.1m and TV pool €15.9m less €2.5m COVID rebate to broadcasters.

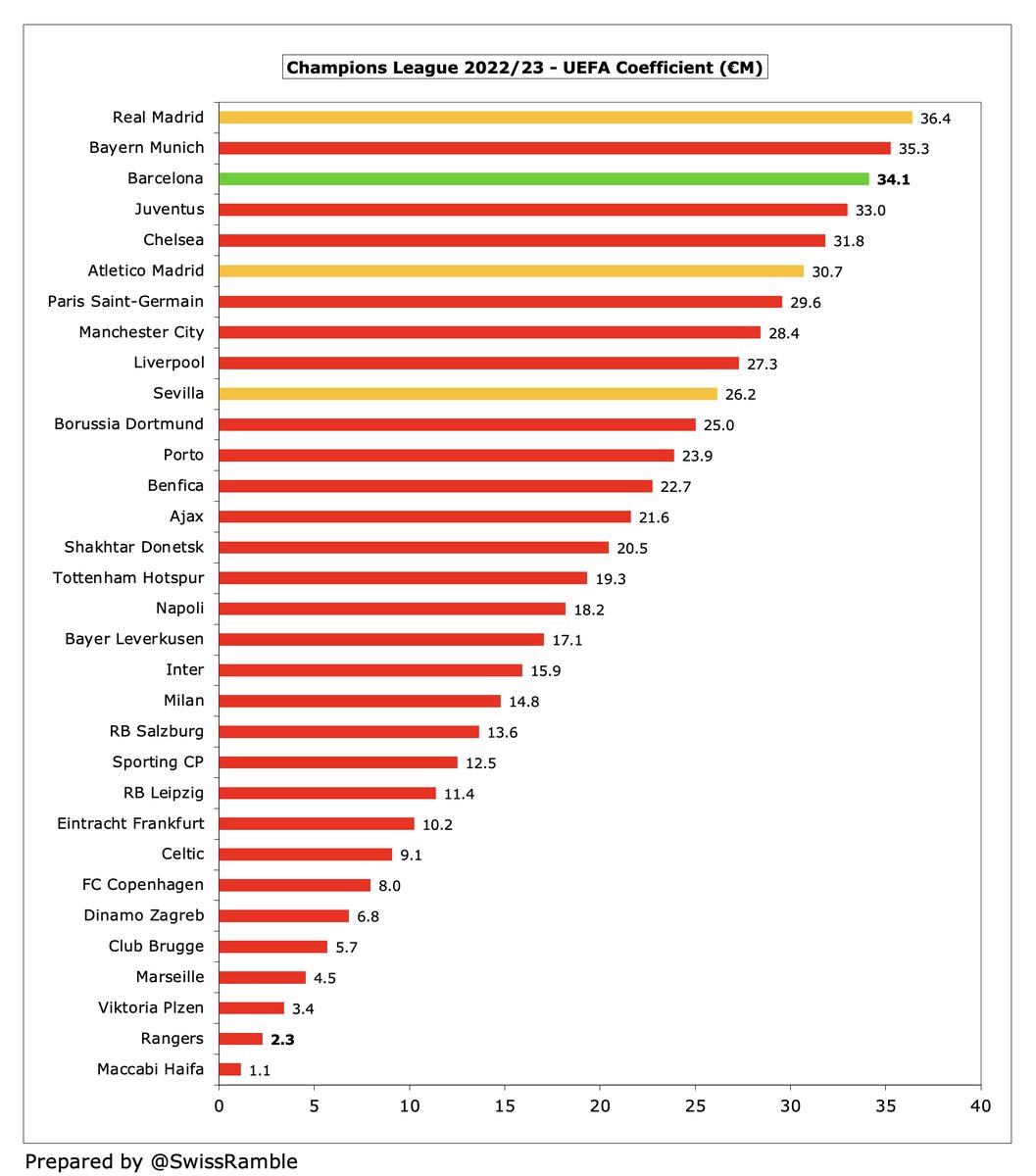

As we can see, #FCBarcelona have benefited from their previous good record in Europe with their UEFA coefficient €34.1m payment accounting for nearly half their total €70.2m distribution. This is currently the third highest in Europe, only behind #RealMadrid and #FCBayern.

In addition, #FCBarcelona will receive some money after dropping down to the Europa League, though only an additional €1.4m as it stands: knockout round prize money €0.5m plus estimated TV pool €0.9m.

The club advised that #FCBarcelona had budgeted to reach the quarter-finals of the Champions League. Assuming that they would have won 3 games in the group to secure qualification, that would have given them €94.1m TV money.

Therefore, as it stands, #FCBarcelona have lost €22.5m TV money from their Champions League exit: current revenue €71.6m (Champions League €70.2m plus Europe League €1.4m) less budgeted €94.1m.

However, #FCBarcelona might progress further in the Europa League. Taking the most optimistic assumption where they win the competition would mean €17.4m income, i.e. prize money €14.9m plus TV pool €3.1m less €0.5m COVID rebate.

If #FCBarcelona do manage to get past #MUFC in the knockout round, then win the Europa League, their revenue loss would only be €6.5m: projected revenue €87.6m (Champions League €70.2m plus Europe League €17.4m) less budgeted €94.1m.

At the other end of the spectrum, if #FCBarcelona had won the Champions League, as they have done on 5 occasions, they would have earned a hefty €127.9m. Prize money would have increased to €61.8m, while TV pool would be up to €20.9m (assuming Real Madrid went out in last 16).

Comparing #FCBarcelona actual European revenue of €71.6m with potential €127.9m for winning the Champions League gives a much larger shortfall of €56.3m. Difference is almost entirely lost prize money: last 16 €9.6m, quarter-final €10.6m semi-final €12.5m & winners €20m.

In addition, #FCBarcelona will lose money from lower gate receipts, while sponsorship agreements are likely to include success payments dependent on Champions League progress. On the other hand, #FCBarcelona costs will be reduced, including lower bonus payments.

Joan Laporta said, “The net impact of Champions League will be lower than expected. It will not be 30 or 35 million.” The #FCBarcelona President is probably correct, but, as we have seen, there is no single answer to how much revenue the club has lost.

• • •

Missing some Tweet in this thread? You can try to

force a refresh