[1/9] "Don't Trust, Verify"

–Ein Spruch, der derzeit die Runde macht, nachdem Unsummen von Milliarden durch #FTX und #SBF veruntreut wurden–

5 Begrifflichkeiten, die du jetzt unbedingt verstehen musst, um Exchanges besser einschätzen zu können!

🧵👇

–Ein Spruch, der derzeit die Runde macht, nachdem Unsummen von Milliarden durch #FTX und #SBF veruntreut wurden–

5 Begrifflichkeiten, die du jetzt unbedingt verstehen musst, um Exchanges besser einschätzen zu können!

🧵👇

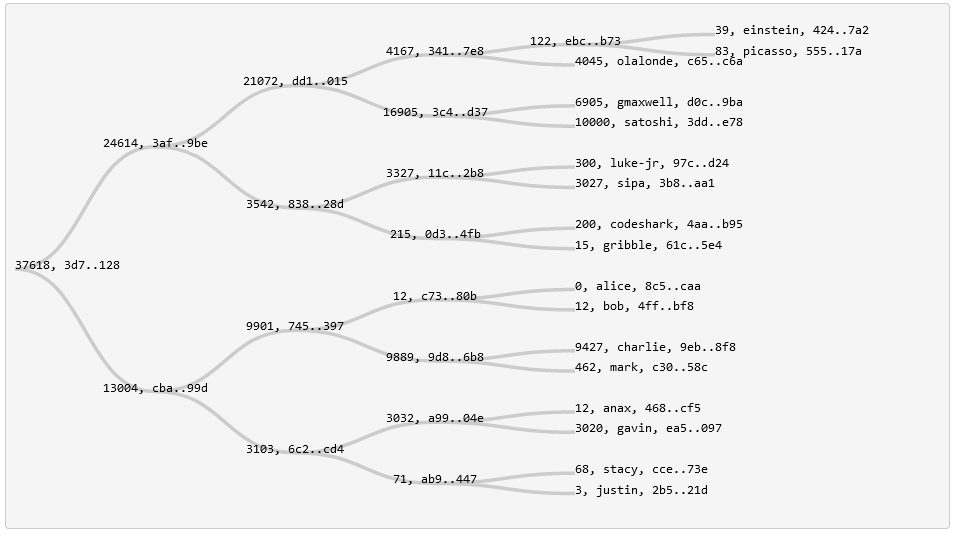

[2/9] 👉 "#Merkle #Tree"

• Ist ein binärer #Hash-Baum, also eine Datenstruktur in der #Kryptografie, bei der jeder Blattknoten ein Hash-Wert eines Datenblocks darstellt

• Nachträgliche Änderungen wirken sich auf die "Wurzel" aus

• Effizientes Mittel der #Datenüberprüfung

• Ist ein binärer #Hash-Baum, also eine Datenstruktur in der #Kryptografie, bei der jeder Blattknoten ein Hash-Wert eines Datenblocks darstellt

• Nachträgliche Änderungen wirken sich auf die "Wurzel" aus

• Effizientes Mittel der #Datenüberprüfung

[3/9] 👉 "#Proof of #Reserves"

• Der Beweis durch einen unabhängigen Prüfer, dass der #Exchange tatsächlich ALLE #Assets (Einlagen und Salden) besitzt, die er vorgibt zu haben

• Während des #PoR wird der "anonymisierte #Snapshot" der Salden zu einem Merkle Baum zusammengesetzt

• Der Beweis durch einen unabhängigen Prüfer, dass der #Exchange tatsächlich ALLE #Assets (Einlagen und Salden) besitzt, die er vorgibt zu haben

• Während des #PoR wird der "anonymisierte #Snapshot" der Salden zu einem Merkle Baum zusammengesetzt

[4/9] • Ab diesem Zeitpunkt, wird die "Wurzel" bestimmt, also ein Fingerabdruck, der alle Salden des #Exchanges einzigartig identifiziert

• In Kombination mit den dig. #Signaturen der veröff. #Nodes und deren Gelder, können im #Audit die Reserven und #Assets nachgewiesen werden

• In Kombination mit den dig. #Signaturen der veröff. #Nodes und deren Gelder, können im #Audit die Reserven und #Assets nachgewiesen werden

[5/9] 👉 "#Proof of #Liability"

• Ähnlich wie beim #PoR muss auch hier mit einem #Audit (z.B. mit einem #Merkle #Tree) bewiesen werden, dass ein #Exchange die Benutzersalden (#Verbindlichkeiten) nachweisen kann, ohne persönliche Informationen preiszugeben

• Ähnlich wie beim #PoR muss auch hier mit einem #Audit (z.B. mit einem #Merkle #Tree) bewiesen werden, dass ein #Exchange die Benutzersalden (#Verbindlichkeiten) nachweisen kann, ohne persönliche Informationen preiszugeben

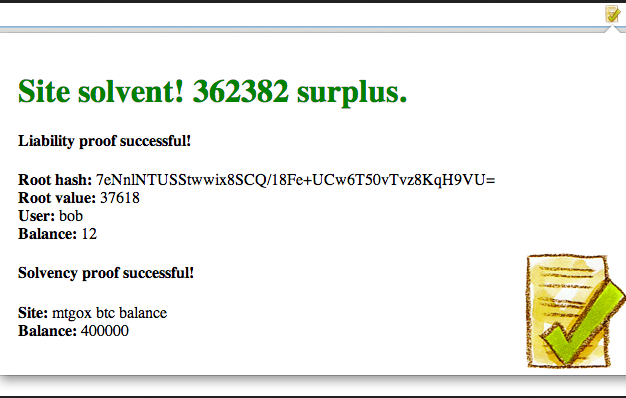

[6/9] 👉 "#Proof of #Solvency"

• Ein anderer Begriff für den Nachweis eines #Exchanges liquide und Zahlungsfähig (#Solvent) zu sein.

• Kann ein Exchange, durch ein Audit, einen PoR ablegen und diesen mit einem PoL abgleichen, kann davon ausgegangen werden, dass er solvent ist.

• Ein anderer Begriff für den Nachweis eines #Exchanges liquide und Zahlungsfähig (#Solvent) zu sein.

• Kann ein Exchange, durch ein Audit, einen PoR ablegen und diesen mit einem PoL abgleichen, kann davon ausgegangen werden, dass er solvent ist.

[7/9] 👉 "Not your #keys, not your #coins"

• Die vorher benannten #Proofs sind alle nahezu wertlos, aber dennoch wünschenswert, erfüllen sie doch den Zweck der #Transparenz.

Nur die #Assets, die in "#Selbstverwahrung" eurer #Wallet zugeordnet sind, gehören immer euch ‼️

• Die vorher benannten #Proofs sind alle nahezu wertlos, aber dennoch wünschenswert, erfüllen sie doch den Zweck der #Transparenz.

Nur die #Assets, die in "#Selbstverwahrung" eurer #Wallet zugeordnet sind, gehören immer euch ‼️

[8/9] ⚠️ Folgendes kann im #Proof of #Solvency nicht sichergestellt werden:

• Die Priv. Keys könnten längst verloren/gestohlen oder dupliziert worden sein

• Kurz vor dem Audit könnten Gelder ausgeliehen worden sein, um den Nachweis zu bestehen

• Prüfer müssten unabhängig sein

• Die Priv. Keys könnten längst verloren/gestohlen oder dupliziert worden sein

• Kurz vor dem Audit könnten Gelder ausgeliehen worden sein, um den Nachweis zu bestehen

• Prüfer müssten unabhängig sein

[9/9] Lasst euch nicht verunsichern und bleibt weiter wachsam! 🧐

Fragt euch, ob ihr nicht endlich die Verantwortung über eure Gelder selbst in die eigene Hand nehmen wollt und verwahrt eure Keys bei euch selbst!

Hardware-Wallets und Software-Wallets gibt es schließlich genug😉

Fragt euch, ob ihr nicht endlich die Verantwortung über eure Gelder selbst in die eigene Hand nehmen wollt und verwahrt eure Keys bei euch selbst!

Hardware-Wallets und Software-Wallets gibt es schließlich genug😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh