1. Imajin going through the torture of getting KYCed on a CEX like @FTX_Official to trade and you end up not being able to withdraw your assets...

With @synthr_defi, you won't face these issues.

here's an overview of what I've learnt:

🧵(1/15)

#Synthread #Sei #Cosmos

With @synthr_defi, you won't face these issues.

here's an overview of what I've learnt:

🧵(1/15)

#Synthread #Sei #Cosmos

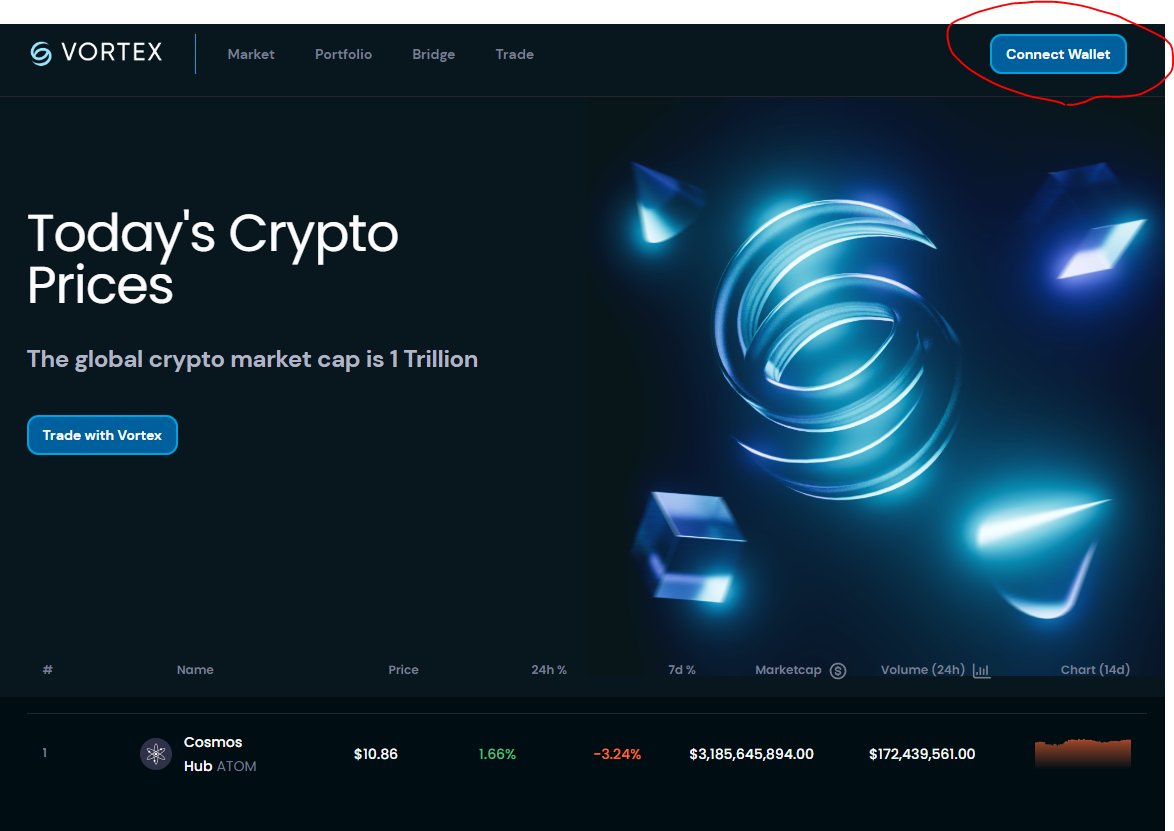

2. @synthr_defi is an Omnichain Synthetics Protocol that empowers anyone with access to trade a variety of assets such as crypto, stocks, FOREX etc on multiple chains, including the up-and-coming @SeiNetwork!

How does it work?

How does it work?

3.

🐸Deposit highly liquid collateral (E.g $USDT, USDC, ETH)

🐸Mints syAsset, @synthr_defi's synthetic versions of the original asset.

syAssets track the prices of the original assets, giving holders exposure to its price movements even without owning the original asset.

🐸Deposit highly liquid collateral (E.g $USDT, USDC, ETH)

🐸Mints syAsset, @synthr_defi's synthetic versions of the original asset.

syAssets track the prices of the original assets, giving holders exposure to its price movements even without owning the original asset.

4. What's more, you can even choose to mint syAssets to another chain, all thanks to @LayerZero_Labs powering @synthr_defi!

Depositing your collateral on @ethereum to mint synthetic assets to @KardiaChain will be as seamless as swapping assets on a DEX!

Depositing your collateral on @ethereum to mint synthetic assets to @KardiaChain will be as seamless as swapping assets on a DEX!

5. What can you do with syAssets?

Similar to most on-chain assets, you can:

🐸Swap it for another asset

🐸Short (profit from an increase in value)

🐸Long (profit from a decrease in value)

🐸Provide liquidity to earn yield

Similar to most on-chain assets, you can:

🐸Swap it for another asset

🐸Short (profit from an increase in value)

🐸Long (profit from a decrease in value)

🐸Provide liquidity to earn yield

6. Apart from minting and trading syAssets, @synthr_defi has also designed a suite of products to allow even beginners to easily participate with 1 click.

What's even better is that most of these vaults do not require you to have syAssets!

What's even better is that most of these vaults do not require you to have syAssets!

7. These are:

🐸Long-Farm Vault

🐸Short-Farm Vault

🐸Delta-Neutral vault

🐸Stability Pool

🐸Long-Farm Vault

🐸Short-Farm Vault

🐸Delta-Neutral vault

🐸Stability Pool

8. Long-Farm vault:

1️⃣ Deposit Stablecoin

2️⃣ 50% utilized to buy discounted syAsset on partner DEX

3️⃣ 50% utilized for pairing with the syAsset to provide liquidity

4️⃣ Earn #RealYield from swap fees, converted back to the Stablecoin

5️⃣ Earn additional SYNTH token rewards!

1️⃣ Deposit Stablecoin

2️⃣ 50% utilized to buy discounted syAsset on partner DEX

3️⃣ 50% utilized for pairing with the syAsset to provide liquidity

4️⃣ Earn #RealYield from swap fees, converted back to the Stablecoin

5️⃣ Earn additional SYNTH token rewards!

9. Short-Farm Vault:

1️⃣ Deposit Stablecoin

2️⃣ Stablecoin used to mint syAsset that are priced higher on partner DEX

3️⃣ Minted syAsset sold on said partner DEX

4️⃣ Earn #RealYield from arbitrage, converted back to the Stablecoin

1️⃣ Deposit Stablecoin

2️⃣ Stablecoin used to mint syAsset that are priced higher on partner DEX

3️⃣ Minted syAsset sold on said partner DEX

4️⃣ Earn #RealYield from arbitrage, converted back to the Stablecoin

10. Stability Pool:

1️⃣ Deposit syAsset

2️⃣ syAsset gets burnt when a user gets liquidated

3️⃣ Earns #RealYield paid out in the liquidated collateral

4️⃣ $120 worth of collateral distributed for every $100 worth of debt burnt from the Stability Pool

1️⃣ Deposit syAsset

2️⃣ syAsset gets burnt when a user gets liquidated

3️⃣ Earns #RealYield paid out in the liquidated collateral

4️⃣ $120 worth of collateral distributed for every $100 worth of debt burnt from the Stability Pool

11. Delta-Neutral vault:

1️⃣ Deposit Stablecoin

2️⃣ Stable coin swapped -> syUSD -> syAsset

3️⃣ syAsset deposited into Stability Pool

4️⃣ Earns #RealYield from liquidated collateral, converted back to Stablecoin

1️⃣ Deposit Stablecoin

2️⃣ Stable coin swapped -> syUSD -> syAsset

3️⃣ syAsset deposited into Stability Pool

4️⃣ Earns #RealYield from liquidated collateral, converted back to Stablecoin

12. In addition, @synthr_defi's Global Debt Pool design provides the infrastructure to enable some of DeFi's most innovative features/products:

🐸Atomic Swaps (zero slippage on swaps of any size)

🐸Options Marketplace utilizing synthetic assets

🐸Atomic Swaps (zero slippage on swaps of any size)

🐸Options Marketplace utilizing synthetic assets

13. Here's a primer to kickstart your learning on Atomic Swaps:

https://twitter.com/synthr_defi/status/1554187059111280642

14. All in all, @synthr_defi provides a highly accessible platform for trading different classes of assets for everyone, especially those bounded by geographical limitations.

To learn more about how @synthr_defi works in-depth, check out their docs:

synthrprotocol.gitbook.io/home/what%20is…

To learn more about how @synthr_defi works in-depth, check out their docs:

synthrprotocol.gitbook.io/home/what%20is…

15. Keen to discuss synthetic assets? Join the Hive Mind over at @orbital_command!

discord.gg/hs23SMDK7B

discord.gg/hs23SMDK7B

• • •

Missing some Tweet in this thread? You can try to

force a refresh