SBF sells billions in assets that don’t actually exist...

World banks: Hold my beer 🍺

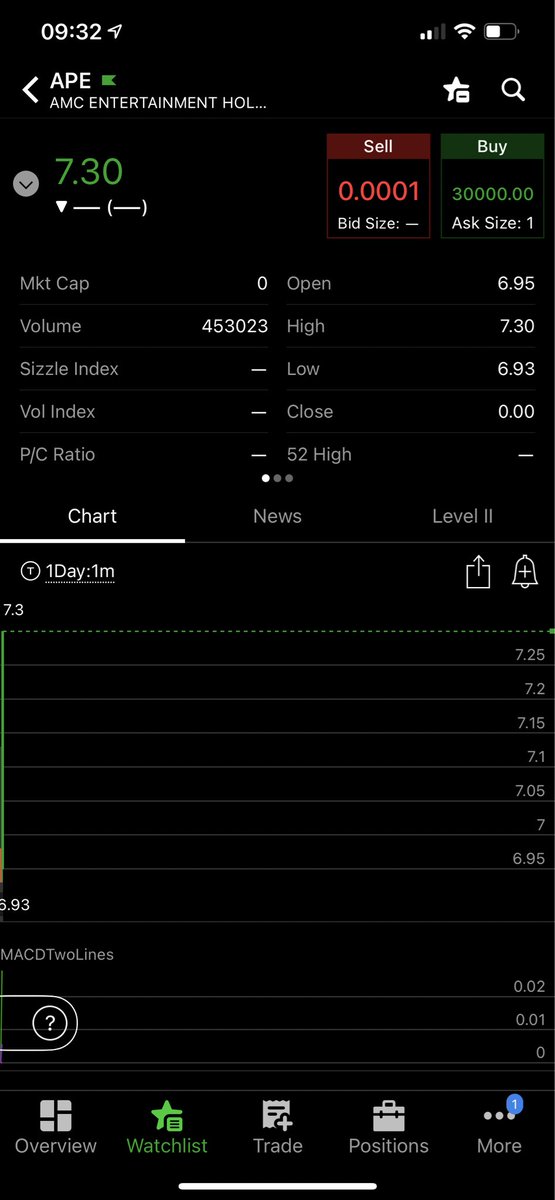

TRILLI0NS of dollars in securities have been sold that they DO NOT own. This 🧵 is just a fraction of the full scope

Where’s the same outrage over this?

#amc #ape

World banks: Hold my beer 🍺

TRILLI0NS of dollars in securities have been sold that they DO NOT own. This 🧵 is just a fraction of the full scope

Where’s the same outrage over this?

#amc #ape

The sale of these fake assets that do not exist have injected more than $1,000,000,000,000+ into these banks (ultimately money they keep & use for their business operations instead of paying for the obligation of what they sold)

Understand that not only has this undermined & diluted the issued shares of thousands of companies, but it is affording these banks the ability to use this surplus

c0unterfe!t cash against retail by pushing their now even bigger chip stacks around the market to man1pulate prices

c0unterfe!t cash against retail by pushing their now even bigger chip stacks around the market to man1pulate prices

This is a fundamental problem because when we invest, they are selling us IOU’s & using our money to drive those very companies into bankrupt¢y so they never have to satisfy those IOU’s (keeping the money) while the shares we hold become worthless & our money is gone

This is outright gl0bal frraud, effectively increasing the separation of wealth, driving more and more families into p0verty

We need to raise awareness about this. Please pass this knowledge on

We need to raise awareness about this. Please pass this knowledge on

For anybody not familiar with how to read balance sheets, look for the designated denomination (here in purple) to assess the full values of each line

• • •

Missing some Tweet in this thread? You can try to

force a refresh