Its odd watching people warning others about the “dangers” of DRS’ing when the current structure to which their shares are handled is this 1 (in vid below)

How could it be any worse than the mainstream structure that investors are blindly accepting?

#amc

How could it be any worse than the mainstream structure that investors are blindly accepting?

#amc

Educate yourself on the current system & form YOUR OWN opinion. Avoid aligning yourself with someone else’s opinions b/c you think they are more knowledgable than you on the topic. Too many people out here putting on a front that they know their sh1t, when really they DON’T

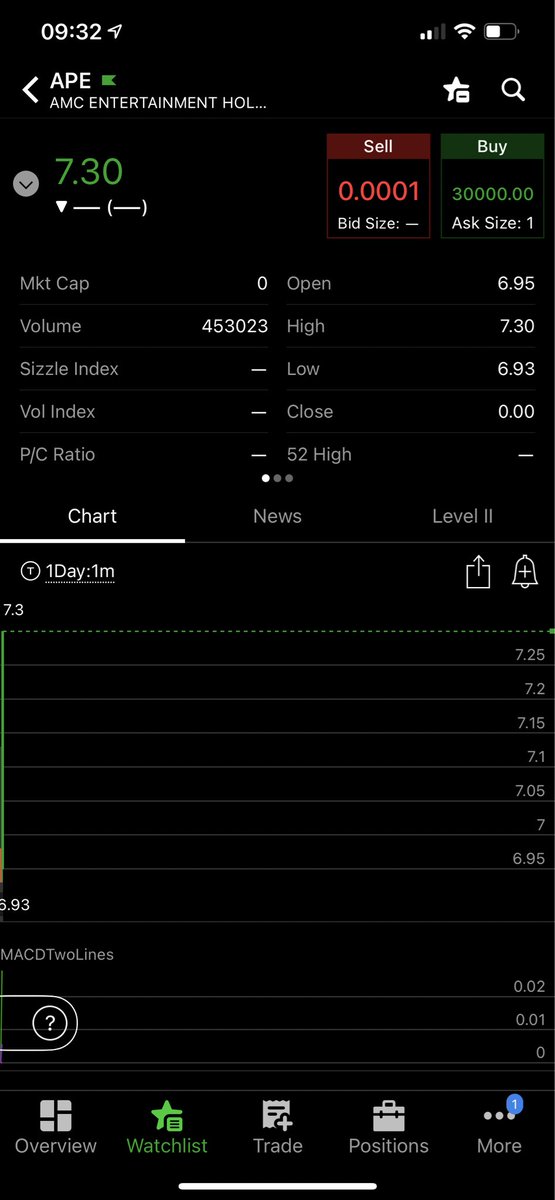

#ape

#ape

This thread is more of a knock against the current system’s stock/shareholding structure (less about how I feel about DRS)

The current structure and understanding how bad it actually is, needs to be the conversation taking center stage more often

The current structure and understanding how bad it actually is, needs to be the conversation taking center stage more often

People are latching on to DRS because it has presented itself as a way of removing some pieces of control that WS refuses to relinquish over our investments & wealth

We as retail are clearly desperate for some kind of change that can distance us from a clearly fr4udulent system

We as retail are clearly desperate for some kind of change that can distance us from a clearly fr4udulent system

Realize what we all share in common:

Instead of seeing the community as pro-DRS’ers vs. non-DRS’ers... its actually we are ALL anti-WS

So lets reset our perceptions and reunite based on that fact cuz we are so much stronger together

Instead of seeing the community as pro-DRS’ers vs. non-DRS’ers... its actually we are ALL anti-WS

So lets reset our perceptions and reunite based on that fact cuz we are so much stronger together

• • •

Missing some Tweet in this thread? You can try to

force a refresh