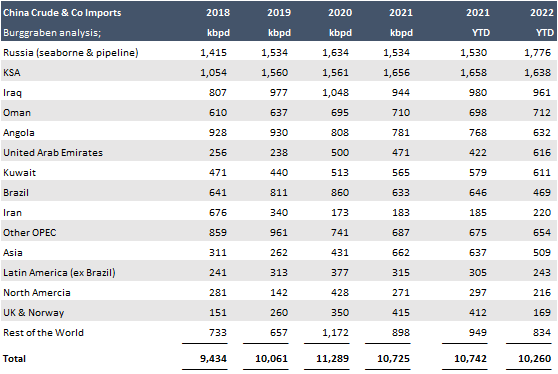

Kazakhstan is a top exporter of crude oil globally. Only KSA, RUS, US, IRQ, UAE, KW, BRA, NOR are bigger; at par with LY, NIG, AO or AZ (Azerbaijan).

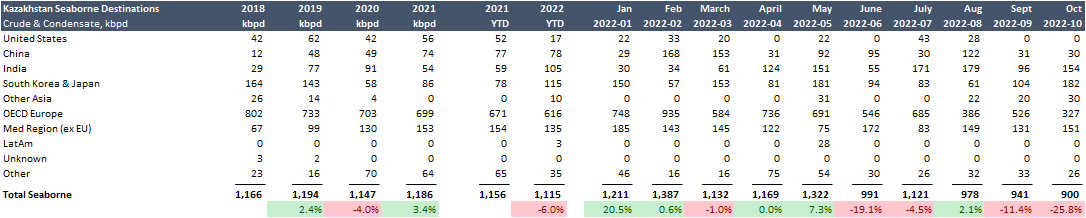

Exports from CPC Terminal in Black Sea (RUS jurisdictions) are down 25% since Jan due to lower output at Kashagan.

1/3 #OOTT

Exports from CPC Terminal in Black Sea (RUS jurisdictions) are down 25% since Jan due to lower output at Kashagan.

1/3 #OOTT

The buoyancy tank of SPM-1 at CPC terminal is now completed.

However, operators stated Kashagan was operating at 50% of capacity in late Oct; the facility’s complete restart is slated for Nov (at earliest).

2/3

cpc.ru/EN/press/relea…

However, operators stated Kashagan was operating at 50% of capacity in late Oct; the facility’s complete restart is slated for Nov (at earliest).

2/3

cpc.ru/EN/press/relea…

Meanwhile, the spin doctors in Russian TV are saying you are next...

3/3 @kittysquiddy

3/3 @kittysquiddy

https://twitter.com/Gerashchenko_en/status/1595041154202058752?s=20&t=ESKmiT9nGp9I7I8f6f3F_Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh