1/ THE HORSEMAN OF #DEFICALYPSE IS HERE!

Yesterday #DeFi markets had an irregular day, as the famous trader @avi_eisen, known for very profitable trades, opened a massive $63M short for $CRV Curve token on @AaveAave.

It did not go well. Keep reading.

👇👇👇

Yesterday #DeFi markets had an irregular day, as the famous trader @avi_eisen, known for very profitable trades, opened a massive $63M short for $CRV Curve token on @AaveAave.

It did not go well. Keep reading.

👇👇👇

2/ Shorting and longing using Aave loans is normal in trading. However, what marks this event special, is that the size of the Avi's position ($63M) was oversized to the relatively illiquid $CRV market.

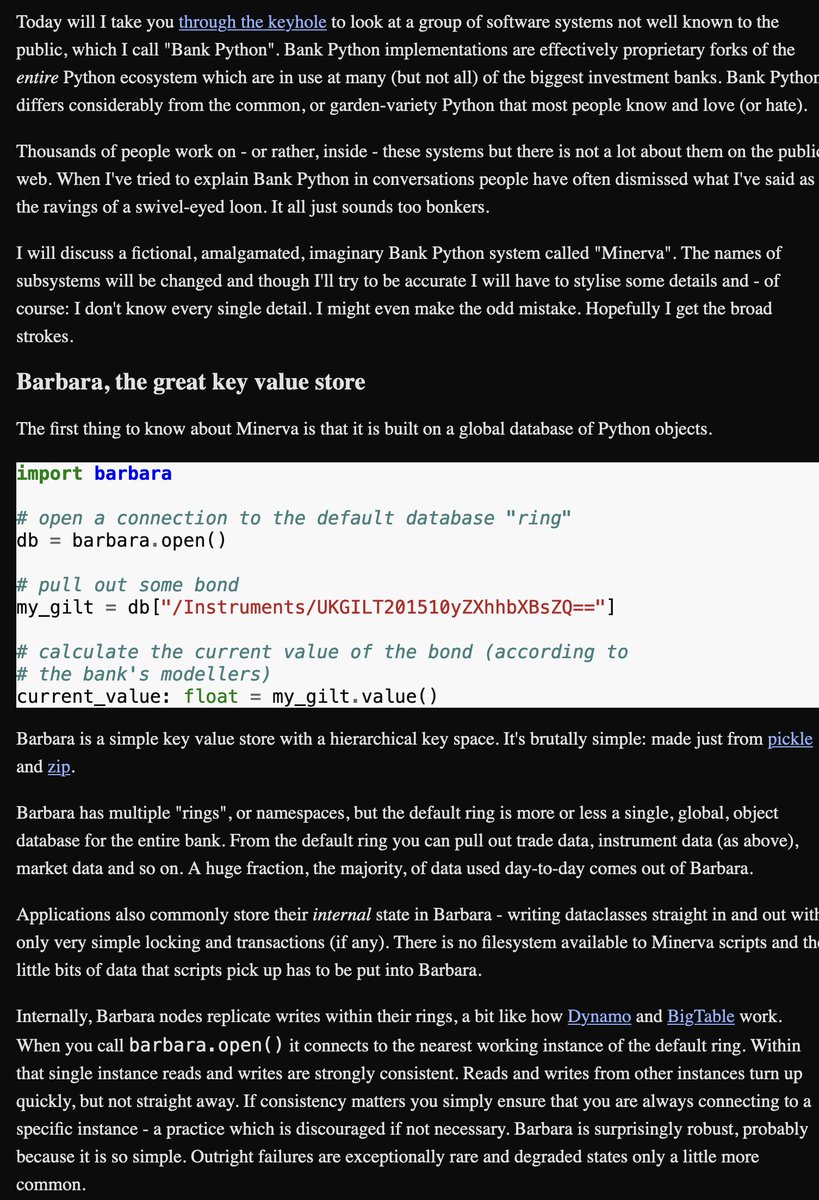

3/ Aave is an over-collateralised lending platform. For taking a short position, you deposit US dollars (USDC) and take out $CRV. Then sell $CRV to USDC, deposit it to Aave, rinse and repeat.

4/ Aave was Aave v2 on #Ethereum blockchain in this case, soon to be replaced v3, but this detail is irrelevant in this point.

5/ @avi_eisen is known to trade with "size" which means he does really big, and often risky trades. He "telegraphs" these trades publicly beforehand to make sure he gets the most attention (and likely copy trades).

6/ Avi is known to actively look for trades that can break the system because of lenient risk parameters. In trading, this means that the size of buy/sell/loan is so large that it starts to severely affect the underlying asset and market being traded.

7/ Earlier, Avi is suspected to break (and profit) this way by trading against:

Mango lending markets:

cointelegraph.com/news/mango-mar…

Mango lending markets:

cointelegraph.com/news/mango-mar…

8/ Another similar recent trade, might or might not have been Avi, was against GMX perpetual swap markets (trade with leverage DEX)

fxstreet.com/cryptocurrenci…

fxstreet.com/cryptocurrenci…

10/ Avi opened $63M $CRV short position on Aave against 92m curve tokens (avg price of 0.68 CRV/USD)

https://twitter.com/0xMerp/status/1595039786074611715

11/ It was suspected Avi was trying to break Aave or was attempting to liquidate a large long $CRV position with a liquidation price of 0.27 CRV/USD

https://twitter.com/Pickle_cRypto/status/1594990970604486659

12/ However, when people noticed the oversized position there is a chance for "short squeeze," Avi's "liquidation price" is defined by the size of USDC collateral against his CRV loan. If the $CRV price goes below this, the health ratio of the loan goes below 1.0.

13/ To protect the system's integrity, unlike in traditional finance, Aave will liquidate the collateral automatically and immediately with a "margin call". The short collateral (USDC) is traded and the proceedings from the sale are used to pay back (Avi's) loan to the creditors.

14/ Because Avi is short, the $USDC and $CRV roles are reversed compared to what we usually understand as base and quote tokens in short trading.

Avi borrowed $CRV. In a liquidation, the collateral USDC is sold, or $CRV bought, to make $CRV creditors whole.

Avi borrowed $CRV. In a liquidation, the collateral USDC is sold, or $CRV bought, to make $CRV creditors whole.

15/ When the loan gets liquidated, Avi will get to keep the $CRV though. However, because of the risk parameters, the collateral to loan is ratio is over-collateralised e.g. 120% USDC to 100% $CRV, buying CRV this way is cost inefficient.

16/ There is another risk: What if the collateral, despite loan being overcollateralised, cannot be sold fast enough for good enough price to get $CRV to pay back Aave creditors?

In this case what is called "bad debt" will be created.

In this case what is called "bad debt" will be created.

17/ In Aave, bad debt is ultimately paid by Aave token stakes that will backstop the system.

18/ In a perfectly functioning system with good risk parameters, bad debt should never occur.

However, in this case, Avi's position was oversized to the relatively illiquid $underlying CRV market.

However, in this case, Avi's position was oversized to the relatively illiquid $underlying CRV market.

19/ There was a risk that Aave's automatic liquidation system cannot buy enough $CRV to pay back Avi's $63M loaned $CRV tokens, because there isn't simply enough liquidity at $CRV markets.

20/ Doom loop:

Aave liquidation trades USDC to CRV ->

CRV price shoots up ->

Avi's loan health ration gets worse and worse ->

Overcollateral margin exceeded ->

Loan cannot be saved (unless liquidations are stopped and CRV price comes down)

Aave liquidation trades USDC to CRV ->

CRV price shoots up ->

Avi's loan health ration gets worse and worse ->

Overcollateral margin exceeded ->

Loan cannot be saved (unless liquidations are stopped and CRV price comes down)

21/ In the bad debt scenario, Aave token holders will pay.

Staked Aave would be liquidated to be used to buy CRV to fill the gap.

Staked Aave would be liquidated to be used to buy CRV to fill the gap.

22/ This is the "systematic" risk in #DeFi. Something breaks at the critical markets and a large market end up with too much bad debt.

23/ And this is exactly what happened with Mango Markets on Solana earlier. Their $MNGO token lending pool risk parameters where lax, Avi could make a trade that flushed out all liquidity and Avi ended up with high profits.

24/ HOW THE $CRV SHORT DRAMA PLAYED OUT

The #defi hold it together and this was a very, very, good stress test for the market ecosystem overall.

👇👇👇

The #defi hold it together and this was a very, very, good stress test for the market ecosystem overall.

👇👇👇

25/ When people noticed Avi's oversized $CRV short positions, they rushed to buy CRV to squeeze him out.

It was easy, because the position size was so large related to the market size.

theblock.co/post/189167/cu…

It was easy, because the position size was so large related to the market size.

theblock.co/post/189167/cu…

26/ Short squeeze happens when trades

1) realise everyone can profit on the expense of someone if they buy a bit more assets

2) people target short sellers from irrational hate

(see /r/WallStreetBets and GameStop saga)

1) realise everyone can profit on the expense of someone if they buy a bit more assets

2) people target short sellers from irrational hate

(see /r/WallStreetBets and GameStop saga)

27/ A normal trader would not do this kind of a trade, or would start to reduce their position if a liquidation risk raises.

But Avi is not normal, he is a man of his word, the slayer of ponzi tokens, a trader with size.

But Avi is not normal, he is a man of his word, the slayer of ponzi tokens, a trader with size.

28/ Avi was liquidated. He ended up with $63M USDC lost and received 92m $CRV tokens, worth $57M at today's price

29/ A lot of market participants suspected "4d chess" and assumed Avi is actually shorting Aave and is intentionally trying to break the markets, or doing some other trade behind the scenes.

Avi had telegraphed this beforehand

Avi had telegraphed this beforehand

https://twitter.com/avi_eisen/status/1582763707742183424

30/ Avi's assumed total on-chain positions were $100M

https://twitter.com/ArkhamIntel/status/1595041038824923136

31/ However despite scratching their head, even the smartest minds of the industry could not figure out how Avi could have profited from this trade.

https://twitter.com/Rewkang/status/1595032919554277377

32/ Aave ended up with $1.3M in bad debt. A minuscule amount, but something was still little broken.

33/ Aave can cover this much of bad debt from interest payments in a short period of time.

The systematic risk realisation is thus avoided.

The systematic risk realisation is thus avoided.

34/ Aave v3 version is deployed to #Ethereum mainnet soon.

It contains further risk management logic to avoid scenarios like this.

It contains further risk management logic to avoid scenarios like this.

https://twitter.com/The3D_/status/1595122284905525248

35/ Meanwhile, the currently deployed Aave v2 risk management parameters are tuned through governance proposals to ensure the system integrity and discourage further trades like Avi did.

https://twitter.com/MonetSupply/status/1595146527642484736

36/ The fact that nothing broke yesterday reflects the health of good, transparent, #defi markets.

This is opposite to FTX, Celsius, Genesis, etc. TradFi lending markets.

This is opposite to FTX, Celsius, Genesis, etc. TradFi lending markets.

37/ FIN

Interested more of #defi this content like this? Please follow us on Twitter @TradingProtocol and subscribe to our newsletter

newsletter.tradingstrategy.ai

Interested more of #defi this content like this? Please follow us on Twitter @TradingProtocol and subscribe to our newsletter

newsletter.tradingstrategy.ai

• • •

Missing some Tweet in this thread? You can try to

force a refresh