1/ Big picture: FTX’s collapse has shaken the #crypto market. But this is not the first time crypto has faced significant turmoil related to the collapse of an exchange.

2/ Mt. Gox’s collapse in Feb of 2014 did likewise, and since then crypto has thrived. To make sense of the implications of FTX, we need to put the event into historical context. Research lead @EricJardine7 compares the collapse of the two exchanges. 🧵

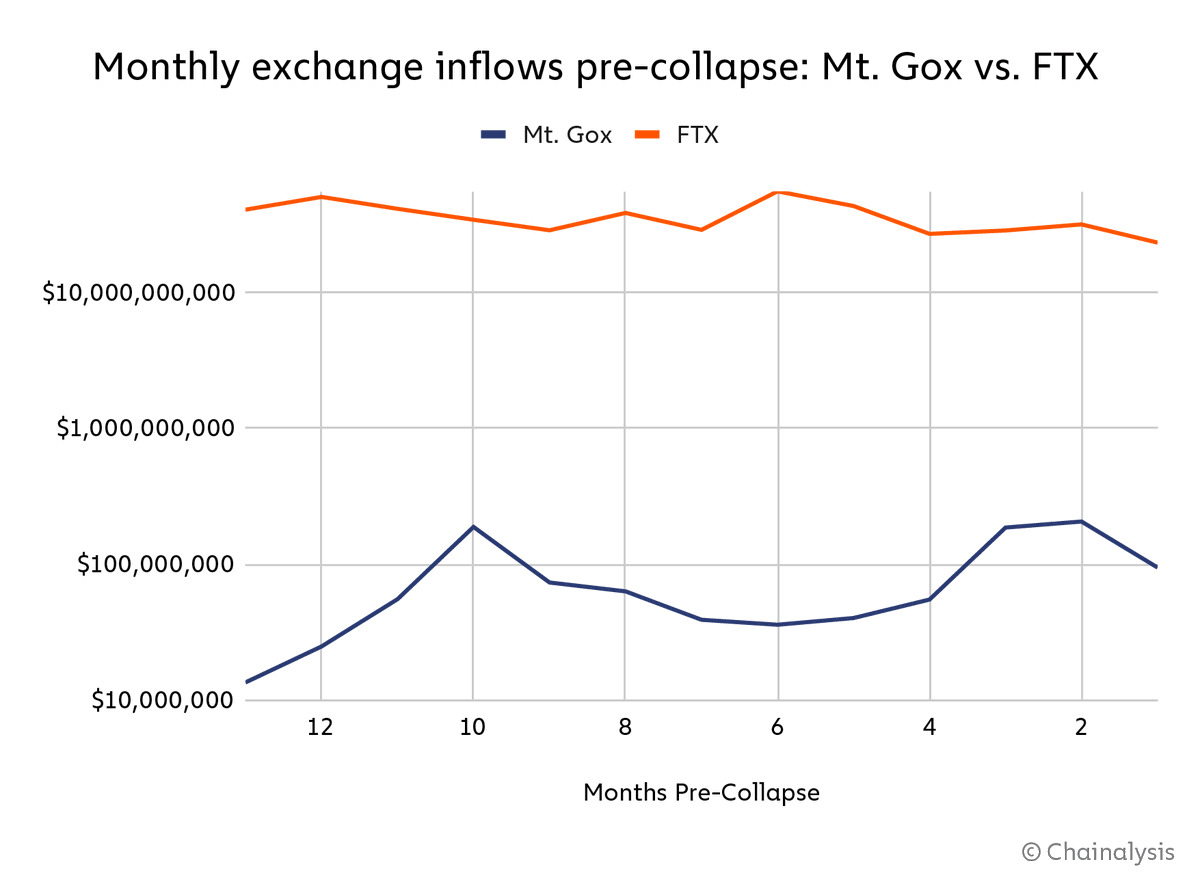

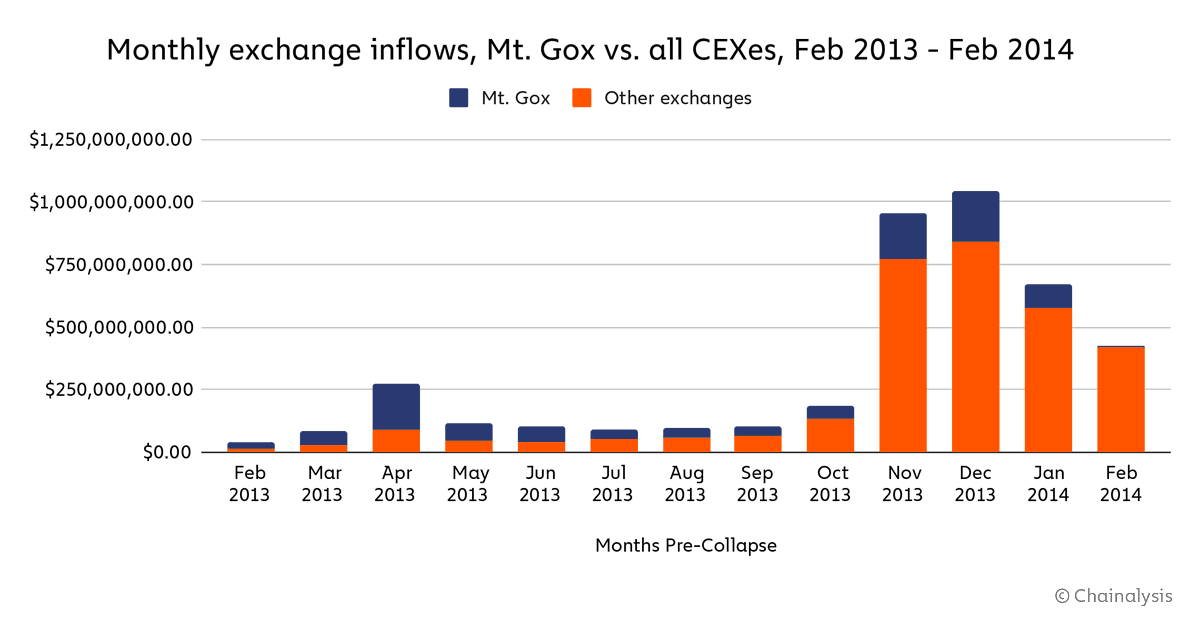

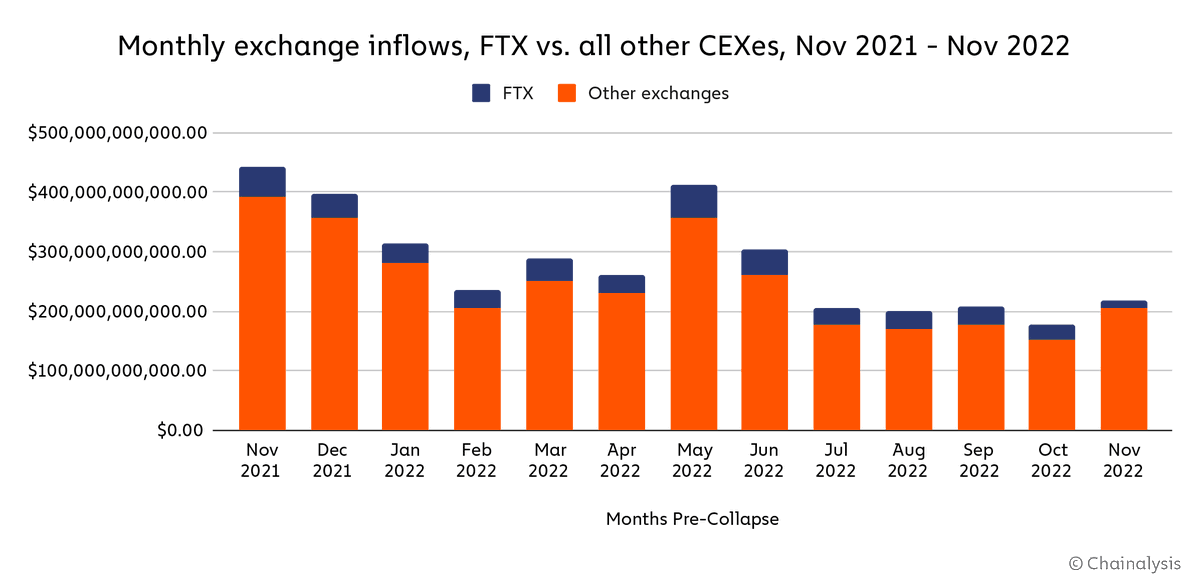

3/ First thing we need to ask: How prominent were Mt. Gox and FTX within the overall crypto exchange ecosystem. In the year prior to its closure, Mt. Gox averaged a 46% share of all exchange inflows, while FTX averaged around 13%.

4/ Objectively, Mt. Gox was a bigger industry player than FTX at the time of its collapse. That’s good news since Mt. Gox’s collapse didn’t destroy crypto. However, the trajectories of the businesses matter too, especially when considering the psychological impact of a collapse.

5/ Mt. Gox was steadily declining in its share of overall exchange activity in the leadup to its collapse, while FTX was slowly gaining in share leading up to Nov 2022.

6/ That would suggest FTX’s collapse may be a bigger blow to the industry’s confidence – it was a big business gaining in market share! But the story changes if we look at raw $ inflows over time. On this measure, Mt. Gox’s volumes were increasing, while FTX’s were decreasing.

7/ Put simply, Mt. Gox was becoming one exchange among many during a period of growth for the category, taking a smaller share of a bigger pie. FTX on the other hand was taking a bigger share of a shrinking pie, beating out other exchanges even as its raw tx volume declined.

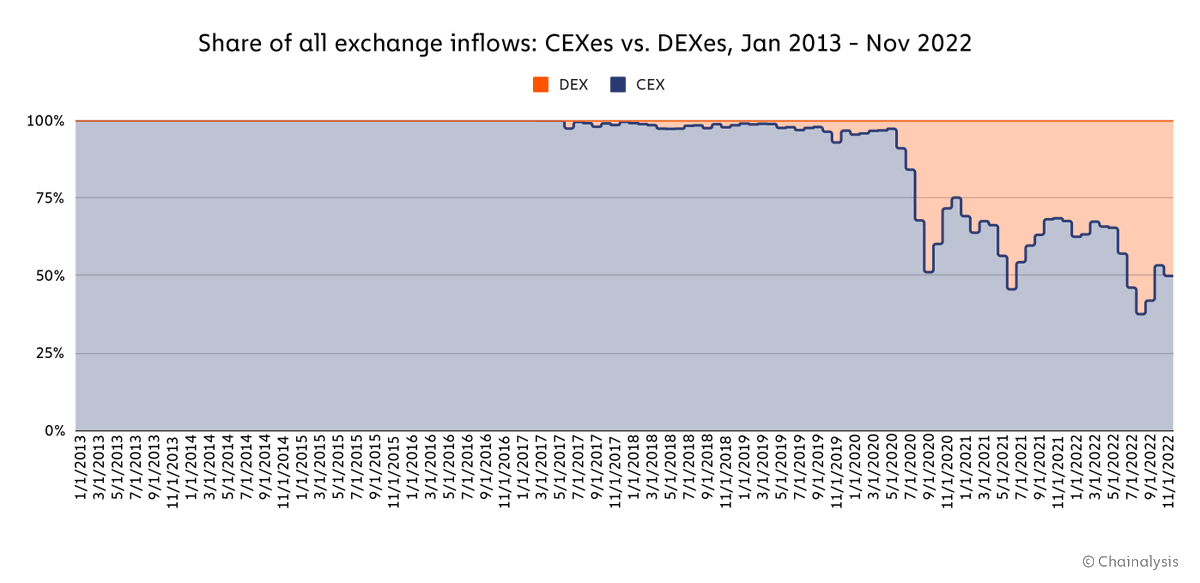

8/ Of course, one big difference between 2014 and now is that there are more crypto services facilitating economic activity than just centralized exchanges. DEXes capture nearly 50% of exchange inflows in late 2022, while CEXes were the only game in town in 2014.

9/ That’s why Mt. Gox was ultimately a bigger part of the crypto ecosystem overall when it collapsed than FTX was. Mt. Gox accounted for 10.9% of total service inflows in the 12 months before its collapse, vs 4.7% for FTX.

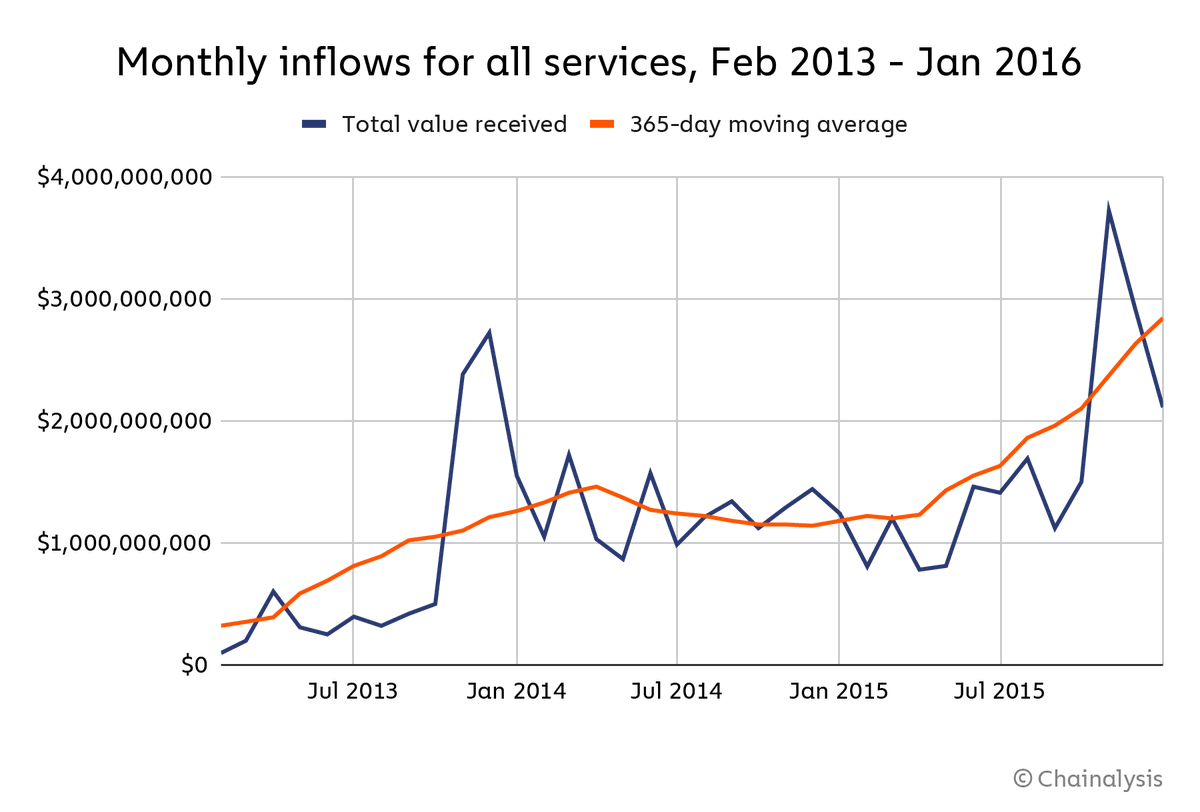

10/ In other words, Mt. Gox was a linchpin of the CEX category at a time when CEXes dominated. But as we all know, crypto survived Mt. Gox’s collapse and continued to grow and thrive. So, what were the immediate effects of that historical collapse?

11/ On-chain transaction volume stagnated for roughly a year afterwards, but after that, picked up again and was soon more than double its pre-Mt. Gox collapse levels.

12/ This comparison should give the industry optimism. Mt. Gox was a bigger part of the crypto ecosystem when it collapsed in 2014 compared to FTX now, and while the market impact was bad, it rebounded relatively quickly.

13/ There are other differences, of course. FTX CEO Sam Bankman-Fried (#SBF) was the face of the industry to many, and the revelation of his financial fraud will damage perceptions of cryptocurrency. Leveraged risk is also probably higher now than before.

14/ But, when we boil it down to market fundamentals, we can see that cryptocurrency has survived worse than the fall of FTX. There’s no reason to think the industry can’t bounce back from this, stronger than ever. Follow along for more updates and market insights.

• • •

Missing some Tweet in this thread? You can try to

force a refresh