1) Sup, folks. While you're busy in your #BlackFriday spending spree, I figured it might be a good time to write a thread about #journaling and, in general, all those practices that seem to be quite undervalued in the #trading world that I find useful. 🧵👇

2) First step: preparation.

Probably you noticed that almost every day, I tweet out stuff like this:

The whole sense of these posts is to remind me in advance of the levels where I'm interested in doing business for the trading session ahead.

Probably you noticed that almost every day, I tweet out stuff like this:

https://twitter.com/L4z0r/status/1595341303214112768?s=20&t=VztxCXRKEcT5yKXe8B4UUA

The whole sense of these posts is to remind me in advance of the levels where I'm interested in doing business for the trading session ahead.

3) The procedure is very simple:

- On your analysis TF (timeframe), mark out each relevant level;

- Describe the scenarios around these levels in an IF => THEN style;

- Take a screenshot and use it as a map during the trading session.

- On your analysis TF (timeframe), mark out each relevant level;

- Describe the scenarios around these levels in an IF => THEN style;

- Take a screenshot and use it as a map during the trading session.

4) I'm a #MarketProfile trader; therefore, every day, I take note of the relevant VAs, Poor H/L, SP, ledges etc.

Then I jot down some scenarios around these levels, set alerts, and bring everything on my execution TF, where I'm on the hunt for my execution triggers.

Then I jot down some scenarios around these levels, set alerts, and bring everything on my execution TF, where I'm on the hunt for my execution triggers.

5) Having a "map" is extremely helpful for me in reducing overtrading while remaining focused on my plan for the day.

Preparation can be simple and effective. It doesn't have to be a frustrating task.

Let's see now what I find useful during the trading session.

Preparation can be simple and effective. It doesn't have to be a frustrating task.

Let's see now what I find useful during the trading session.

6) Second step: self-management/recording

One simple tool I found extremely useful is the so-called "Demon Finder", popularised by @Trader_Dante quite a while ago. It's a simple sheet where each row corresponds to a behavioural mistake, and each column corresponds to a session.

One simple tool I found extremely useful is the so-called "Demon Finder", popularised by @Trader_Dante quite a while ago. It's a simple sheet where each row corresponds to a behavioural mistake, and each column corresponds to a session.

7) During your trading session, you must cross an X as soon as you realise that you deviated from your plan by making one of the listed mistakes. By doing so, with time, you'll be able to quickly identify your recurring behavioural mistakes and correct them.

8) It might seem banal and utterly simple, but you don't have long-term memory for your behavioural mistakes. This tool promptly solves this issue and can guide you toward correcting what matters to you.

9) Let's say you're not profitable because you struggle with following your daily plan, but your own cognitive bias drives you to think that your setups don't have an edge. Therefore you're stuck in a trading course spending spree. The Demon Finder solves this.

10) The next practice I want to talk about is recording and tagging every trade you take.

@FatCatsOfWallStreet made an excellent video about playbooking and reviewing your trades

But here is my simplistic approach to gathering data during the session:

@FatCatsOfWallStreet made an excellent video about playbooking and reviewing your trades

But here is my simplistic approach to gathering data during the session:

11) Live recording and tagging:

-With @ShareX I immediately start recording my screen as I get into a position;

-On a simple .txt I Immediately jot down the following tags: Setup; Trade location; Orderflow pattern; Grade/confidence (A+,A, B etc.).

That's it.

-With @ShareX I immediately start recording my screen as I get into a position;

-On a simple .txt I Immediately jot down the following tags: Setup; Trade location; Orderflow pattern; Grade/confidence (A+,A, B etc.).

That's it.

12) Let's say that you trade #SFP, a trading setup popularised by @Trader_Dante and then recycled by countless others. You notice that one forms at the range low of an Inside Day, which overlaps with a CVAL. You want to quickly tag everything ASAP, along with a confidence grade.

13) As you do that, you're slowly building the foundation to see with time how well your trading setups perform with various degrees of confluence between trade locations, #orderflow patterns and confidence levels. Giving you a chance to filter your execution for the better.

14) Part three: logging onto your journal and reviewing

This is an example of a logged trade on @tradersync

To bring you in the right spot to make some decent statistical analysis, you want to create custom tags for your setups, any confluence factors, and mistakes.

This is an example of a logged trade on @tradersync

To bring you in the right spot to make some decent statistical analysis, you want to create custom tags for your setups, any confluence factors, and mistakes.

15) Most journaling apps out there to date support auto-sync with your trading platform, but you still have to manually fill in your stop loss and TP location. This is especially important to derive your MAE (maximum adverse excursion) and your MFE (maximum favourable excursion).

16) MAE: maximum adverse excursion.

This is a useful stat to keep track of for improving your already profitable setups. Let's see in the next post how you can use it.

This is a useful stat to keep track of for improving your already profitable setups. Let's see in the next post how you can use it.

17) If you use a -10 tick stop and you realised through your stats that your winners rarely go against you more than -4 ticks, you have the chance to use a -5 tick SL instead, using an higher size, while maintaining the same TP, aiming for a higher R:R.

18) MFE: maximum favourable excursion

This is the same logic as the MAE but applied to your losing trades. It can turn non-profitable setups from a statistical standpoint into profitable setups. Let's see how you can use it.

This is the same logic as the MAE but applied to your losing trades. It can turn non-profitable setups from a statistical standpoint into profitable setups. Let's see how you can use it.

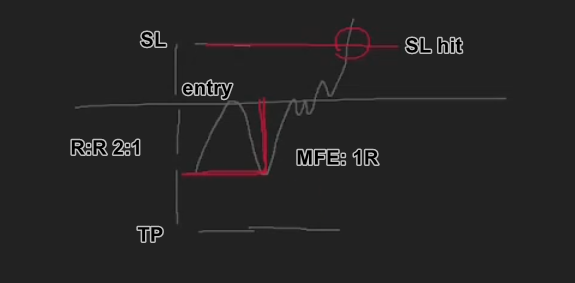

19) Let's say that you have a non-profitable setup with a predetermined R:R of 2:1, and you realise that most of your losing trades, before hitting the SL go in your favour for around +1R.

20) The solution here is to run a simulation of what it would happen if you aimed for a 1:1 R:R instead for that trading setup, and if the W% is over 60%, I would say that you just found a fairly decent trading strategy out of a non-profitable one.

21) @edgewonk has a great risk-management cheat sheet here: edgewonk.com/14-risk/ that you can use to support these considerations during your journaling review.

22) Recap.

Before the session: make a map of scenarios

During: record your trades, tag them and use the DF.

After: import your trades AND your tags into your trading journal.

Review your trading setups through statistical analysis 1x per week to discover/improve your edge.

Before the session: make a map of scenarios

During: record your trades, tag them and use the DF.

After: import your trades AND your tags into your trading journal.

Review your trading setups through statistical analysis 1x per week to discover/improve your edge.

23) Good trading journals (not affiliated):

@tradersync

@edgewonk

@tradesviz

@tradervueapp

@CoinMarketMan (crypto)

@EdgeSheet (crypto)

@tradestream_xyz

Just pick the one that best fits your taste/integrations.

@tradersync

@edgewonk

@tradesviz

@tradervueapp

@CoinMarketMan (crypto)

@EdgeSheet (crypto)

@tradestream_xyz

Just pick the one that best fits your taste/integrations.

24) Honourable mentions:

@ZigsOnTheBid Notion Trading Business Template: ziiiggy.com

If you're into @NotionHQ this is probably the best template out there for incorporating pretty much everything that has been shown in this thread.

@ZigsOnTheBid Notion Trading Business Template: ziiiggy.com

If you're into @NotionHQ this is probably the best template out there for incorporating pretty much everything that has been shown in this thread.

25) I hope you liked this post and found it useful. If so, please consider RT the first post.

If you want to read more content from me, please consider reading the articles on my #medium blog (basically a free trading course, as I don't sell anything): medium.com/@L4z0r

If you want to read more content from me, please consider reading the articles on my #medium blog (basically a free trading course, as I don't sell anything): medium.com/@L4z0r

• • •

Missing some Tweet in this thread? You can try to

force a refresh