1/15 - Become a better trader by tracking markets and learning how to make your own decisions. Don’t try to chase other peoples trades or fall victim to overly simplified narratives from those with vested interests. Here’s how I do it with the data I provide 👇

2/15 - For context, know which type of macro market Mode we’re in, by mapping the monthly rate of change in growth #GDP and inflation #CPI. The closer we are to the zero point, the more impact the #Fed has on markets.

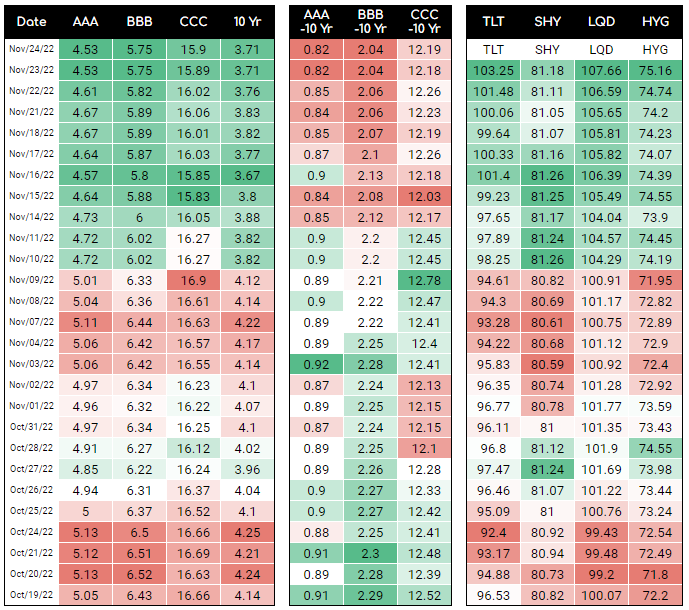

3/15 - Appreciate what the #YieldCurve in bonds looks like and their spreads. Steep yield curves suggest a growing economy and potentially rising inflation, while flat and inverted curves indicate uncertainty and stock market declines.

4/15 - Follow #PMI trends as a leading indicator for the business cycle. Inventories lead New Orders. New Orders are a lead for #GDP. (New Orders - Inventories) is a lead for PMI. A PMI reading below 50 signals negative returns in asset markets.

5/15 - Track the M2 money supply to see if markets are being supported. This is especially important when QE is underway.

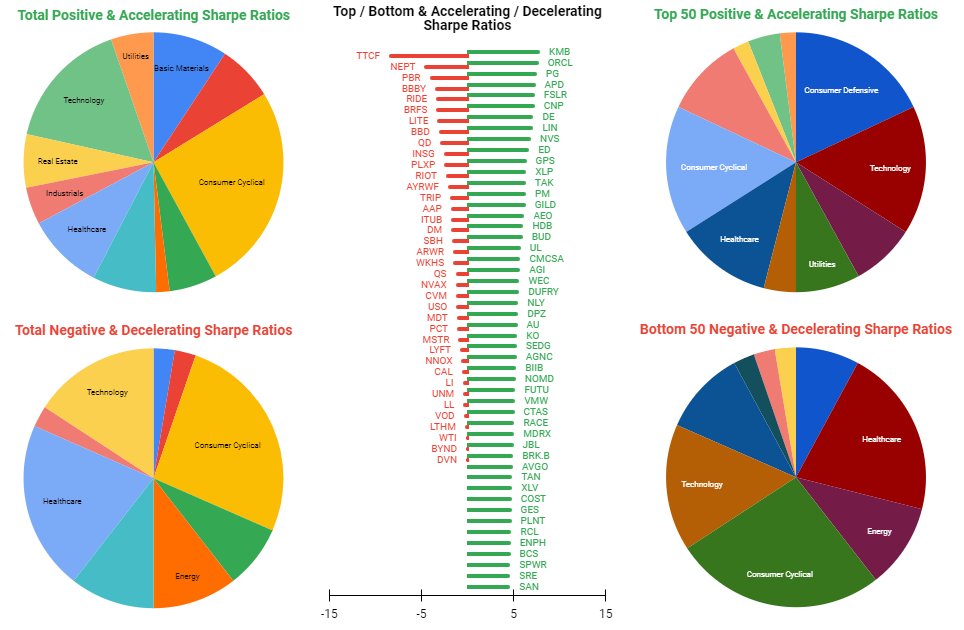

6/15 - Know how Sector Styles are pricing the market Mode, by tracking long/short performances of back tested preferences. Sharp reversals in my signals help determine what's next. Use back tested analysis to know what Styles, Sectors, and Industries are favored in each Mode.

8/15 - Also look at what Style Factors are performing, their rate of change in signal strengths, along with comparative ratios and volume flows. These ETFs can form a larger part of your portfolio relative to individual company positions.

9/15 - Review other quantitative measures to help strengthen your sector preference ideas. Use the options market to help define important support/resistance and #Gamma flip levels, along with my volatility adjusted fractal ranges.

10/15 - Measure and map signals of sector components to see how they’re tracking compared against the slower moving sector ETFs.

11/15 - Review the economic leading indicators in the #PMI Manufacturing and Services reports each month to determine the state of subsector components, read what company managers are saying, and sharpen your trade ideas.

12/15 - Use a variety of tools to look for individual trade ideas within your chosen sectors, including my Bot that trades based on several of my signals and creates a Daily Hitlist.

13/15 - Create up to three different watchlists to monitor the quantitative signals for stocks using my mobile and desktop application, which has no limit on how many you can track.

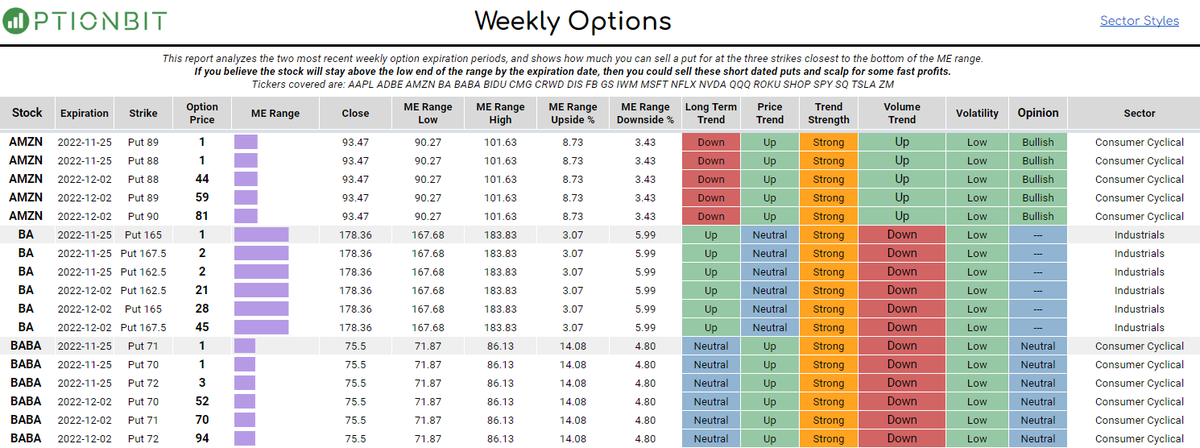

14/15 - For efficient use of capital and hedging, look for option trades where premiums provide good risk/reward setups with high probability of profit, and define your risk with vertical spread ideas when required.

15/15 - Empower your decision making process by signing up today, and get access to all this data and more. If you have some Google Sheets knowledge, you can even build your own dashboards with direct access to my whole archive of signals.

optionbit.blog/join-the-optio…

optionbit.blog/join-the-optio…

• • •

Missing some Tweet in this thread? You can try to

force a refresh