Good morning and God bless! Time to focus on the #NextPlay.

In our 10/29 Around the Horn, we discussed how max pain for us bears was likely to be ~4100 on the $SPX. The path getting here (2 big days of 0DTE call-induced gamma squeezes) has been weird, but we are here. What now?

In our 10/29 Around the Horn, we discussed how max pain for us bears was likely to be ~4100 on the $SPX. The path getting here (2 big days of 0DTE call-induced gamma squeezes) has been weird, but we are here. What now?

The answer to “What now?” has 3 components:

1. Will the $SPX squeeze past its 200DMA, forcing capitulation by a net short investor consensus?

2. Will CPI behave?

3. Will Powell have to backtrack regardless, given that he catalyzed a sharp move higher in inflation expectations?

1. Will the $SPX squeeze past its 200DMA, forcing capitulation by a net short investor consensus?

2. Will CPI behave?

3. Will Powell have to backtrack regardless, given that he catalyzed a sharp move higher in inflation expectations?

All I know is that I’m happy it’s December, because November was not a good month for me.

As a someone who studies POSITIONING like a hawk, I know November was a sh!tty month for nearly everyone — I’m just one of the few that is open and honest about EVERY trade I make in my PA.

As a someone who studies POSITIONING like a hawk, I know November was a sh!tty month for nearly everyone — I’m just one of the few that is open and honest about EVERY trade I make in my PA.

One of the few that likely had a good Nov is our friend @jam_croissant over at Kai Volatility Advisors. While I believe it would be a stretch to imply “seasonality” caused the two ~5% melt ups (Oct CPI and Powell yesterday), right = right. I’m excited to pick his brain next week!

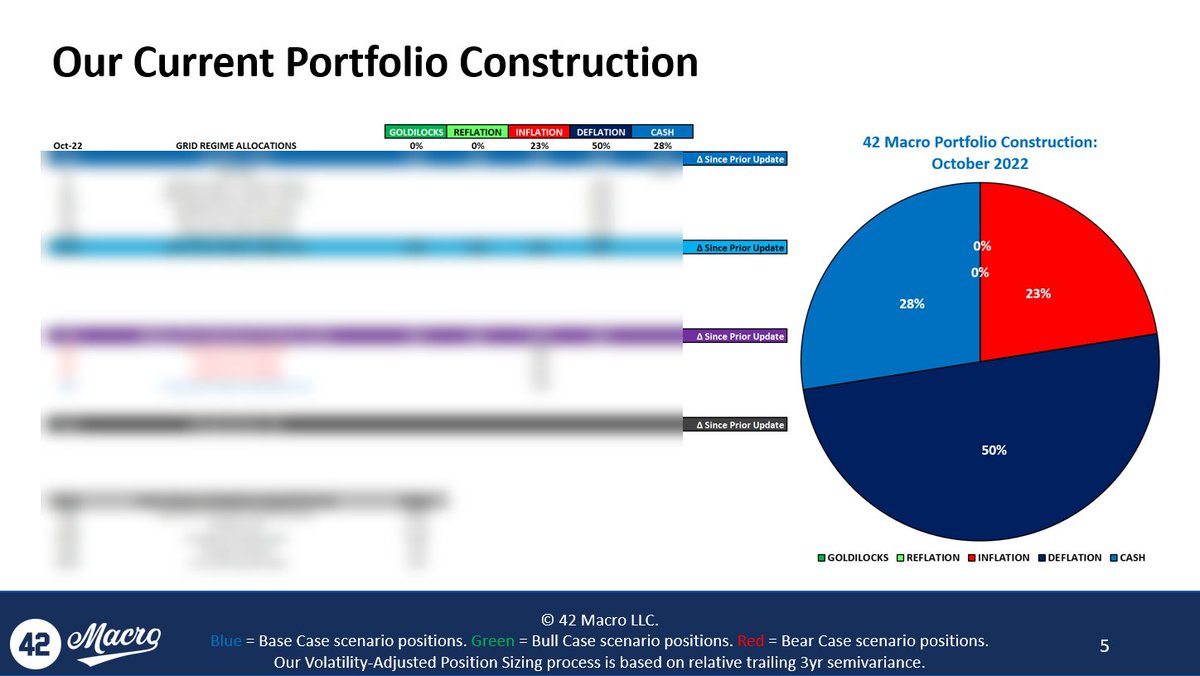

Subscribe or upgrade to Macro Bundle at 42macro.com to learn from two heavyweights asking and answering specific process and risk management questions. These insights will greatly exceed the typically-nebulous guidance we provide for free — hence behind the paywall.

• • •

Missing some Tweet in this thread? You can try to

force a refresh