The Texas grid operator ERCOT just released a report that evaluates the adequacy of installed generation capacity for the winter based on historic data + several risk scenario forecasts (eg extreme demand, low wind, extreme peak load)

2/

2/

The ERCOT report shows that Bitcoin miners are predicted to provide (ie curtail) 1.7GW to help meet winter peak demand in Texas

3/

3/

The 1.7 GW curtailment by Bitcoin miners represents 2.5% of the winter peak load forecast (baseline), which is not insignificant if you consider the nascency of mining in Texas

4/

4/

Bitcoin miners are expected to provide more capacity to the Texas grid from curtailment (1.7GW) than energy storage (0.9GW), solar (1.5GW), or hydro (0.4GW) alone!

- ERCOT resource adequacy study

5/

- ERCOT resource adequacy study

5/

ERCOT assumes that co-located Bitcoin miners shut down below their breakeven threshold (est to be at $86/MWh for an s19 this Nov)

97% of their power requirements become available to meet winter grid demand

6/

97% of their power requirements become available to meet winter grid demand

6/

Why is this important? Texas suffered an extreme weather event in 2021, which strained the grid, left 4.5m people w/out power (& heat), & caused damages to water & gas distribution systems

Miners provide a capacity buffer that help grids weather the storm during extreme events

7

Miners provide a capacity buffer that help grids weather the storm during extreme events

7

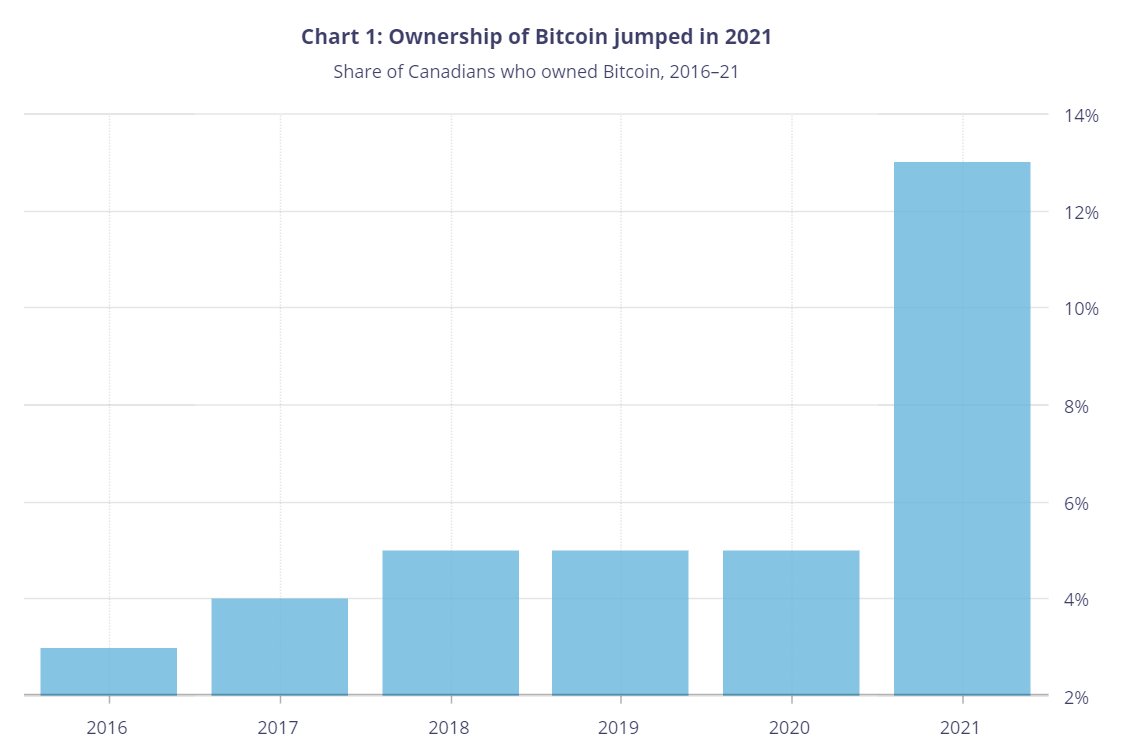

Outside of extreme weather events, bitcoin miners provide a predictable revenue steam for the power they use, thus supporting the generators they're colocated with, or subsidize other ratepayers in regulated electricity markets such as Canada (system costs need to be recovered)

8

8

Reports like this are an important tool for short term system planning (ie this winter)

Further, ERCOT can also model the impact of Bitcoin miners wrt long term system planning, as additional renewables & industrial & household loads are expected to change overtime

9/

Further, ERCOT can also model the impact of Bitcoin miners wrt long term system planning, as additional renewables & industrial & household loads are expected to change overtime

9/

ERCOTs report can also provide valuable insights to other jurisdictions wrt how Bitcoin mining fits into the electricity grid, particularly those that are contemplating unfavorable politices wrt mining

Looking at you NY, Quebec, Manitoba, Labrador & Ontario #canpoli

10/

Looking at you NY, Quebec, Manitoba, Labrador & Ontario #canpoli

10/

ERCOT report link: ercot.com/files/docs/202…

11/

11/

• • •

Missing some Tweet in this thread? You can try to

force a refresh