Seven charts to explain, why the U.S. is heading into a #recession (which is unlikely to be "mild"). 🧵

Let's start with the most problematic one: the yield curves. Many read these like the Bible, and they rarely have gotten it wrong. However, this time there's a problem.

1/14

Let's start with the most problematic one: the yield curves. Many read these like the Bible, and they rarely have gotten it wrong. However, this time there's a problem.

1/14

Our first-ever U.S. #recession call, in March 2019, predicting the beginning of an U.S. recession in early 2020, was based on the inversion of the yields of the Treasuries with 10-year and 3-month maturities.

But, they are being manipulated. 2/

gnseconomics.com/2019/03/27/rec…

But, they are being manipulated. 2/

gnseconomics.com/2019/03/27/rec…

This is depicted in the strange divergence of the 10y/3mo and 10y/2y spreads in early 2022 shown in the figure above. I explained this in detail in my @EpochOpinion piece in May.

Main point: purchases of Treasuries by the #Fed are twisting the curves. 3/

theepochtimes.com/recession-come…

Main point: purchases of Treasuries by the #Fed are twisting the curves. 3/

theepochtimes.com/recession-come…

I summarized the situation as:

"In any case, because of the quantitative easing (QE) and QT, the whole bond market is a mess, and all signals from it should be interpreted with a heavy grain of salt."

More on QT here.👇

4/

theepochtimes.com/the-failure-of…

"In any case, because of the quantitative easing (QE) and QT, the whole bond market is a mess, and all signals from it should be interpreted with a heavy grain of salt."

More on QT here.👇

4/

theepochtimes.com/the-failure-of…

Yet, we can argue that because the inversion is so large now, it probably holds true, but we need some information outside the bond markets to verify this.

Such verifications can be found from bank, more precisely on bank lending standards, and debt data. 5/

Such verifications can be found from bank, more precisely on bank lending standards, and debt data. 5/

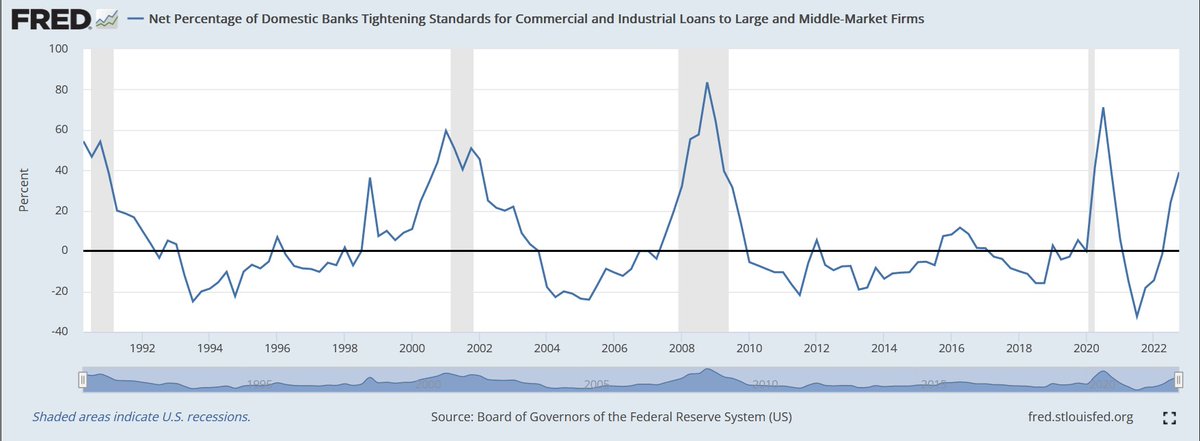

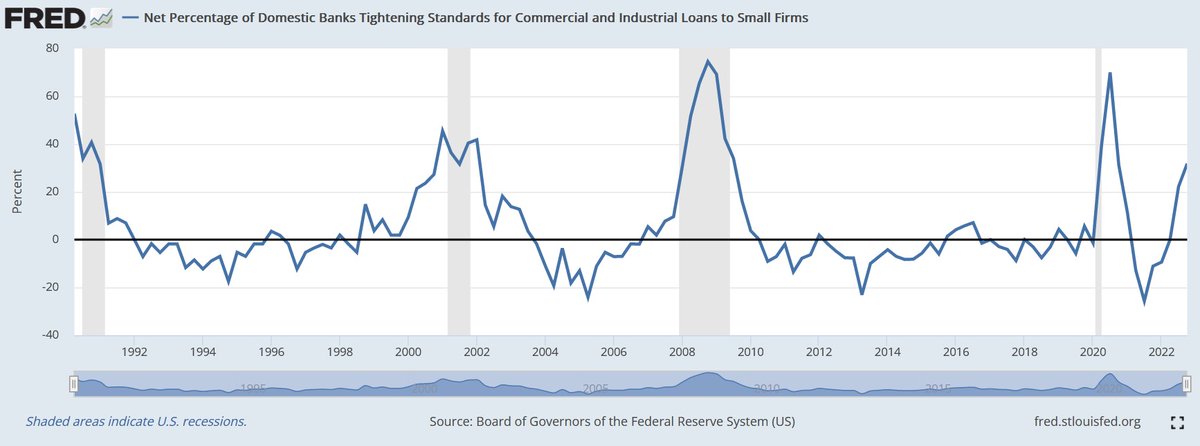

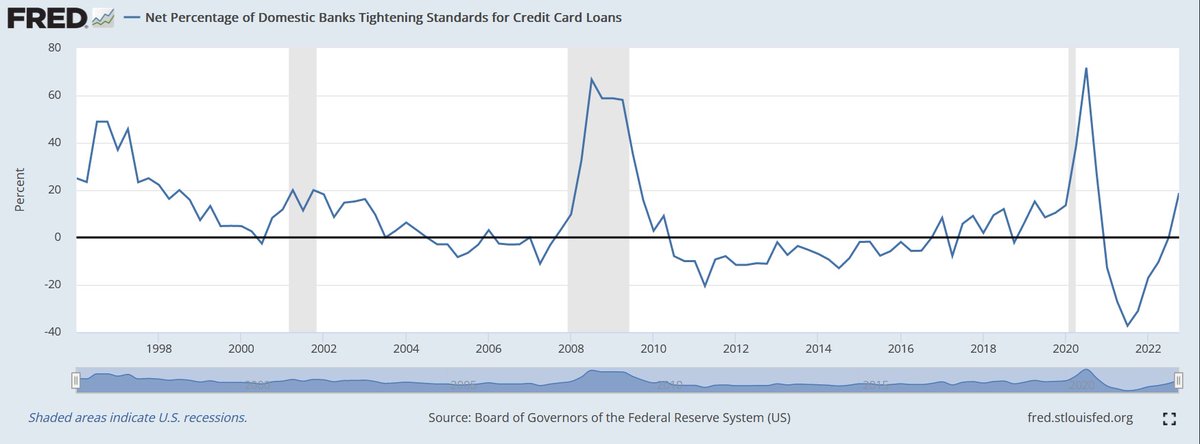

The share of banks tightening lending standards has been a reliable #recession indicator. It gave a warning even right before the artificial 2020 recession caused by the lockdowns.

So, here are the three main bank lending charts all showing the same thing. 6/

So, here are the three main bank lending charts all showing the same thing. 6/

They show than #banks are tightening standards in all their lending activities for corporations and for credit cards. However, this is not enough to guarantee the arrival of a #recession , by itself.

Corporations, for example can seek funding from the bond markets.

7/

Corporations, for example can seek funding from the bond markets.

7/

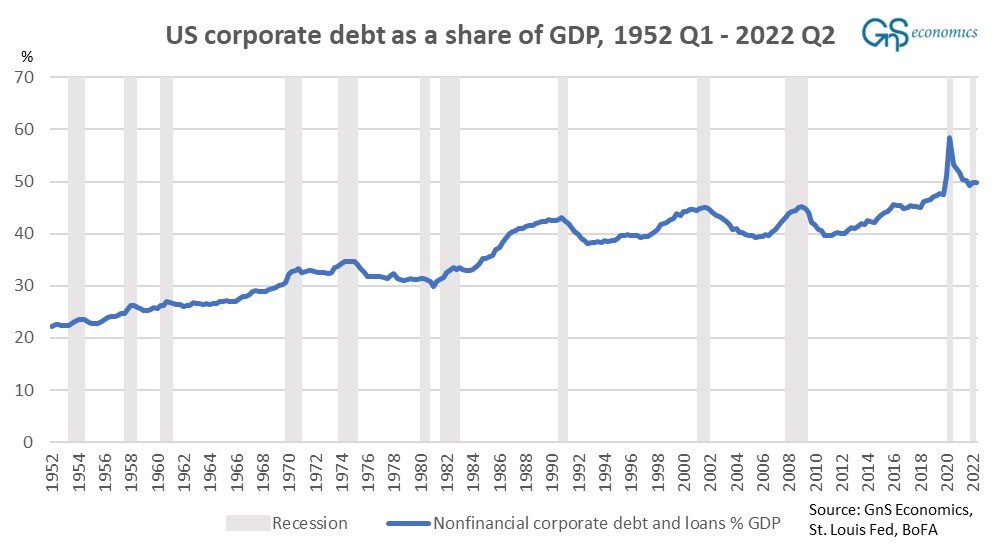

However, first note that U.S. corporations are more indebted than ever in total terms, but also when compared to their income base (gross domestic product). Firms are effectively "swimming" in #debt .

How are their interest payments (yields) behaving then?

8/

How are their interest payments (yields) behaving then?

8/

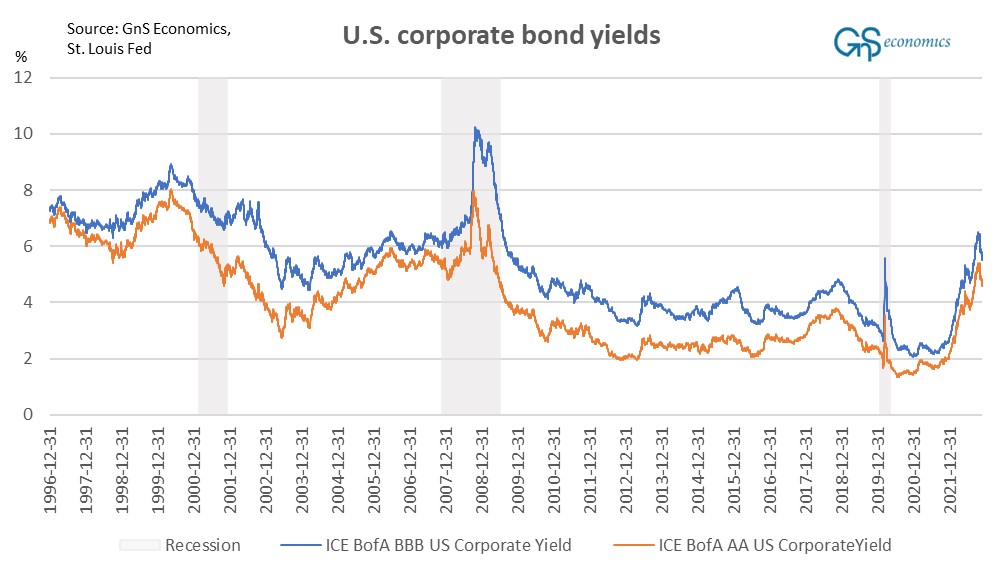

Unsurprisingly, not good. Interest rate hikes and QT of the #FederalReserve have pushed yields of corporate bonds considerably higher in practically all credit-rated classes.

Alas, the ability of U.S. firms to borrow more is becoming gravely limited.

9/

Alas, the ability of U.S. firms to borrow more is becoming gravely limited.

9/

Moreover, some corporations are likely to face problems of maintaining their debt sustainability (interest payments + the principal).

This concerns especially the so-called zombie corporations. Mass bankruptcies loom.

10/

theepochtimes.com/zombie-corpora…

This concerns especially the so-called zombie corporations. Mass bankruptcies loom.

10/

theepochtimes.com/zombie-corpora…

So, because firms are more indebted than ever, banks are tightening lending standards on their loans and because yields of their bonds are their 13-year peak, corporations will be forced to cut spending, and some (mostly 'zombies') are likely to fail.

11/

11/

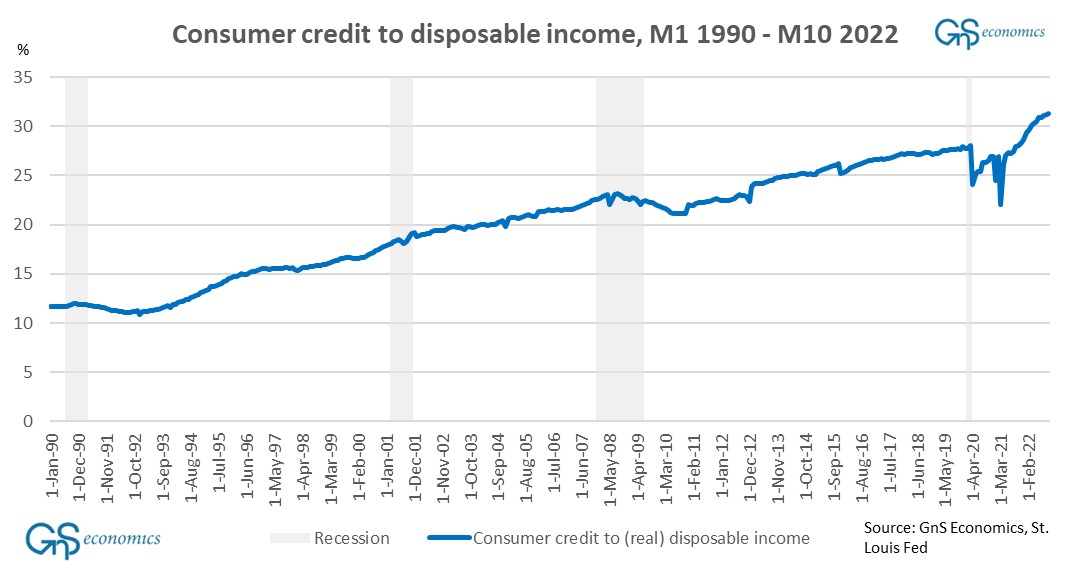

This implies layoffs, possible on a massive scale, less investment spending and less corporate consumption.

These will eat further into the income of, rather heavily indebted, households who are already suffering from high interest rates and tightening lending standards.

12/

These will eat further into the income of, rather heavily indebted, households who are already suffering from high interest rates and tightening lending standards.

12/

Alas, the U.S. is, almost certainly, heading into a #recession during the first two quarters of next year.

The massive problems in #Europe , however, may (are likely to) turn the approaching recession to something more sinister. 👇😬

13/

mtmalinen.substack.com/p/european-deb…

The massive problems in #Europe , however, may (are likely to) turn the approaching recession to something more sinister. 👇😬

13/

mtmalinen.substack.com/p/european-deb…

In the worst-case, we will see a very destructive loop of falling household consumption, wide-spread bankruptcies and mass layoffs feeding falling consumption.

It would lead to existential banking problems and to an outright economic collapse. 🥶

/End

mtmalinen.substack.com/p/enter-the-pe…

It would lead to existential banking problems and to an outright economic collapse. 🥶

/End

mtmalinen.substack.com/p/enter-the-pe…

• • •

Missing some Tweet in this thread? You can try to

force a refresh