#THREAD

Are dangerously irresponsible free-market extremists deliberately colluding to manufacture ANOTHER global economic crash?

The 2008 crash was caused by reckless deregulation of the financial sector, & resulted in a decade of brutal #austerity.

theguardian.com/business/2022/…

Are dangerously irresponsible free-market extremists deliberately colluding to manufacture ANOTHER global economic crash?

The 2008 crash was caused by reckless deregulation of the financial sector, & resulted in a decade of brutal #austerity.

theguardian.com/business/2022/…

The 2008 global economic crash was catastrophic, sparking another Great Recession which resulted in increases in unemployment, suicide, far-right extremism & dangerous levels of societal polarisation, & decreases in institutional trust & fertility.

In Britain, it led to a decade of catastrophic #austerity which cost 330,000 lives & meant cuts to essential public services & various benefits, wage stagnation,

massive bail-outs of financial institutions, & new policies designed to prevent collapse of Global financial system.

massive bail-outs of financial institutions, & new policies designed to prevent collapse of Global financial system.

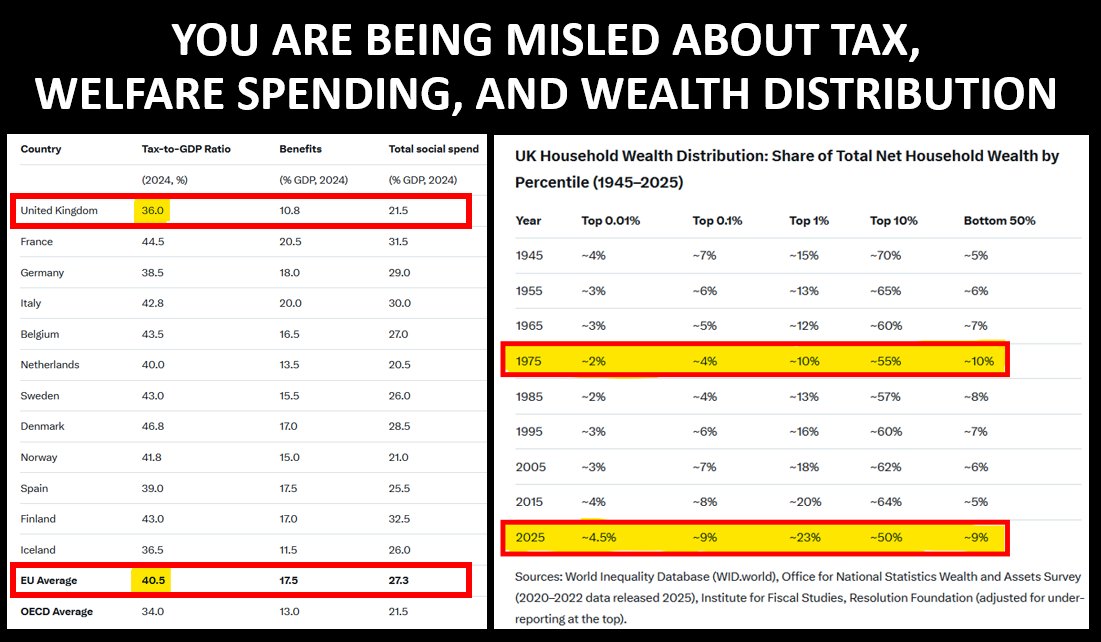

Free-market extremists are the greatest threat to peace & humanity, & to nature & the planet. Failed neoliberal deregulatory policies have led to unsustainable use of finite natural resources, catastrophic climate change & other environmental problems, which have all accelerated.

Unbridled market forces leads to selfish competitive individualism & the breakdown of local, national. & global communities, & social cohesion.

Income from privatised public services which used to benefit everyone, now goes to already rich shareholders.

Income from privatised public services which used to benefit everyone, now goes to already rich shareholders.

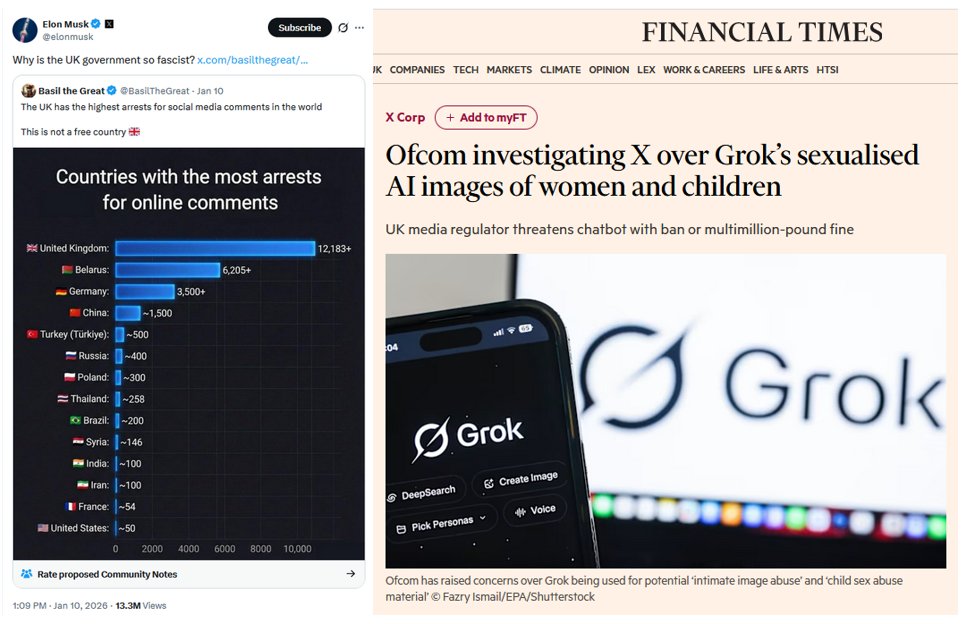

Neoliberal policies have led to dangerous concentration of ownership of media channels in the hands of grotesquely wealthy elites, & have demonstrably increased insecurity, mistrust, polarisation, & inequality in personal & national wealth, widening the gap between rich & poor.

The richest 1% now own 45% of global wealth. The richest 10% own 76%. Since beginning of pandemic the world’s 10 richest men doubled their fortunes, from $700bn to $1.5 TRILLION (a rate of $15,000/SECOND) & have accumulated more wealth than the bottom 3.1 billion people combined.

The new ideologically extreme & reckless changes UK Government Chancellor Jeremy Hunt is introducing will redraw the financial services rule book, including casting aside some of the safeguards explicitly designed to avoid a repeat of the 2008 crash!

Hunt argues some of the changes are only possible because of “freedoms” gained from #Brexit, but there will also be a relaxation of rules Britain introduced unilaterally after 2008 - changes that often went FURTHER than the EU - making the UK a riskier place to do business.

Regulators have privately expressed doubts about the government’s efforts to loosen the reins on banks, especially given the recession, & the Bank of England has unveiling plans to introduce a tighter version of new global banking capital rules than those being pursued in the EU.

And as if they aren't already sufficiently grotesquely wealthy, Jeremy Hunt is removing the cap on bankers’ bonuses during the #CostOfLivingCrisis, while rules intended to separate risky investment banking from retail operations will be 'relaxed' to help “retail-focused banks”.

The regime introduced to hold bankers responsible for infractions that happened on their watch will be reviewed, & City regulators will be given a new “secondary objective” of 'delivering growth & competitiveness', alongside ensuring financial stability & consumer protection.

Sir John Vickers, who chaired an independent commission on banking, says the secondary objective was either “pointless or dangerous”. Lord Adair Turner, FSA Chair after 2008, agreed: “It is a mistake to give the regulators of the finance sector a competitiveness objective.”

"But some of the reforms you are scrapping came after the financial crisis, & were considered for years before being implemented. Are there risks to removing them?"

Hunt insists there are not. He talks about the need to be careful not to unlearn the lessons of the 2008 crisis.🤪

Hunt insists there are not. He talks about the need to be careful not to unlearn the lessons of the 2008 crisis.🤪

• • •

Missing some Tweet in this thread? You can try to

force a refresh