Grab a cup of coffee☕️

Today, we’ll learn one of the simplest valuation models for a publicly traded stock which can also blend in with your financial goals.

I’m talking about the Dividend Discount Model (DDM)

A detailed thread 🧵with HCL Tech as example & bonus giveaway

(1/n)

Today, we’ll learn one of the simplest valuation models for a publicly traded stock which can also blend in with your financial goals.

I’m talking about the Dividend Discount Model (DDM)

A detailed thread 🧵with HCL Tech as example & bonus giveaway

(1/n)

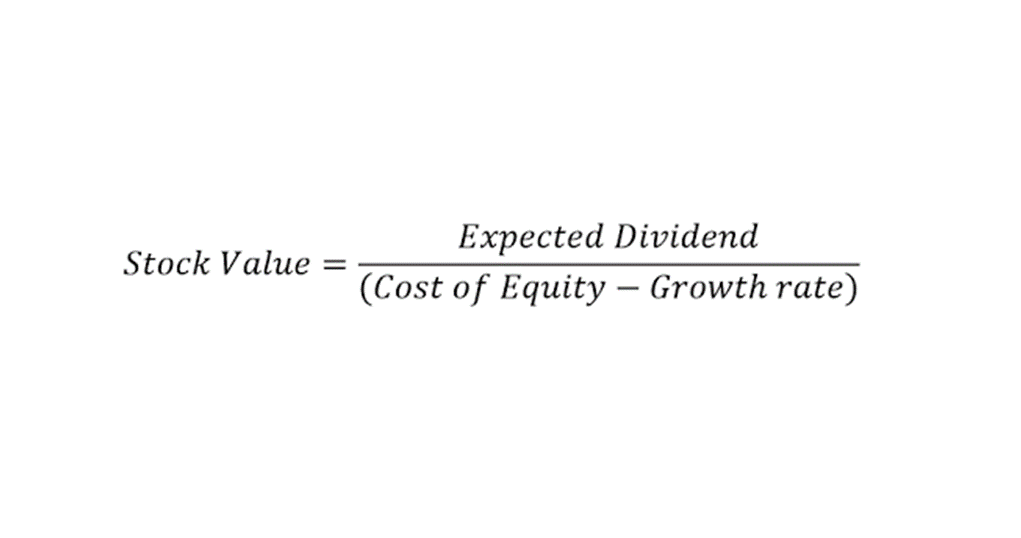

The Dividend Discount Model (DDM) calculates the fair value of a stock based upon the sum of all future dividends discounted to their present value

Stock Price = D/(r-g)

D = est. next year dividend

r = cost of equity capital

g = growth rate of dividends, in perpetuity

(2/n)

Stock Price = D/(r-g)

D = est. next year dividend

r = cost of equity capital

g = growth rate of dividends, in perpetuity

(2/n)

How to simplify the DDM Formula?

“D” – You can use latest FY dividend vs est. of next yr

“r” – You can use 10yr G-sec yield as cost of equity capital or refer to next tweet

• AAA Rated Cos - G-Sec

• AA - G-Sec +1-2%

• A & below - G-Sec + 3-5%

(3/n)

“D” – You can use latest FY dividend vs est. of next yr

“r” – You can use 10yr G-sec yield as cost of equity capital or refer to next tweet

• AAA Rated Cos - G-Sec

• AA - G-Sec +1-2%

• A & below - G-Sec + 3-5%

(3/n)

How to link Financial Goals with Dividend Discount Model?

Use of G-Sec yield for “r” = a variable based on interest rate cycle.

Instead of G-Sec, you can use “Target CAGR” which links it with your financial goals.

Example: If you want 15% CAGR returns, use 15% as “r”

(4/n)

Use of G-Sec yield for “r” = a variable based on interest rate cycle.

Instead of G-Sec, you can use “Target CAGR” which links it with your financial goals.

Example: If you want 15% CAGR returns, use 15% as “r”

(4/n)

“g” – Est. growth rate of future dividends

Most important assumption

A company can have very high dividend CAGR over long term, but much lower in recent past

Ex: #EicherMotors has grown dividends at 26% CAGR since 2005 (Re 0.4 to Rs. 21), but only 13% CAGR in past 6 yrs

(5/n)

Most important assumption

A company can have very high dividend CAGR over long term, but much lower in recent past

Ex: #EicherMotors has grown dividends at 26% CAGR since 2005 (Re 0.4 to Rs. 21), but only 13% CAGR in past 6 yrs

(5/n)

Is it realistic to assume growth rate of dividends into perpetuity?

No, and no company can maintain same growth rate forever!

Markets are forward looking, but most analysts value a stock based on next 1-3 yrs growth, our job is to roughly guesstimate next 3-5 yrs growth

(6/n)

No, and no company can maintain same growth rate forever!

Markets are forward looking, but most analysts value a stock based on next 1-3 yrs growth, our job is to roughly guesstimate next 3-5 yrs growth

(6/n)

How to estimate “g”?

1. Use management guidance on PAT growth & subtract 3-4% for dividend growth rate

2. If no guidance available, study recent 3-5 yrs PAT/dividend growth & subtract 2-3% from it

3. Always err on the side of caution & try to estimate for next 3-5 yrs

(7/n)

1. Use management guidance on PAT growth & subtract 3-4% for dividend growth rate

2. If no guidance available, study recent 3-5 yrs PAT/dividend growth & subtract 2-3% from it

3. Always err on the side of caution & try to estimate for next 3-5 yrs

(7/n)

Bonus Giveaway

I use this template for any high dividend yielding (>2-3%) companies which have a good track record of growing dividend > GDP growth rate

With the 3 DDM inputs, it will reveal the fair value of any stock and the current discount/premium to the fair value

(8/n)

I use this template for any high dividend yielding (>2-3%) companies which have a good track record of growing dividend > GDP growth rate

With the 3 DDM inputs, it will reveal the fair value of any stock and the current discount/premium to the fair value

(8/n)

All my followers who Like & RT the 🧵 can get this Dividend Discount Model (DDM) spreadsheet for your personal use to calculate the fair value of any business

It's pre-populated with my DDM valuation for 5 stocks.

Just drop me a DM & I will share the link by 9pm tomorrow

(9/n)

It's pre-populated with my DDM valuation for 5 stocks.

Just drop me a DM & I will share the link by 9pm tomorrow

(9/n)

Caveats - Do not apply DDM for 👇

1. Cos which have never paid dividend

2. Cos with highly fluctuating dividend payout %

3. Cos with high rate of dividend growth (>20-30%)

Recommended use only for mature businesses with history of regular, predictable dividends

(10/n)

1. Cos which have never paid dividend

2. Cos with highly fluctuating dividend payout %

3. Cos with high rate of dividend growth (>20-30%)

Recommended use only for mature businesses with history of regular, predictable dividends

(10/n)

Dividend Discount Model (DDM) - Example #HCLTech

Stock Price = D/(r-g)

D = Rs 42/share (FY22)

r = 12% (Target XIRR)

g = 8%

5 yr PAT growth is 9% so I assume 8% rate of growth for foreseeable future

Fair Value = Rs 1050

Note - DDM is an approximation based on assumptions

END

Stock Price = D/(r-g)

D = Rs 42/share (FY22)

r = 12% (Target XIRR)

g = 8%

5 yr PAT growth is 9% so I assume 8% rate of growth for foreseeable future

Fair Value = Rs 1050

Note - DDM is an approximation based on assumptions

END

Thanks a lot everyone for the extremely warm response to this thread 🙏

As promised, I've shared (via DM) my personal DDM Google sheets pre-populated with DDM for 5+ stocks - #ITC, #HCLTech, #HDFCAMC, #Polyplex, #SwarajEngines

Please DM me if I missed sharing it with anyone.

As promised, I've shared (via DM) my personal DDM Google sheets pre-populated with DDM for 5+ stocks - #ITC, #HCLTech, #HDFCAMC, #Polyplex, #SwarajEngines

Please DM me if I missed sharing it with anyone.

• • •

Missing some Tweet in this thread? You can try to

force a refresh