While many hang on Powell's every word and look for every clue to try and gain an edge into where the Fed's monetary policy is headed, the #FOMC have made the equation clear: rates will stay high until #inflation is unambiguously on the way to 2%.

A 🧵

A 🧵

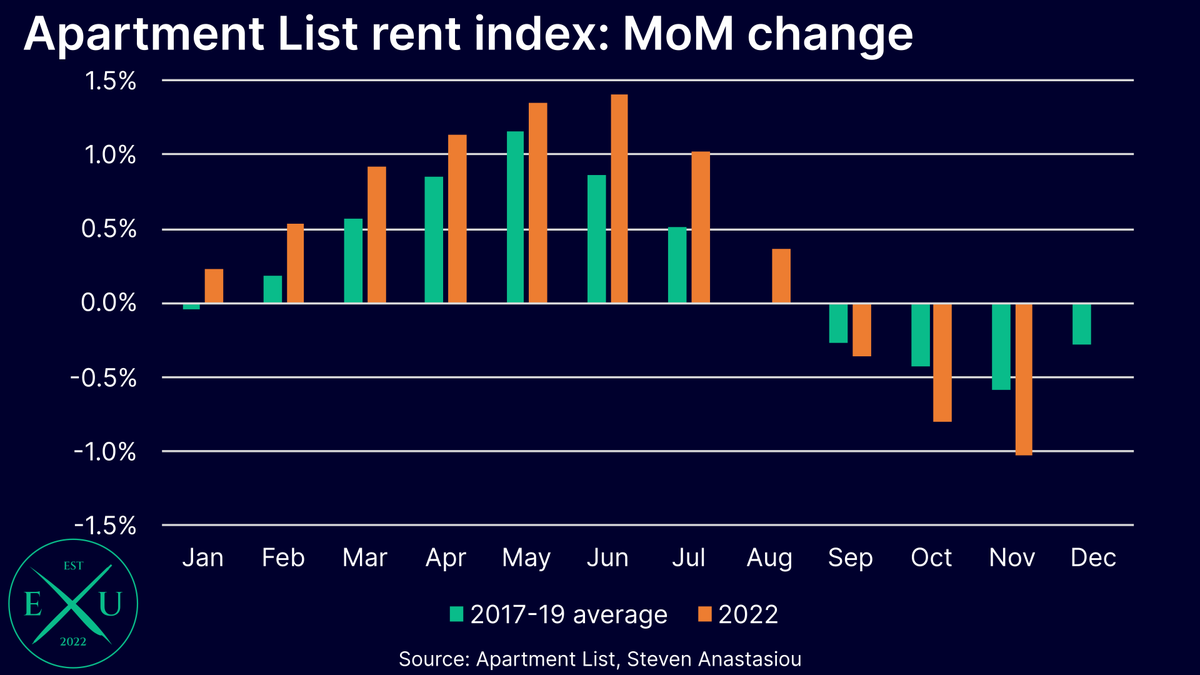

Therefore the only variable that people really should be focusing on, is inflation. While I think that inflation will fall significantly over the next year (see my most recent inflation analysis 👇), it is likely to remain elevated in 1H23.

https://twitter.com/steveanastasiou/status/1603041605291839488

This creates a significant problem: the chance of a SEVERE recession.

With M2 ALREADY seeing MoM declines, the latest 50bps of tightening, plus the additional tightening that the Fed has articulated (rates >5% in 2023), further increases the odds of a severe recession happening.

With M2 ALREADY seeing MoM declines, the latest 50bps of tightening, plus the additional tightening that the Fed has articulated (rates >5% in 2023), further increases the odds of a severe recession happening.

The risk also grows the longer that the Fed continues with its restrictive policy. Despite the many clear signs that already exist, the Fed is unlikely to be unambiguously convinced of 2% inflation until 2H23. Many more months of highly restrictive monetary policy thus lie ahead.

While the Fed can talk about keeping rates restrictive throughout ALL of 2023, the simple fact is, once inflation clearly begins moving to 2%, the Fed will cut rates - particularly as the economy is likely to simultaneously be in a recession.

This is why bond markets are choosing to not fully price in the hawkish rhetoric from the Fed - as bond investors know that lower inflation and a recession likely lie ahead.

On the other hand, equity market multiples show stock investors are focusing on the pivot, but are ignoring the economic reality that the Fed's tightening will bring - a recession, earnings declines, and investor pessimism & panic that likely temporarily hits market multiples.

• • •

Missing some Tweet in this thread? You can try to

force a refresh