⚠️The curious case of GMM Pfaudler⚠️

"Commitments made in Concalls were never Implemented & company continue to lie. "

How?

A thread 🧵

Like Retweet Share Follow if you find valuable

#GMmpfaudler #redflag #corporategovernance

"Commitments made in Concalls were never Implemented & company continue to lie. "

How?

A thread 🧵

Like Retweet Share Follow if you find valuable

#GMmpfaudler #redflag #corporategovernance

The backstory in Aug-2020, GMM entered into complex transaction involving GMM pfaudler, promoter, DBAG buying out their international parent whuch owns international business

Details of which are summarized below

Most importantly read highlighted in red that stake is locked

Details of which are summarized below

Most importantly read highlighted in red that stake is locked

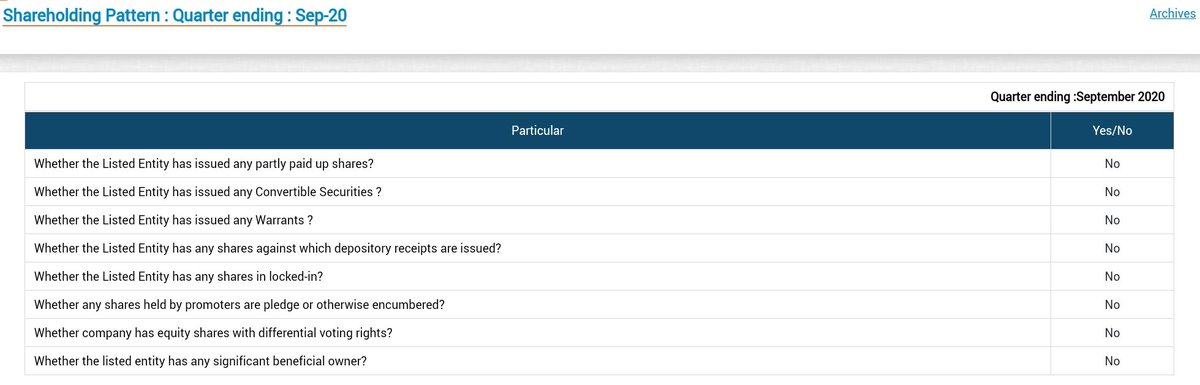

Redflag 1

Lock in period?

Post complex transaction in Sept-20 concall Company said promoters (Patel 33% & DBAG 24% stake will be locked in for 3 yrs i.e. till Aug-23)

Same was reiterated in Q2FY23 concall also as asked by @saketreddy

Lock in period?

Post complex transaction in Sept-20 concall Company said promoters (Patel 33% & DBAG 24% stake will be locked in for 3 yrs i.e. till Aug-23)

Same was reiterated in Q2FY23 concall also as asked by @saketreddy

But this stake lock in was never intimated to exchange and hence forth lock in was never recorded actually.

So lock in was just communicated in concalls not actually implemented as who cares

Company is not committed to what they are saying in concalls

So lock in was just communicated in concalls not actually implemented as who cares

Company is not committed to what they are saying in concalls

Now the same PE - promoter whose stake was supposed to be locked in till Aug-23 is now selling its entire 29.88% stake.

Investors are cheated as promoters didn't act on what they earlier committed

@YatinMota

Investors are cheated as promoters didn't act on what they earlier committed

@YatinMota

Redflag 2 as highlighted by @deepakshenoy

https://twitter.com/deepakshenoy/status/1310857509989617665?t=Z9E_wt7Qsc-eOa_0rtS73g&s=19

Redflag 3

their complex deal of Aug-20 and OFS of Sept-20

@capitalmind_in @deepakshenoy

OFS : capitalmind.in/2020/09/that-m…

Deal

capitalmind.in/2020/09/unfold…

their complex deal of Aug-20 and OFS of Sept-20

@capitalmind_in @deepakshenoy

OFS : capitalmind.in/2020/09/that-m…

Deal

capitalmind.in/2020/09/unfold…

• • •

Missing some Tweet in this thread? You can try to

force a refresh