@KSE_Institute & @sanctionsgroup insights from Expert Conference on the Impact of Russian #Sanctions

1. Russia is losing the #Gas battle it has launched against the West

@McFaul @CraigKennedy77 @elinaribakova @BLSchmitt @ben_moll @ben_hilgenstock @Nataliia_Shapo

1/5

1. Russia is losing the #Gas battle it has launched against the West

@McFaul @CraigKennedy77 @elinaribakova @BLSchmitt @ben_moll @ben_hilgenstock @Nataliia_Shapo

1/5

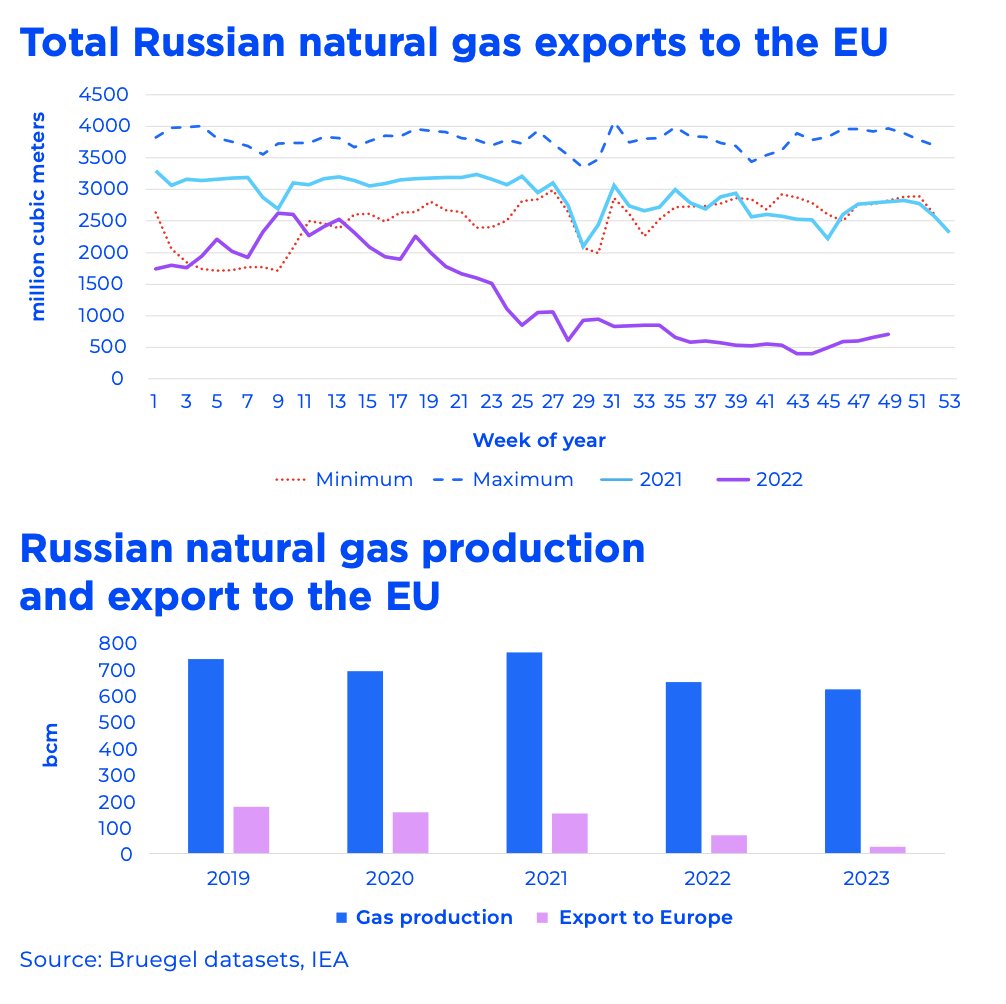

Before the invasion of #Ukraine, 65% of Russia’s total gas exports by volume went to Europe, and around 90% by value, since exports to China and the CIS are at a much lower price

2/5

2/5

Russia has sharply curtailed exports to the EU in an effort to compel the EU to pressure Ukraine to make concessions to Russia

But this effort so far has failed.

3/5

But this effort so far has failed.

3/5

As of Nov 30, 2022 the EU storages were 92% full, well above the 90% target and providing a buffer for the upcoming winter

At the same time, Russia won't be able to redirect the gas to other markets

The @IEA forecasts its production cut by 111 bcm in 2022 and 139 bcm in 2023

4/5

At the same time, Russia won't be able to redirect the gas to other markets

The @IEA forecasts its production cut by 111 bcm in 2022 and 139 bcm in 2023

4/5

Overall Russian #OilGas financial losses are estimated by the IEA at US$ 1 trillion by 2030 compared to a no invasion scenario

5/5

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh