We specialize in analytics, consulting, research, and develop strategies and recommendations for the governmental bodies.

Сooperation: partnerships@kse.org.ua

How to get URL link on X (Twitter) App

2/7 Seaborne crude exports decreased 1.4% MoM in August, oil products fell 1.7%. IG P&I-insured tankers shipped just 21% of crude and 82% of products, leaving room for the shadow fleet to grow.

2/7 Seaborne crude exports decreased 1.4% MoM in August, oil products fell 1.7%. IG P&I-insured tankers shipped just 21% of crude and 82% of products, leaving room for the shadow fleet to grow.

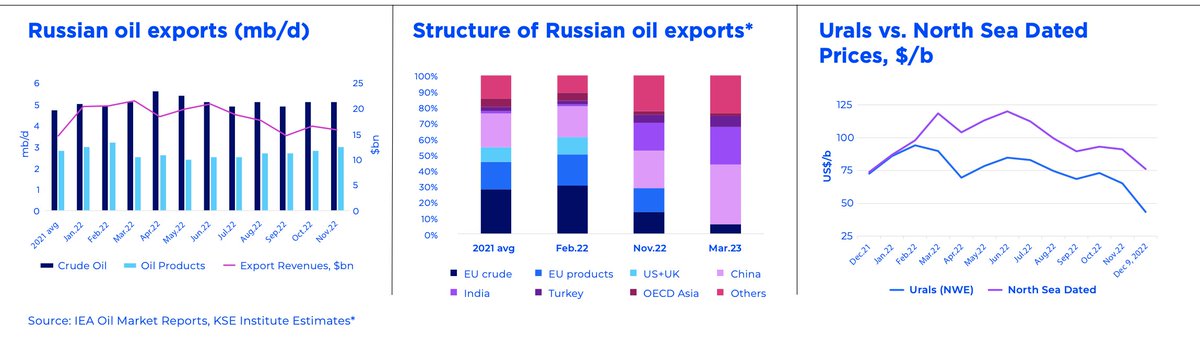

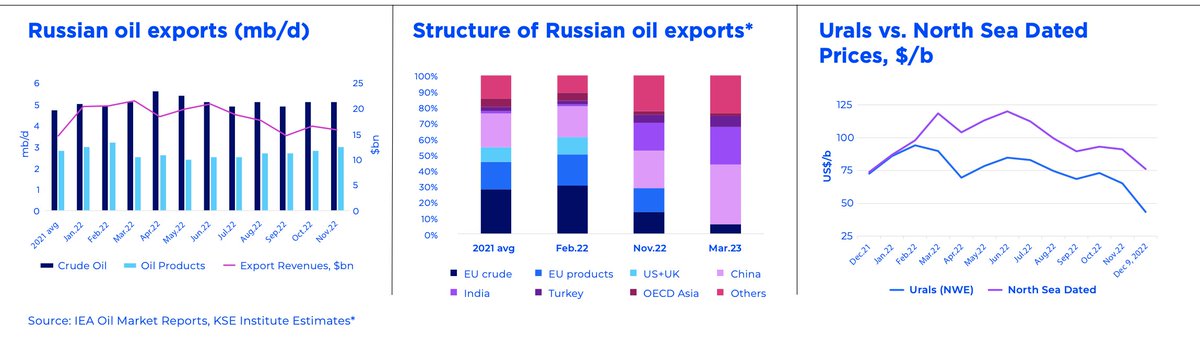

2/7 Oil exports revenues rose to $14.3 billion in July, as Russian oil prices were pushed back by $60/barrel ⛽. Oil & gas budget revenues down >30% YoY in May-July due to weak extraction taxes and lower prices.

2/7 Oil exports revenues rose to $14.3 billion in July, as Russian oil prices were pushed back by $60/barrel ⛽. Oil & gas budget revenues down >30% YoY in May-July due to weak extraction taxes and lower prices.

2/9 This report follows two previous studies, "Assessing the Shadow Fleet" and "The Core of Russia’s Shadow Fleet," which analyzed the shadow fleet's growth and identified ships for future sanctions.

2/9 This report follows two previous studies, "Assessing the Shadow Fleet" and "The Core of Russia’s Shadow Fleet," which analyzed the shadow fleet's growth and identified ships for future sanctions.

2/7 Russia’s shadow fleet, comprising 435 tankers, is designed to circumvent G7/EU oil price caps. In April 2024, 83% of Russian crude oil & 46% of petroleum products were shipped on these tankers, posing significant environmental risks due to lack of proper insurance.

2/7 Russia’s shadow fleet, comprising 435 tankers, is designed to circumvent G7/EU oil price caps. In April 2024, 83% of Russian crude oil & 46% of petroleum products were shipped on these tankers, posing significant environmental risks due to lack of proper insurance.

2/5 March Exits: Notable exits include @Deezer, @densoeurope, and Teijin through liquidation, alongside @dxctechnology, @ForacoDrilling, @GrantThornton, Herpa.

2/5 March Exits: Notable exits include @Deezer, @densoeurope, and Teijin through liquidation, alongside @dxctechnology, @ForacoDrilling, @GrantThornton, Herpa.

2/5 In Feb, 225 Russian shadow fleet tankers departed from ports, with 84% over 15 years old, posing environmental risks for the EU. Currently, OFAC has sanctioned 41 shadow tankers: 29 unloaded and not scheduled, 7 loaded but inactive, and 5 completing voyages.

2/5 In Feb, 225 Russian shadow fleet tankers departed from ports, with 84% over 15 years old, posing environmental risks for the EU. Currently, OFAC has sanctioned 41 shadow tankers: 29 unloaded and not scheduled, 7 loaded but inactive, and 5 completing voyages.

2/7: Of these companies, those that have fully withdrawn had generated $82 billion in revenue, compared to $65 billion by companies still in the process of exiting.

2/7: Of these companies, those that have fully withdrawn had generated $82 billion in revenue, compared to $65 billion by companies still in the process of exiting.

2/7 Russia's oil and gas earnings surge due to rising prices and a weaker ruble. In September, federal oil and gas revenues totaled 12.3 billion. Extraction taxes hit 1.2 trillion rubles in August, a record since May 2022.

2/7 Russia's oil and gas earnings surge due to rising prices and a weaker ruble. In September, federal oil and gas revenues totaled 12.3 billion. Extraction taxes hit 1.2 trillion rubles in August, a record since May 2022.

From February 24, 144 companies completed withdrawal from 🇷🇺, 1156 companies have curtailed 🇷🇺 operations, 501 have reduced current operations and held off new investments in 🇷🇺, and 1201 companies continue to work in 🇷🇺

From February 24, 144 companies completed withdrawal from 🇷🇺, 1156 companies have curtailed 🇷🇺 operations, 501 have reduced current operations and held off new investments in 🇷🇺, and 1201 companies continue to work in 🇷🇺

Individual sanctions may be some numbers that we can refer to as the number of assets that were frozen in different jurisdictions. One of the impacts of individual sanctions, we understand that they have a really chilling effect.

Individual sanctions may be some numbers that we can refer to as the number of assets that were frozen in different jurisdictions. One of the impacts of individual sanctions, we understand that they have a really chilling effect.

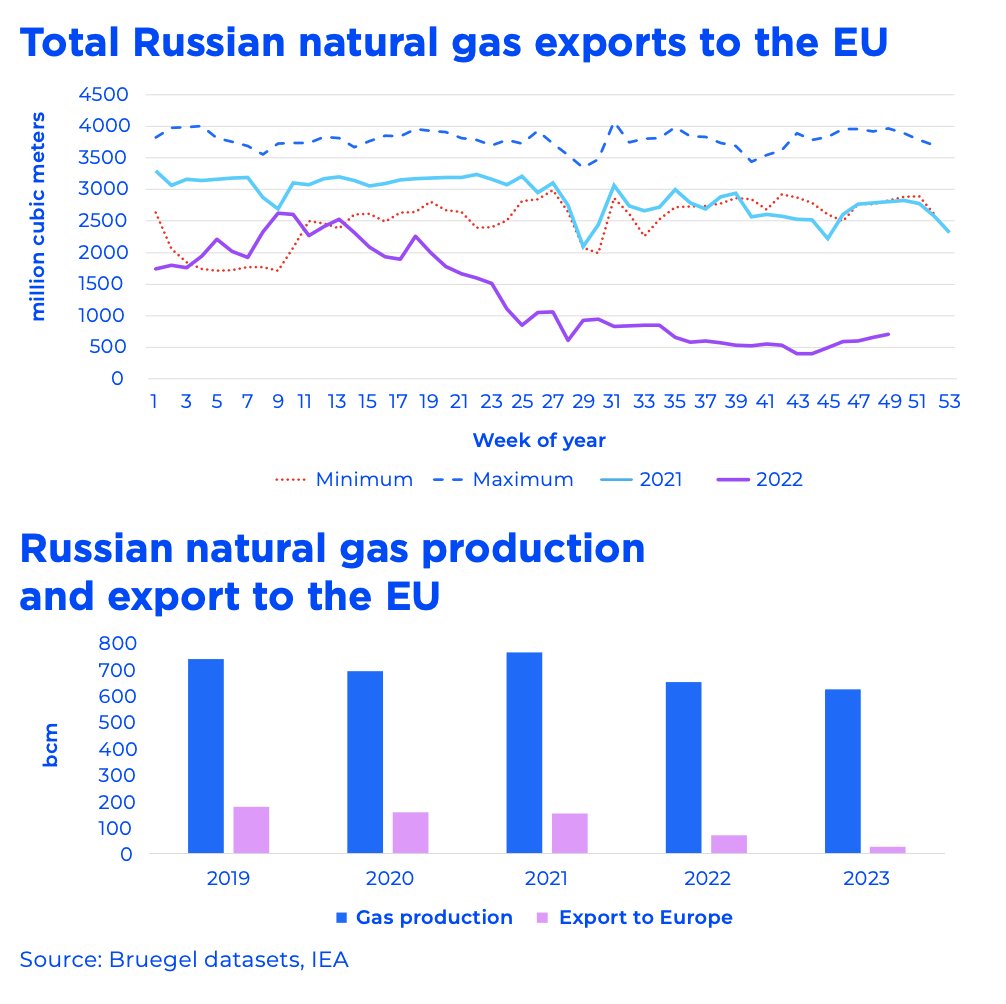

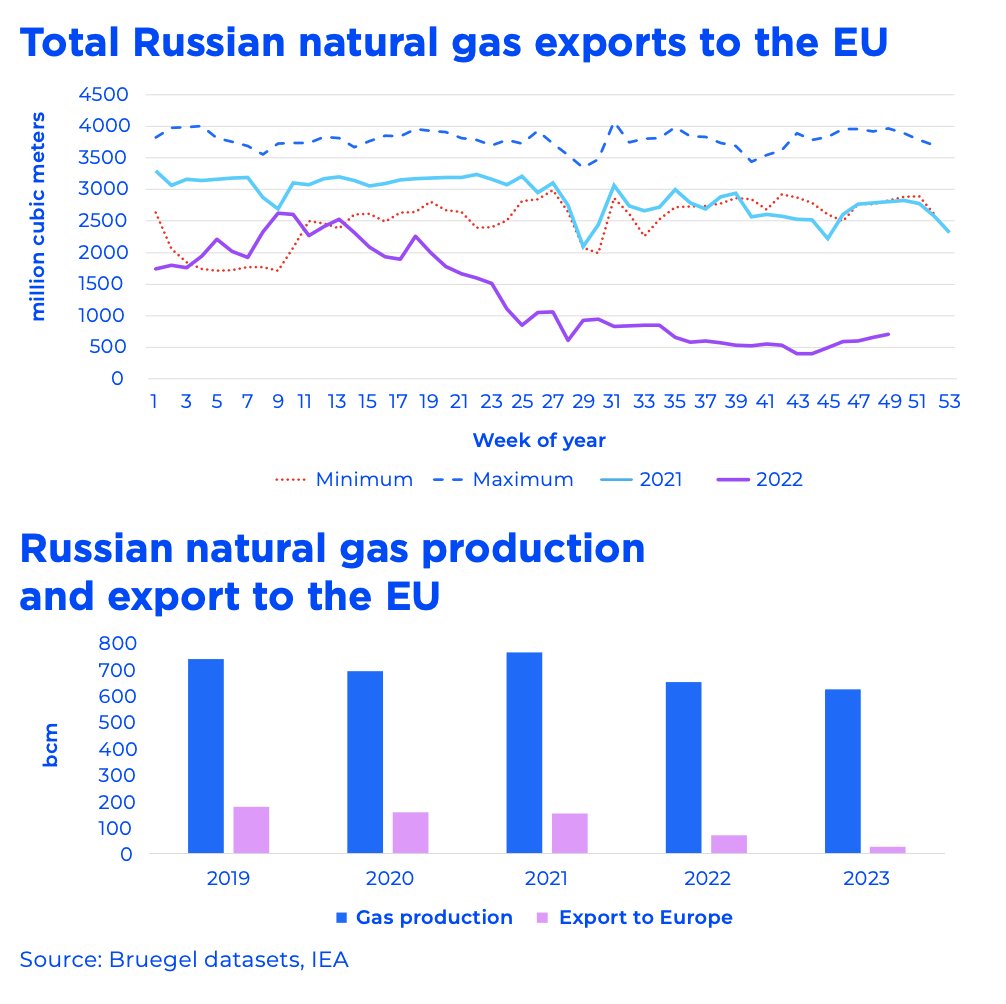

Before the invasion of #Ukraine, 65% of Russia’s total gas exports by volume went to Europe, and around 90% by value, since exports to China and the CIS are at a much lower price

Before the invasion of #Ukraine, 65% of Russia’s total gas exports by volume went to Europe, and around 90% by value, since exports to China and the CIS are at a much lower price

2. Structure of exports changed substantially as Russia was able to redirect the oil from Europe to China, India and Turkey proposing record discounts

2. Structure of exports changed substantially as Russia was able to redirect the oil from Europe to China, India and Turkey proposing record discounts