Navkar Corp : A interesting smallcap company can be wealth creator on mutliple thesis points

A quick thread 🧵on covering thesis and anti-thessis

Like Retweet Share Follow if you find valuable

#NAVKARCORP #NAVKARCORPORATION

A quick thread 🧵on covering thesis and anti-thessis

Like Retweet Share Follow if you find valuable

#NAVKARCORP #NAVKARCORPORATION

1. Have sold Vapi Unit to Adani for ₹835crore which will help in capex, have 200 crore cash after deal

2. repaid its entire debt taken from various Financial Institutions

3. Promoters are buying at levels of 53 to 56 (0.20% till now)

4. Released full promoter pledge

2. repaid its entire debt taken from various Financial Institutions

3. Promoters are buying at levels of 53 to 56 (0.20% till now)

4. Released full promoter pledge

5. Cheap Valuation

A. PE Ratio of 15 vs Container Corp PE ratio of 40

B. EVEBITDA of 7-7.5 which is the same valuation at which Adani bought company's Vapi unit

Note : Above ratios are after removing earnings of discont biz of Vapi Unit (Cont approx 50% PAT, Revenue, EBITDA)

A. PE Ratio of 15 vs Container Corp PE ratio of 40

B. EVEBITDA of 7-7.5 which is the same valuation at which Adani bought company's Vapi unit

Note : Above ratios are after removing earnings of discont biz of Vapi Unit (Cont approx 50% PAT, Revenue, EBITDA)

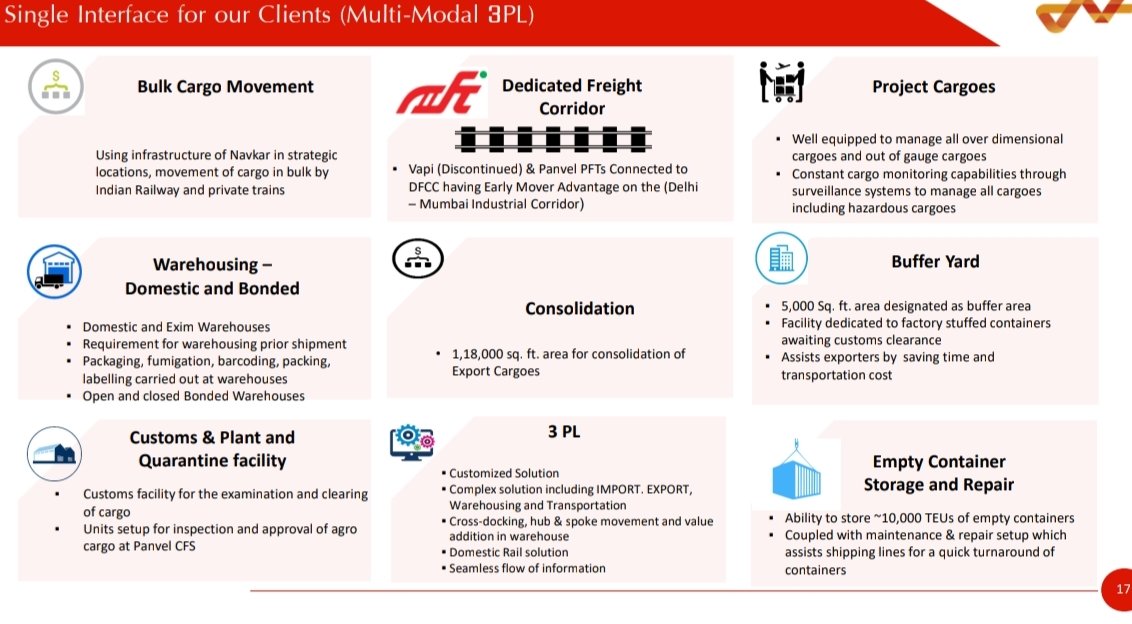

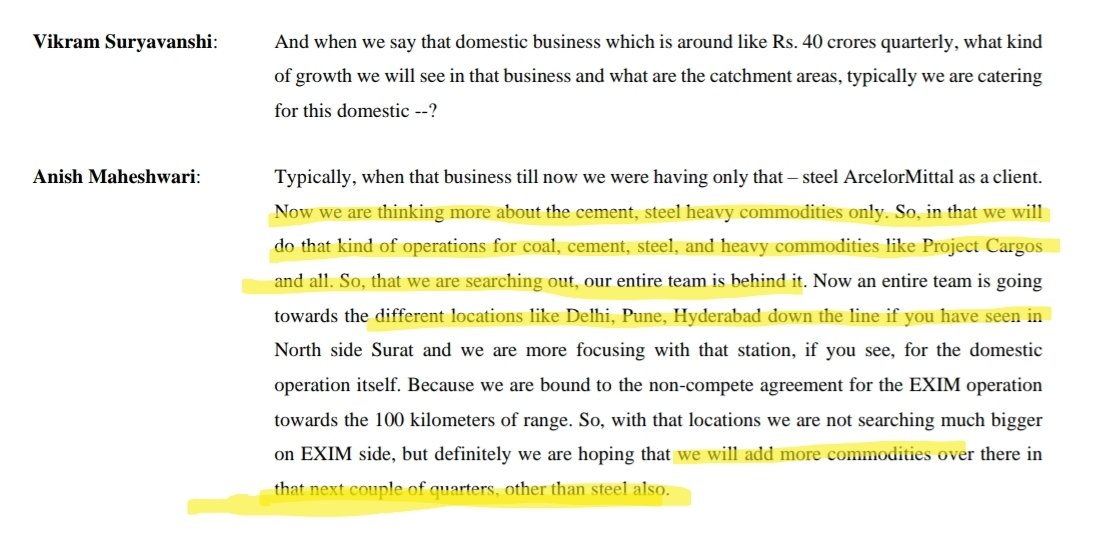

6. Some capex is ongoing at other locations (including commodities)

7. Adani considering buying Container Corp if it happens sector and company both will re-rate from here on

7. Adani considering buying Container Corp if it happens sector and company both will re-rate from here on

Anti Thesis

1. Very low capacity utilization of 50%

2. Headline no. in Q3 would fall by 50% due to discontinued biz which may lead to some fall in stock prices

1. Very low capacity utilization of 50%

2. Headline no. in Q3 would fall by 50% due to discontinued biz which may lead to some fall in stock prices

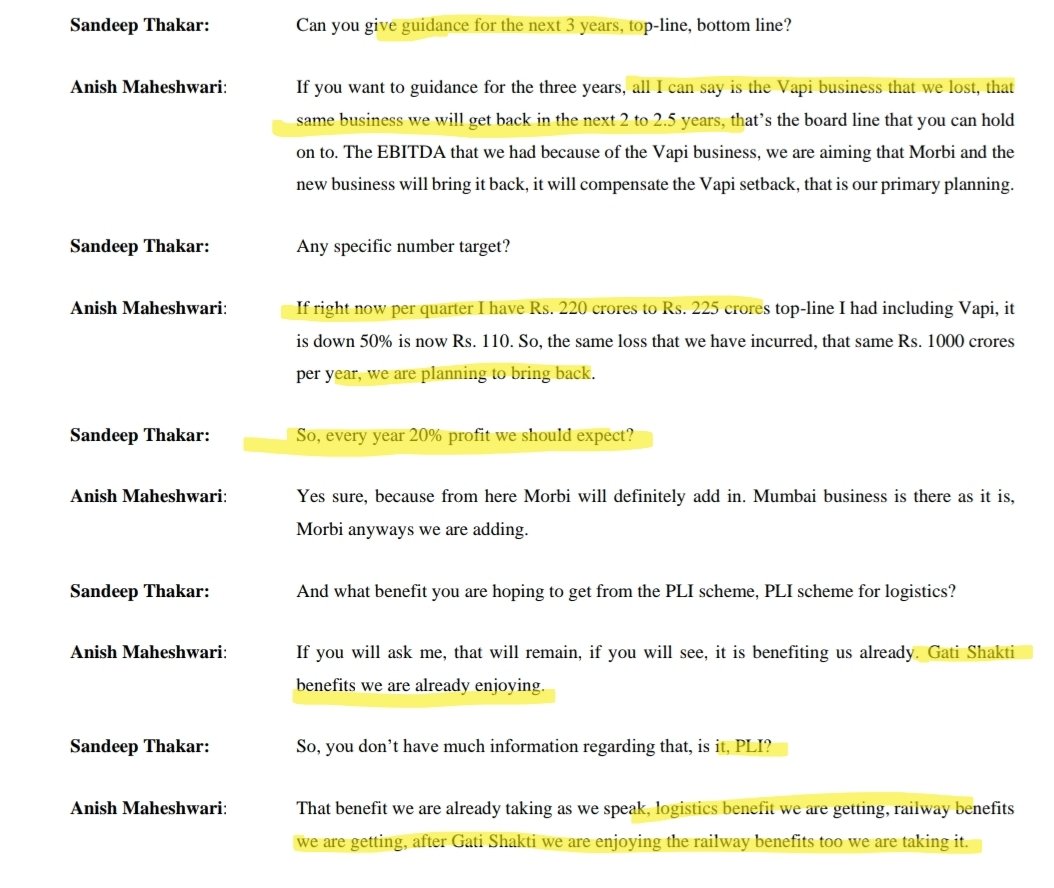

Guidance for Next 3 years : Whatever biz lost due to sale of vapi unit will cone from new Morbi unit in next 3 yr. So approx 20% growth rate

• • •

Missing some Tweet in this thread? You can try to

force a refresh