🥶January Unlocks

In bull market we follow IDO, in Bear Market we follow Unlock Schedule

l have sorted them by market cap + did a Cliff amount/marketcap for your reference.

link to excel in the end

$APE

$AXS

$APT

$BIT

$IMX

$DYDX

$GLMR

$ACA

$EUL

$GAL

$RON

$SWEAT

$YGG

$NYM

$TORN

In bull market we follow IDO, in Bear Market we follow Unlock Schedule

l have sorted them by market cap + did a Cliff amount/marketcap for your reference.

link to excel in the end

$APE

$AXS

$APT

$BIT

$IMX

$DYDX

$GLMR

$ACA

$EUL

$GAL

$RON

$SWEAT

$YGG

$NYM

$TORN

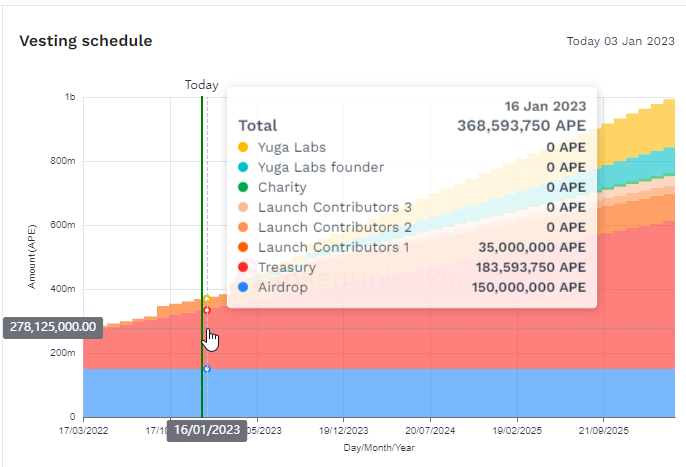

@BoredApeYC $ape

#safu

2.03% [cliff amount/mcap]

The unlock tokens are going towards the treasury.

Haven't been following the ape staking very closely

#safu

2.03% [cliff amount/mcap]

The unlock tokens are going towards the treasury.

Haven't been following the ape staking very closely

@AxieInfinity $axs

#safu ish

4.28% [cliff amount/mcap]

The unlock tokens are going towards staking reward.

i miss the good old days in breeding, trading nfts and playing the game. Their land play just launched and review seems not bad!

i don't hold any anymore🥲

#safu ish

4.28% [cliff amount/mcap]

The unlock tokens are going towards staking reward.

i miss the good old days in breeding, trading nfts and playing the game. Their land play just launched and review seems not bad!

i don't hold any anymore🥲

@Aptos_Network $apt

#safu ish

3.49% [cliff amount/mcap]

The unlock tokens are going towards Foundation & Community

i was sour i missed the airdrop hence i don't follow the aptos news.

#safu ish

3.49% [cliff amount/mcap]

The unlock tokens are going towards Foundation & Community

i was sour i missed the airdrop hence i don't follow the aptos news.

@Immutable $imx

#safu ish

2.35% [cliff amount/mcap]

all tokens are going to Project Development & Private Sales

@illuviumio @GuildOfGuardian @PlayEmberSword

I JUST WANT TO PLAY GAMES IN BEAR HELP ME

#safu ish

2.35% [cliff amount/mcap]

all tokens are going to Project Development & Private Sales

@illuviumio @GuildOfGuardian @PlayEmberSword

I JUST WANT TO PLAY GAMES IN BEAR HELP ME

@dYdX

no comment

4.02% [cliff amount/mcap]

tokens going to Safety Module, Liquiidity Module, Liquidity provider Rewards.

I like perps & syn tbh, but dydx token inflation is really high + another unlock is coming in 30days rip.

How much protocol value does the token capture?

no comment

4.02% [cliff amount/mcap]

tokens going to Safety Module, Liquiidity Module, Liquidity provider Rewards.

I like perps & syn tbh, but dydx token inflation is really high + another unlock is coming in 30days rip.

How much protocol value does the token capture?

@MoonbeamNetwork $GLMR

😶🌫️

9.42% [cliff amount/mcap]

tokens going to Founders & Early Empolyees, Future, Seed Funding, Key Partners & Advisors, PureStake Early Backers.

I enjoyed some of the early farms of moonbeam, then lost a lot of it to ftx ❤️

😶🌫️

9.42% [cliff amount/mcap]

tokens going to Founders & Early Empolyees, Future, Seed Funding, Key Partners & Advisors, PureStake Early Backers.

I enjoyed some of the early farms of moonbeam, then lost a lot of it to ftx ❤️

@AcalaNetwork $ACA

no idea

0.82% [cliff amount/mcap]

token going to crowdloan participants

Never user or research into it. shill me if its cool

no idea

0.82% [cliff amount/mcap]

token going to crowdloan participants

Never user or research into it. shill me if its cool

@eulerfinance $EUL

#safu

0.58% [cliff amount/mcap]

token going to community selected markets

I like protocol design, isolated lending pool by tiers. Right risk & reward for lender & borrower

#safu

0.58% [cliff amount/mcap]

token going to community selected markets

I like protocol design, isolated lending pool by tiers. Right risk & reward for lender & borrower

@Galxe $gal

#safu

1.31% [cliff amount/mcap]

Token going towards Team & Public sale

Good job for the team, kept building, gud BD & delivering @Quest3_xyz is interesting too!

token.unlocks.app/project-galaxy

#safu

1.31% [cliff amount/mcap]

Token going towards Team & Public sale

Good job for the team, kept building, gud BD & delivering @Quest3_xyz is interesting too!

token.unlocks.app/project-galaxy

@Ronin_Network $ron

😶🌫️

28.85% [cliff amount/mcap]

Token going to community, staking reward, sky mavis and eco system fund.

I always have love for sky mavis, but short term winnie the pool

token.unlocks.app/ronin

😶🌫️

28.85% [cliff amount/mcap]

Token going to community, staking reward, sky mavis and eco system fund.

I always have love for sky mavis, but short term winnie the pool

token.unlocks.app/ronin

@Sweatcoin $sweat

😶🌫️

8.99% [cliff amount/mcap]

Token going to Foundation and Airdrop

i am fat i don't run i don't follow

token.unlocks.app/sweatcoin

😶🌫️

8.99% [cliff amount/mcap]

Token going to Foundation and Airdrop

i am fat i don't run i don't follow

token.unlocks.app/sweatcoin

@YieldGuild

😶🌫️

8.97% [cliff amount/mcap]

Token going to community, treasury, founders, investor, advisors

gaming guild as gamefi investors/famers, game user acquisition tool or tutorial is a hard business to be in right now.

token.unlocks.app/yield-guild-ga…

😶🌫️

8.97% [cliff amount/mcap]

Token going to community, treasury, founders, investor, advisors

gaming guild as gamefi investors/famers, game user acquisition tool or tutorial is a hard business to be in right now.

token.unlocks.app/yield-guild-ga…

@nymproject $nym

😶🌫️

18.03% [cliff amount/mcap]

token going to reserve & community

small cap, not sure where can you leverage X

token.unlocks.app/nym

😶🌫️

18.03% [cliff amount/mcap]

token going to reserve & community

small cap, not sure where can you leverage X

token.unlocks.app/nym

@TornadoCash

no comment

11.59% [cliff amount/mcap]

token going to team and investors and governance

token.unlocks.app/tornado-cash

no comment

11.59% [cliff amount/mcap]

token going to team and investors and governance

token.unlocks.app/tornado-cash

Thank you @Token_Unlocks amazing tool

new year new me, lets see how long can i keep writing content this time

new year new me, lets see how long can i keep writing content this time

Tagging for engagement farm

@DAdvisoor

@rektdiomedes

@crypto_linn

@CryptoDragonite

@0xconcentrator

@aladdindao

@cryptoPothu

@crypthoem

@alpha_pls

@Route2FI

@KoroushAK

@shivsakhuja

@kamikaz_ETH

@DeFi_Made_Here

@Cov_duk

@0xmisaka

@puntium

@Gojo_Crypto

@0x_illuminati

@TaikiMaeda2

@DAdvisoor

@rektdiomedes

@crypto_linn

@CryptoDragonite

@0xconcentrator

@aladdindao

@cryptoPothu

@crypthoem

@alpha_pls

@Route2FI

@KoroushAK

@shivsakhuja

@kamikaz_ETH

@DeFi_Made_Here

@Cov_duk

@0xmisaka

@puntium

@Gojo_Crypto

@0x_illuminati

@TaikiMaeda2

• • •

Missing some Tweet in this thread? You can try to

force a refresh