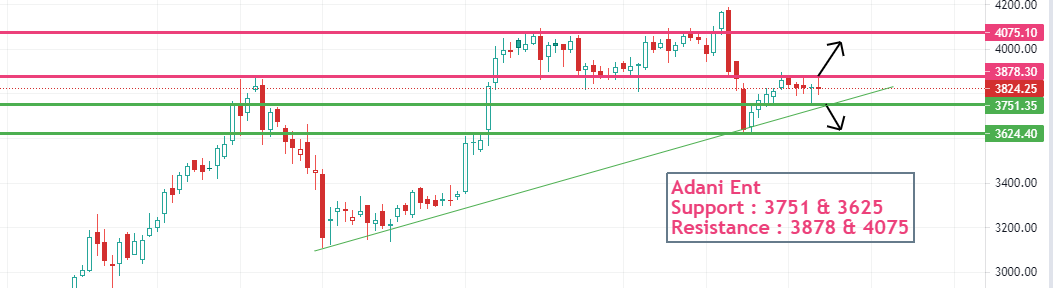

#Nifty50 stock chart

👉🏻Support and resistance levels.

👉🏻It can be helpful if you are stucked in any of the following stock.

🔀Retweet- Let the needful can get support.

You can also post your stock charts below.

#StockMarketindia #trading @kuttrapali26

👉🏻Support and resistance levels.

👉🏻It can be helpful if you are stucked in any of the following stock.

🔀Retweet- Let the needful can get support.

You can also post your stock charts below.

#StockMarketindia #trading @kuttrapali26

@kuttrapali26 #BAJAJAUTO

Support: 3590 & 3500

Resistance : 3760 & 3800+

This stock looks good for coming sessions.

Keep on radar until abv 3590

Support: 3590 & 3500

Resistance : 3760 & 3800+

This stock looks good for coming sessions.

Keep on radar until abv 3590

• • •

Missing some Tweet in this thread? You can try to

force a refresh