Last #jobsreport for 2022 out today shows in Dec:

*223,000 jobs added, down modestly from 256,000 in Nov

*Unemp down to 3.5% + LFP up 0.1pp

*Wage growth decelerates to 4.6%

Overall, a nice gift to end 2022 with measured slowing getting us closer to a soft landing.

1/

*223,000 jobs added, down modestly from 256,000 in Nov

*Unemp down to 3.5% + LFP up 0.1pp

*Wage growth decelerates to 4.6%

Overall, a nice gift to end 2022 with measured slowing getting us closer to a soft landing.

1/

Payroll growth slowed to 223,000 in December 2022, roughly in line with expectations.

With the exception of July, jobs growth has been steadily and gradually declining through much of 2022.

#jobsreport 2/

With the exception of July, jobs growth has been steadily and gradually declining through much of 2022.

#jobsreport 2/

Across 2022, there were 4.5 million jobs added, the 2nd highest annual level since 1940 after 2021 when 6.7 million jobs were added.

In large part, the job gains in 2021 & 2022 were about recovering from Covid. But we're now exceeding pre-pandemic job levels.

#jobsreport 3/

In large part, the job gains in 2021 & 2022 were about recovering from Covid. But we're now exceeding pre-pandemic job levels.

#jobsreport 3/

We're still getting job gains in most major industries though health care & social assistance (+74,400) and leisure & hospitality (+67,000) continue to lead job gains, like much of 2022.

#jobsreport 4/

#jobsreport 4/

-Professional & business services was down due to temporary help services falling, potentially signaling early cost-cutting by employers

-Construction was surprisingly up 28,000 despite the slowdown in housing

-Transportation & warehousing back in the green after losses in Nov

5/

-Construction was surprisingly up 28,000 despite the slowdown in housing

-Transportation & warehousing back in the green after losses in Nov

5/

We did see Information lose 5,000 jobs in Dec, but notably, this is *still* not due to #tech layoffs. It was instead due to losses in motion picture & sound recording. Several of the tech subsectors continue adding jobs on net.

#jobsreport 6/

#jobsreport 6/

#Retail did end up with a weak holiday hiring season in 2022. On a non-seasonally adjusted basis, retail job gains were the lowest since 2009.

#jobsreport 7/

#jobsreport 7/

Average hourly earnings growth decelerated to 4.6% year-over-year in Dec and notably, Nov's hot print was revised down from 5.1% to 4.8%.

An encouraging sign for a Fed worried about wage-driven inflation.

#jobsreport 8/

An encouraging sign for a Fed worried about wage-driven inflation.

#jobsreport 8/

Average weekly hours also fell to 34.3 in December. This data is noisy but could suggest that employers are cutting back hours but holding onto workers in the face of economic headwinds.

#jobsreport 9/

#jobsreport 9/

The unemployment rate is back down to 3.5%. The unemployment rate has only been that low in the last year, at the end of the pre-pandemic expansion in 2019-2020, and then not since 1969.

#jobsreport 10/

#jobsreport 10/

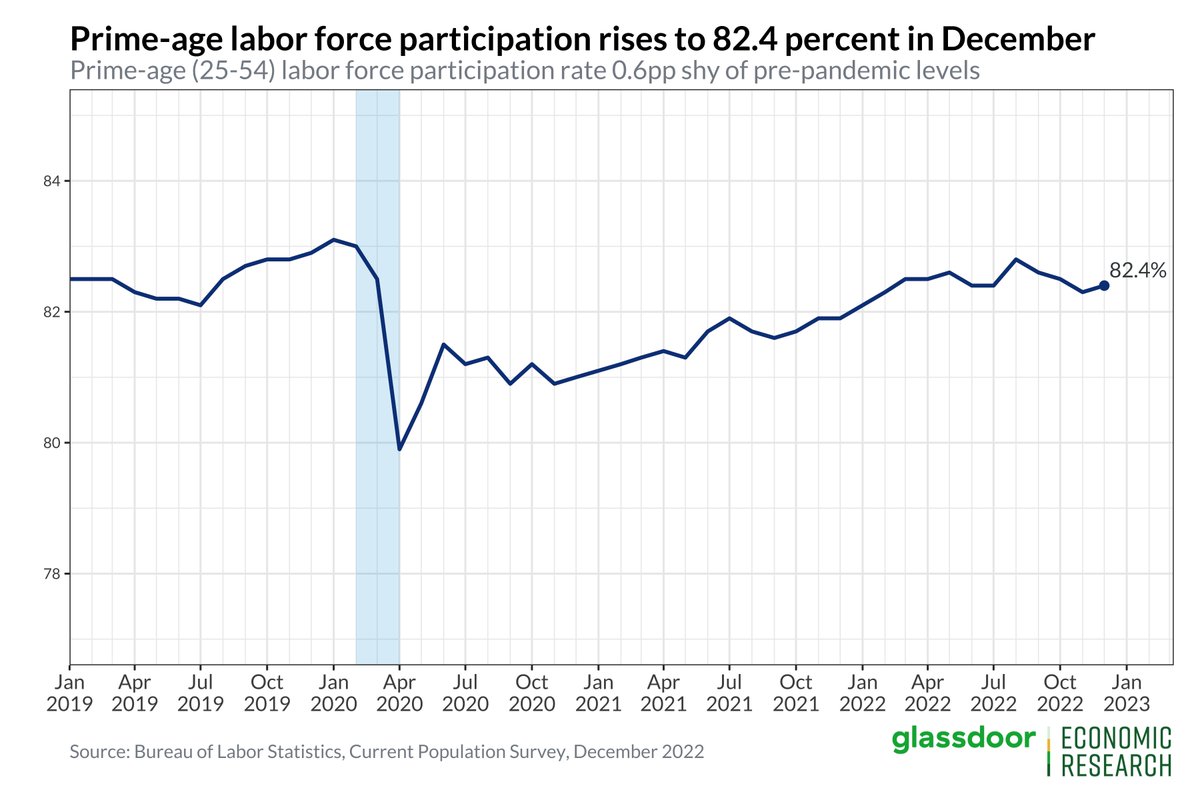

And the unemployment rate decrease was married with a rise in labor force participation both overall and for prime-age workers (25-54) after a few months of trending downwards.

#jobsreport 11/

#jobsreport 11/

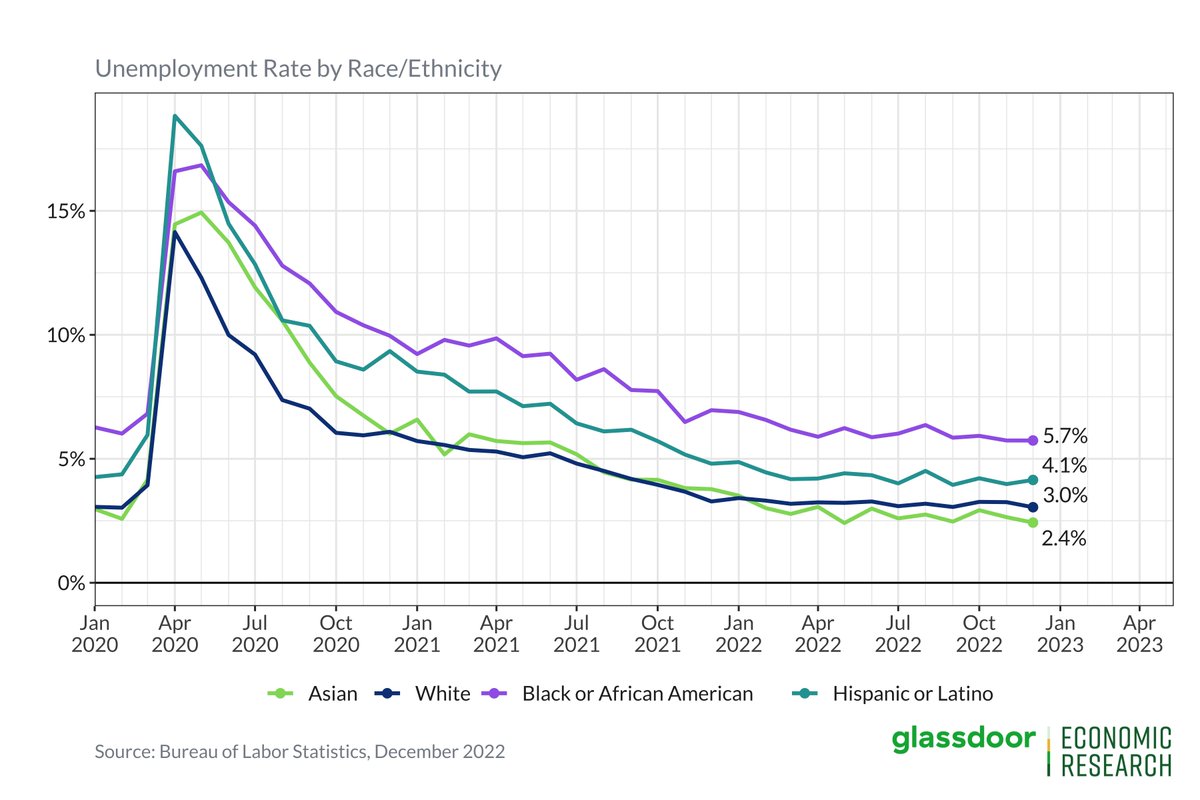

Labor force participation and unemployment by race/ethnicity can be volatile on a month-to-month basis, but they still appear to be trending in the right direction as the labor market remains healthy.

#jobsreport 12/

#jobsreport 12/

Overall, a nice report to end the year on: solid job gains, improvement in the household survey after a few months of divergence, and measured deceleration for inflation hawks.

For more commentary, see our Chief Economist's write-up here: glassdoor.com/research/bls-j…

13/13

For more commentary, see our Chief Economist's write-up here: glassdoor.com/research/bls-j…

13/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh