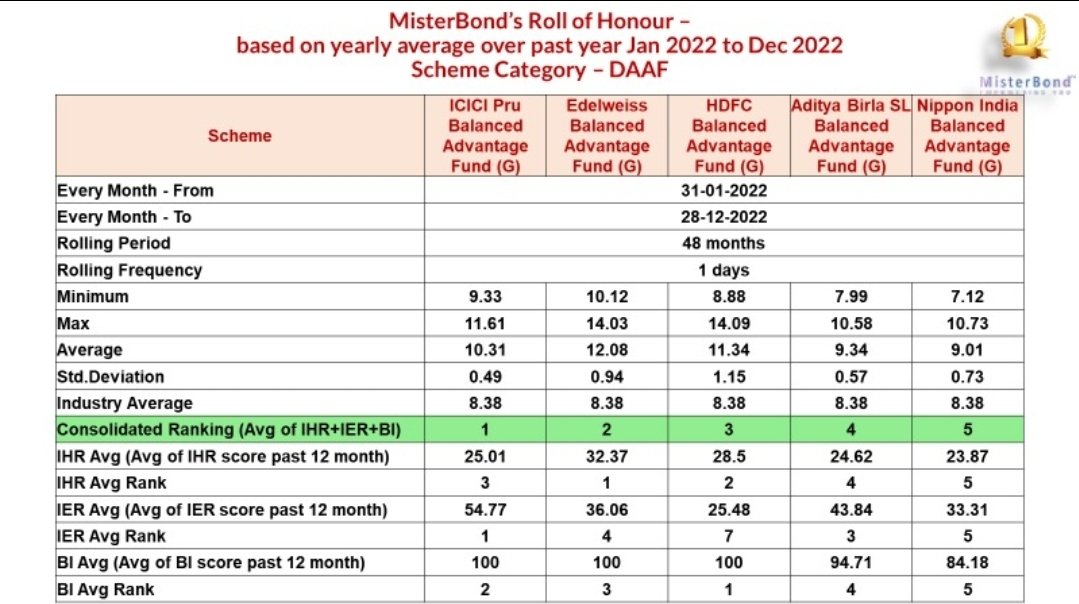

MISTERBOND'S #ROLLofHONOUR IN DIFFERENT #MUTUALFUND SCHEME CATEGORIES BASED ON PAST 12 MONTHLY RANKING DATA FROM JAN 22 TO DEC 22 AND AVERAGE OF THE SAME - In JAN 2023:

Entirely #Quantitative analysis:

Entirely #Quantitative analysis:

#DAAF (Dynamic Asset Allocation)

• • •

Missing some Tweet in this thread? You can try to

force a refresh