Investment Advisor, Author & Coach. Only Investment & Life fundas. I have conviction in my ideas & hence consistency in my Advice. Digest them or ignore them.

3 subscribers

How to get URL link on X (Twitter) App

MisterBond's Roll of Honour - #BankingAndPSUFund:

MisterBond's Roll of Honour - #BankingAndPSUFund:

MisterBond's Roll of Honour in #ELSS schemes

MisterBond's Roll of Honour in #ELSS schemes

We then do value STP of 3X over next few months till markets remain in Yellow Zone. If markets collapse to Green Zone, balance amount in liquid can be deployed in Equity immediately.

We then do value STP of 3X over next few months till markets remain in Yellow Zone. If markets collapse to Green Zone, balance amount in liquid can be deployed in Equity immediately. https://twitter.com/sidd1307/status/1524600061836939271Same is the case with IPOs, their timings and their valuations. Companies also come with #IPOs when markets were on a roll.

https://twitter.com/IamMisterBond/status/1514149145749037062When interest rates go up, price of underlying securities come down and vice versa. There is inverse correlation to interest rates and price of bonds

Results of Smart Investing v/s Buy & Hold under all Market Caps is for all to see - with 1) lower volatility, 2) beating results of Buy & Hold by big margins

Results of Smart Investing v/s Buy & Hold under all Market Caps is for all to see - with 1) lower volatility, 2) beating results of Buy & Hold by big margins

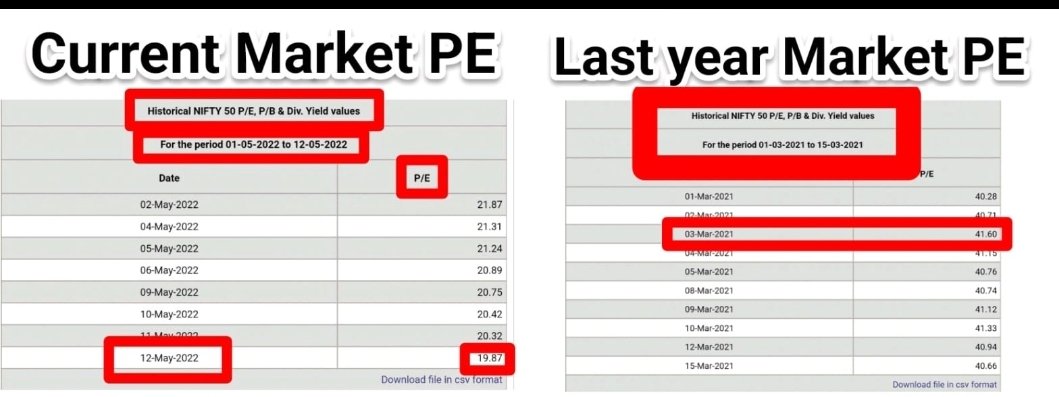

Investing at right Valuations is of paramount importance

Investing at right Valuations is of paramount importance