🚨 Trust Score Update!

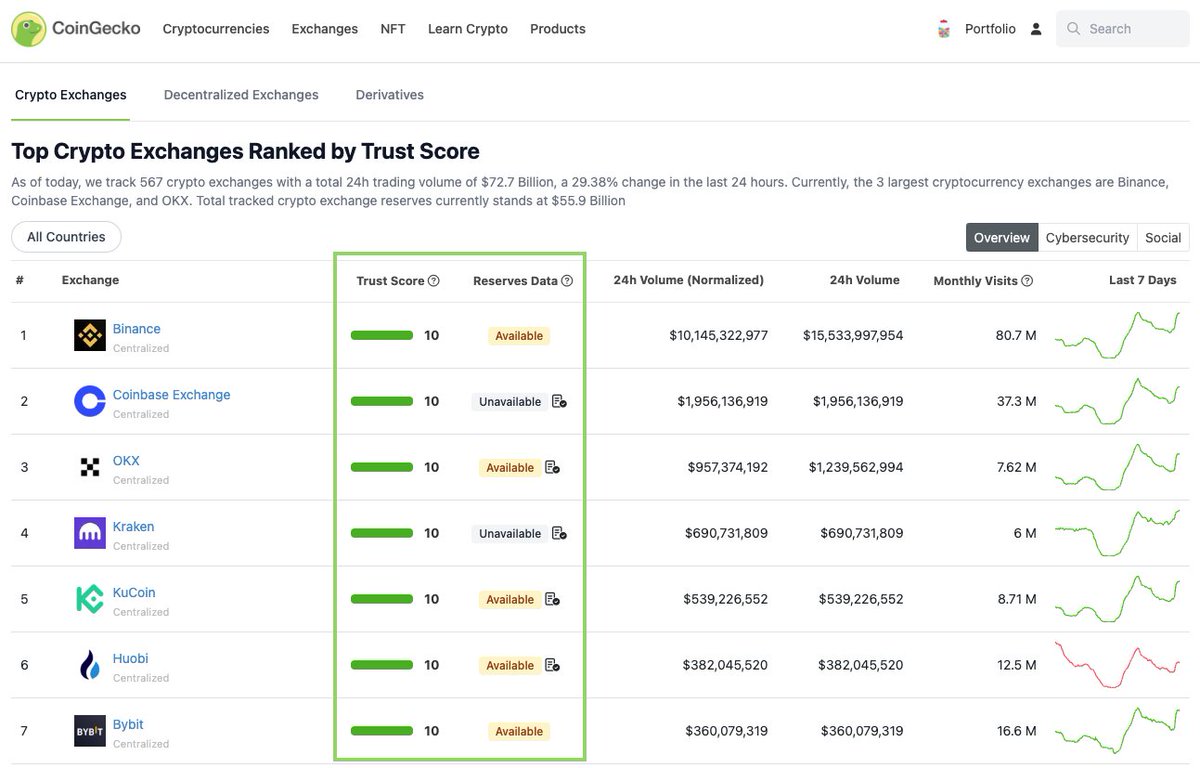

1/ We're excited to announce the our Trust Score 3.0 update, which incorporates #ProofofReserves (PoR) data for centralized #crypto exchanges to improve industry accountability.

A thread on what's new and what's to come 🧵

1/ We're excited to announce the our Trust Score 3.0 update, which incorporates #ProofofReserves (PoR) data for centralized #crypto exchanges to improve industry accountability.

A thread on what's new and what's to come 🧵

2/ With recent events highlighting the importance of accountability from CEXs, we've incorporated PoR data into our Trust Score, for centralized crypto exchanges.

3/ Trust Score 3.0 is being implemented in 2 phases.

Phase 1, which is already completed, assigns scores to exchanges based on the availability of PoR data:

Unavailable = 0 points

Audited, but no assets = 0.5 points

Available = 1 points

Available and Audited = 1 points

Phase 1, which is already completed, assigns scores to exchanges based on the availability of PoR data:

Unavailable = 0 points

Audited, but no assets = 0.5 points

Available = 1 points

Available and Audited = 1 points

4/ Phase 2 (Proof of Liability), set for Q4 2023, will consider evaluation of features such as Merkle tree self-attestation where users can verify their own balances.

Goal is to showcase assets + liabilities, but more research is required due to technical + privacy challenges.

Goal is to showcase assets + liabilities, but more research is required due to technical + privacy challenges.

5/ As of November 2022, we've been tracking #PoR with the introduction of an 'Exchange Reserves' tab on each centralized crypto exchange's page.

We aggregate existing info from on-chain data providers and official disclosures.

We aggregate existing info from on-chain data providers and official disclosures.

https://twitter.com/coingecko/status/1592493513240821760

6/ Want to deep dive on our Trust Score Methodology? Check it out here: coingecko.com/en/methodology

7/ #Crypto exchanges and individuals can get in touch to share PoR data through our submission form below. Let's work together to improve the transparency and accountability of the crypto industry! 💪

docs.google.com/forms/d/e/1FAI…

docs.google.com/forms/d/e/1FAI…

What are some other product improvements you'd like to see next? Tag @coingecko #askcoingecko to let us know! 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh