Greenland Resources Comments on Trading Activity.

Molybdenum price going from $25-32/lb or ~30%+ might have something in do with it?

globenewswire.com/news-release/2…

Molybdenum price going from $25-32/lb or ~30%+ might have something in do with it?

globenewswire.com/news-release/2…

A 30% jump in the price of #molybdenum $moly Greenland Resources is more than just a significant development imho

greenlandresources.ca/data/pdfs/Malm…

greenlandresources.ca/data/pdfs/Malm…

32.8 mln lbs per year multiplied by $7/lb is ~$230mln per year x 20+ years means and extra $4.6 BILLION of cash flow.

The increase in #molybdenum price is greater than $moly’s forecasted cash cost!

The increase in #molybdenum price is greater than $moly’s forecasted cash cost!

Market cap increase over this same time period is a paltry ~$65 million

Vs

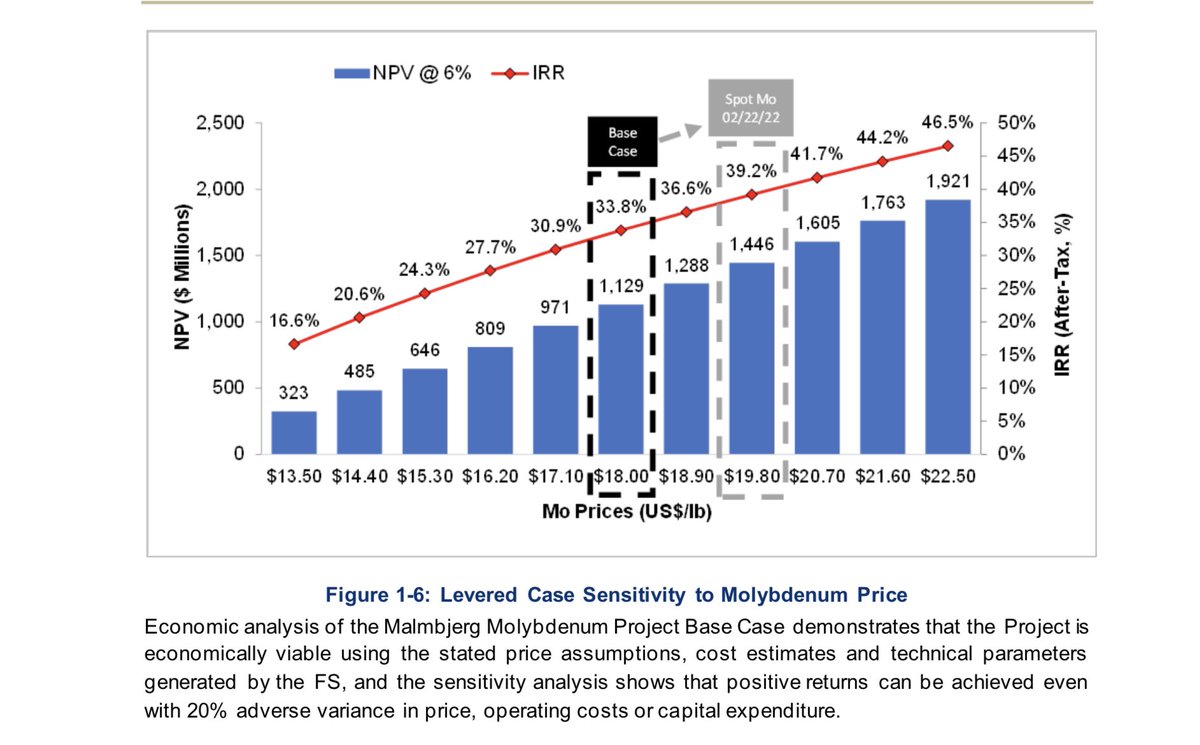

NPV increase probably around $1 bln depending on assumptions.

Vs

NPV increase probably around $1 bln depending on assumptions.

Begs the question: If a mining company sees their NPV 6 increase by +40% due to a 30% spot commodity price rise which is also more than its cash costs. And that npv6 increase is also more than ~20x it’s market cap… how much should the stock go up? Lol

Some times it just nuts to simply consider the potential value change in a company like $moly talk about torque

Show me other companies with economic mining projects that already had a nice IRR’s that have seen a commodity price rise that torqued their npv6 like so

Show me other companies with economic mining projects that already had a nice IRR’s that have seen a commodity price rise that torqued their npv6 like so

If anyone knows of other companies who’s underlying commodity has increased such that their npv6 has increased by 20x their market cap in the last month I’d like to know and invest :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh