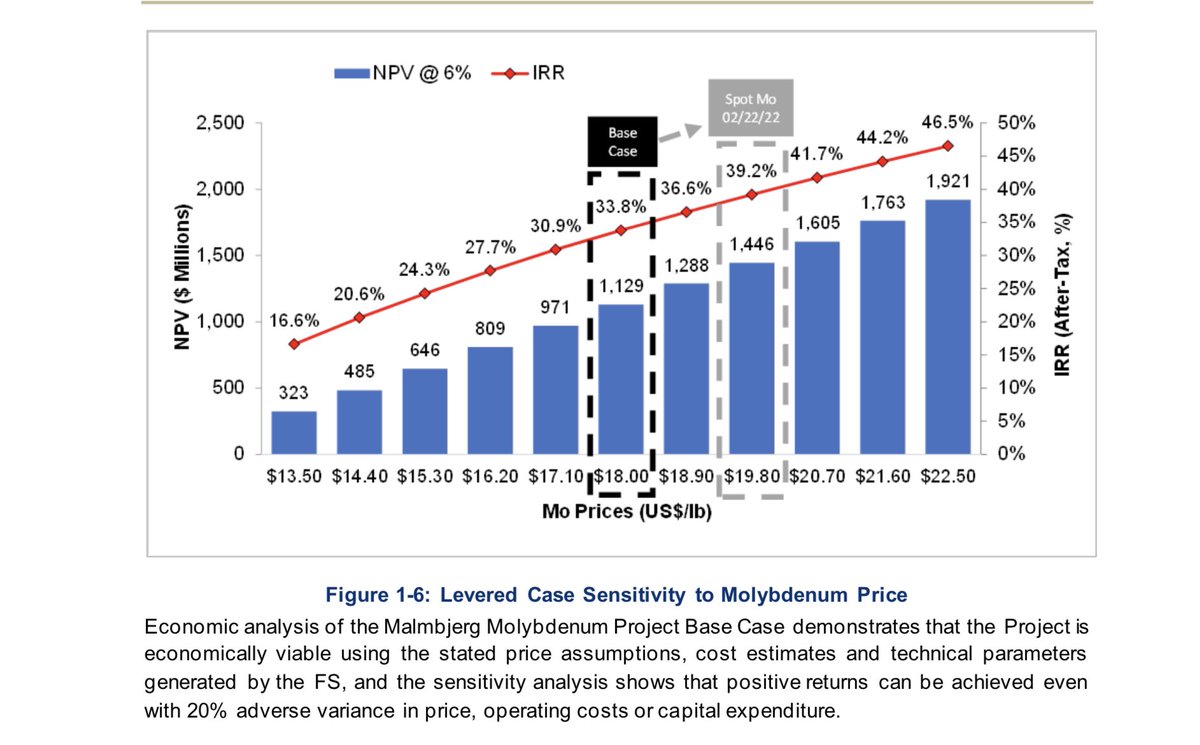

#molybdenum sensitivity is actually ‘off the charts’ since the current price is ~$31/lb and dramatically above the high case

The ‘net present value’ using a 6% discount rate is more than ~$1 bln higher than the levered best case at the end of the chart above. The higher the price of Molybdenum the easier it will be to get a fat supply/sales agreement done with a major euro steel co.

A very good priced contract will make the case for a even more levered debt financing and also lower the finance cost. Understand the only thing missing here is a repermiting (emphasis on RE) SIA and EIA submissions are occurring around now and wil get 👍 👎 in 4-12 months

If repermit 👍 is complete than the current -$110 mln market cap will prove to be unbelievable cheap vs the multibillion dollar npv based on cost estimates vs molybdenum sales price.

Decide for yourself. Will molybdenum be up or down and will the decision be positive or not. Invest or don’t invest. Care or don’t care. I currently have over 5 mln shares cause I think we go higher and getting a permit is more likely than not. I like these bets. It’s what I do

It’s not often you get this kind of risk to reward on a simple bet that I think anyone should be able to research and analyze. Will the public/government/regulators in Greenland support this project or not? Read the press releases over the last year and look at who’s on the team

greenlandresources.ca

CEO is open to interviews and emails/calls

The DD ain’t that hard people…

I hunt though 100’s of mining companies and I’m just flagging this one as worth of looking at and considering

CEO is open to interviews and emails/calls

The DD ain’t that hard people…

I hunt though 100’s of mining companies and I’m just flagging this one as worth of looking at and considering

• • •

Missing some Tweet in this thread? You can try to

force a refresh