Could @GMX_IO collapse in a bull market?

In this 🧵👇we will walk you through:

how an imbalance between longs/shorts in a bull market will reduce GLP returns, decrease GLP AUM and liquidity, and trigger a death spiral.

#CryptoResearch

In this 🧵👇we will walk you through:

how an imbalance between longs/shorts in a bull market will reduce GLP returns, decrease GLP AUM and liquidity, and trigger a death spiral.

#CryptoResearch

2/

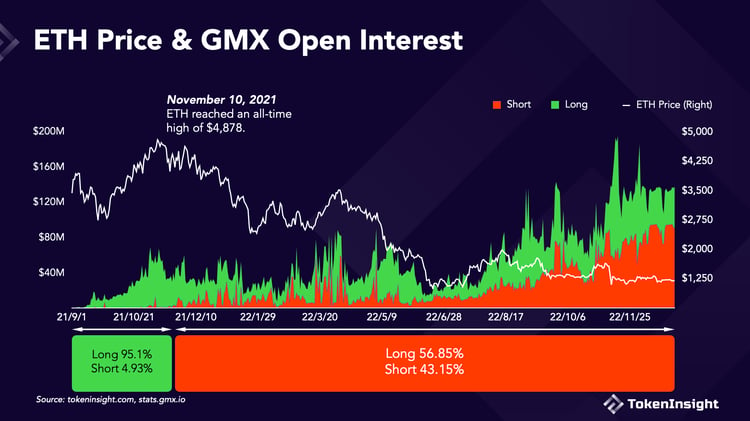

In a bull market, GMX shorts not only do not receive funding fees but also have to pay borrowing fees.

As a result, GMX will be 95%+ long in a bull, as evidenced by OI between 2021-9-1 and 2021-11-10.

In a bull market, GMX shorts not only do not receive funding fees but also have to pay borrowing fees.

As a result, GMX will be 95%+ long in a bull, as evidenced by OI between 2021-9-1 and 2021-11-10.

3/

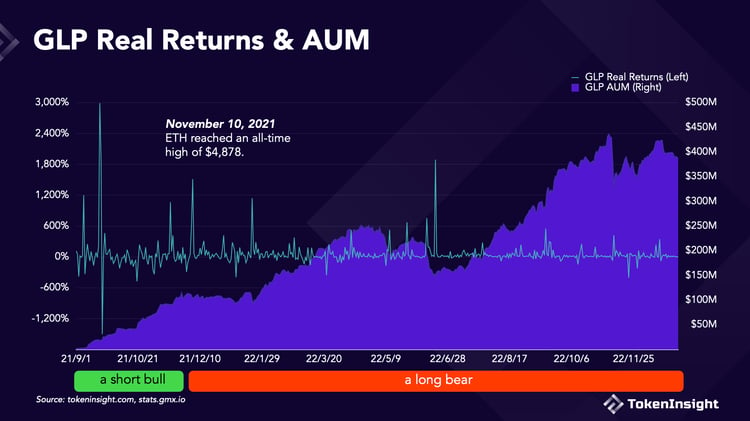

GLP was losing money to traders during that period as well.

Traders made a profit of ~$5 million.

GLP was losing money to traders during that period as well.

Traders made a profit of ~$5 million.

5/

GLP's adjusted APR was lower during the bull because traders were winning and higher during the bear because traders were losing.

GLP adjusted APR averaged ~50%.

GLP's adjusted APR was lower during the bull because traders were winning and higher during the bear because traders were losing.

GLP adjusted APR averaged ~50%.

6/

The sharp decreases in GLP were triggered by events rather than fluctuations in APR, resulting in a positive flywheel that stabilized GLP supply.

Market-wide crypto FUD ➡️ more GLP redeem & more traders & high fees ➡️ high GLP APR ➡️ more GLP mint

The sharp decreases in GLP were triggered by events rather than fluctuations in APR, resulting in a positive flywheel that stabilized GLP supply.

Market-wide crypto FUD ➡️ more GLP redeem & more traders & high fees ➡️ high GLP APR ➡️ more GLP mint

7/ Conclusion

The so-called GMX bull market death spiral is not valid.

GLP prints money even if all traders are long and winning in a bull market. GLP-based vaults now also hedge these risks, such as

@rage_trade, @GMDprotocol, etc.

The so-called GMX bull market death spiral is not valid.

GLP prints money even if all traders are long and winning in a bull market. GLP-based vaults now also hedge these risks, such as

@rage_trade, @GMDprotocol, etc.

8/

If you find this insightful, give us a ❤️

Retweet it for us!

Read the full article at:

tokeninsight.com/en/research/an….

The author: @quantumzebra123

If you find this insightful, give us a ❤️

Retweet it for us!

Read the full article at:

tokeninsight.com/en/research/an….

The author: @quantumzebra123

• • •

Missing some Tweet in this thread? You can try to

force a refresh