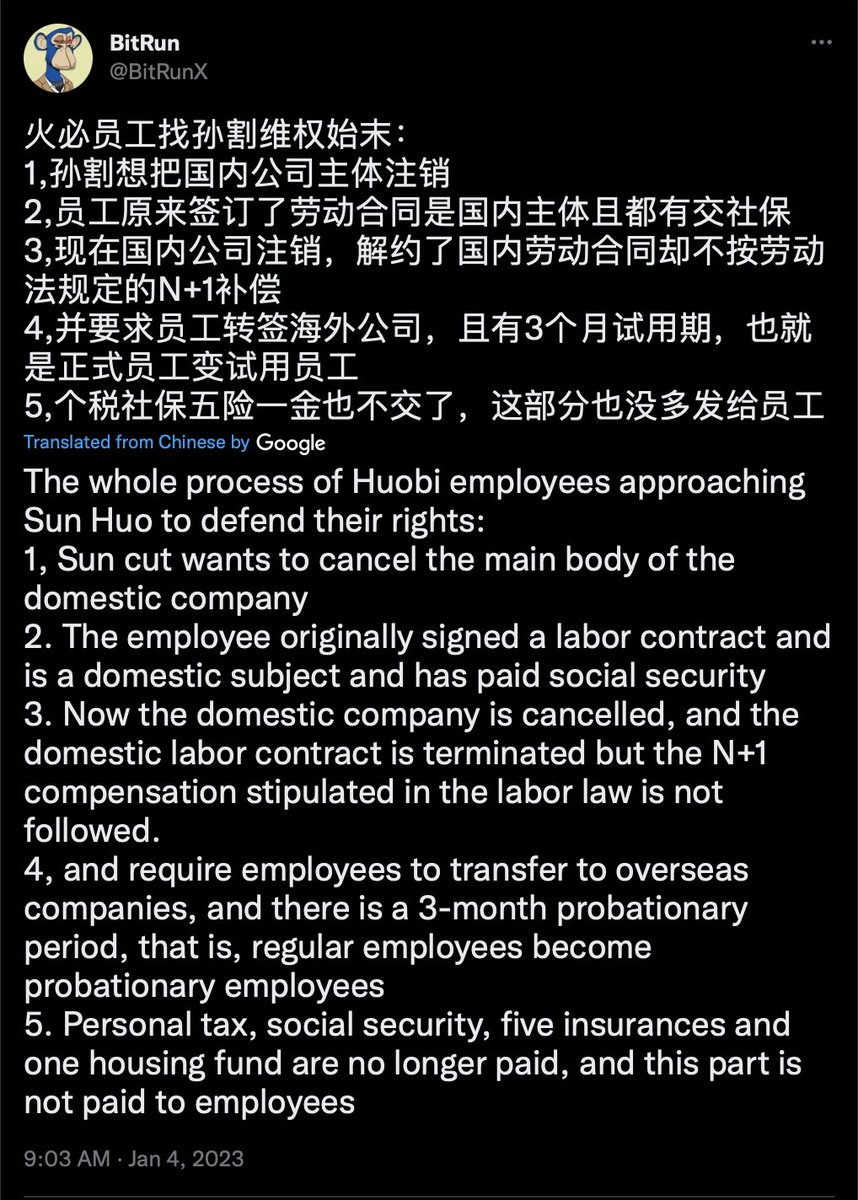

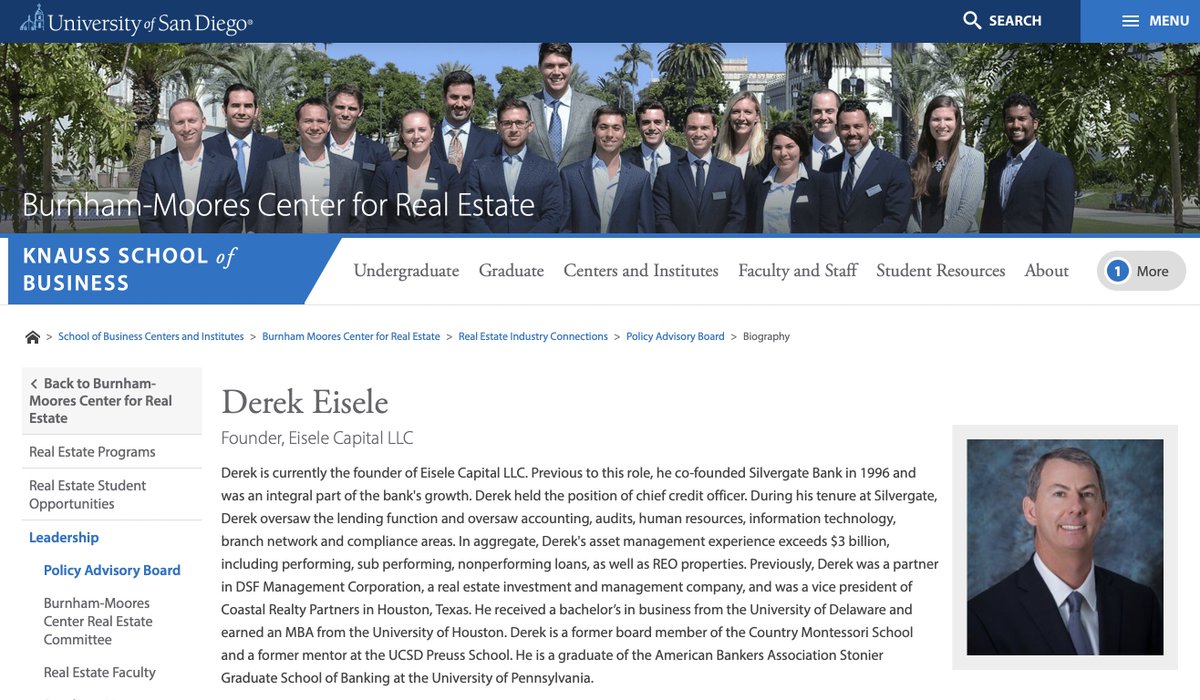

News today about $SI mentioned layoff of Chief Credit Officer but didn't mention that position was for many years filled by the co-founder of the bank. #DerekEisele also seems to have wiped his social media

cc @AureliusValue @AlderLaneEggs though the shadows may not let you see.

cc @AureliusValue @AlderLaneEggs though the shadows may not let you see.

Founders do not get pushed out lightly, so if the San Diego Tribune is right this is a big deal. #DerekEisele still appears on the $SI website as the Chief Credit Officer.

silvergate.com/about/leadersh…

silvergate.com/about/leadersh…

p.s. #DerekEisele is also on the board of @uofsandiego business school, @usd_business...

sandiego.edu/business/cente…

sandiego.edu/business/cente…

just to close out the 🧵, @AureliusValue has confirmed that Derek Eisele no longer works at #silvergatebank / $SI.

I wonder why?

I wonder why?

https://twitter.com/AureliusValue/status/1614715600139436035

• • •

Missing some Tweet in this thread? You can try to

force a refresh