Yearbook 2023 | Indian economy: An oasis in the desert 🏝️

Published by @hdfcmf

Here's a summary 👇🏼

1/n

Published by @hdfcmf

Here's a summary 👇🏼

1/n

2022: A year of challenging returns

👉 Rising inflation & interest rates + growth concerns + rollback of COVID monetary stimulus + geopolitical events = pressure on returns

👉 Most asset classes delivered negative returns, except💲, Oil🛢️ & agricultural commodities🌾

2/n

👉 Rising inflation & interest rates + growth concerns + rollback of COVID monetary stimulus + geopolitical events = pressure on returns

👉 Most asset classes delivered negative returns, except💲, Oil🛢️ & agricultural commodities🌾

2/n

2022: A year of challenging returns

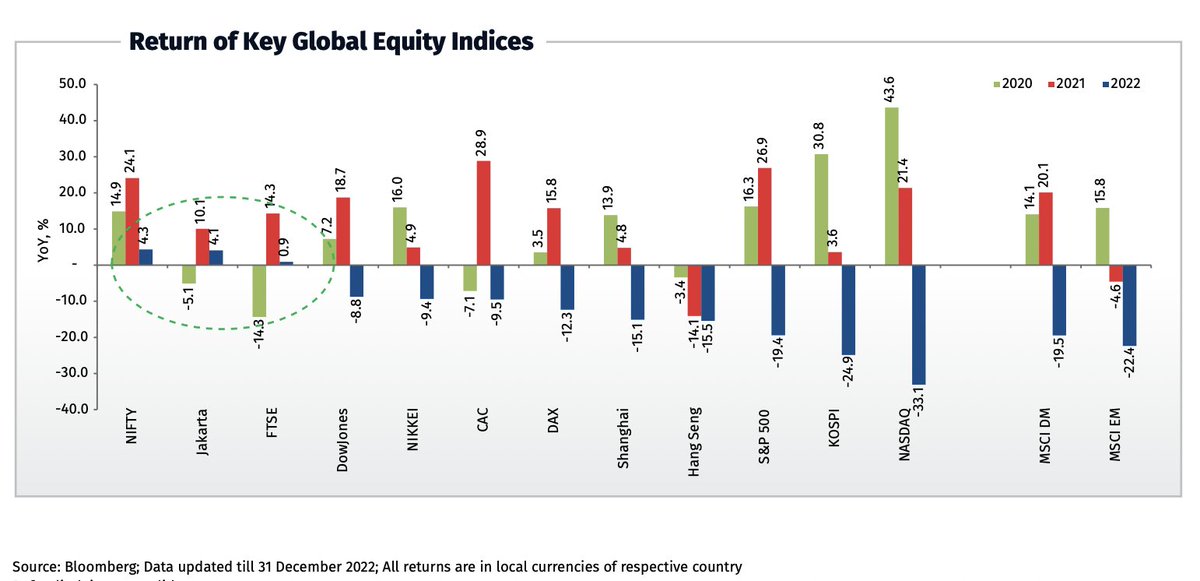

Global Equities: #NIFTY outperforms 😇as most global indices struggle 😢

India 🇮🇳 & Indonesia 🇮🇩 among the few markets to deliver +ve returns.

3/n

Global Equities: #NIFTY outperforms 😇as most global indices struggle 😢

India 🇮🇳 & Indonesia 🇮🇩 among the few markets to deliver +ve returns.

3/n

Currencies: The year of the Dollar

For most part 2022, the ₹ outperformed other EM currencies...

... but it depreciated faster in the last few months and ended the year weaker than other EM currencies against USD💲

4/n

For most part 2022, the ₹ outperformed other EM currencies...

... but it depreciated faster in the last few months and ended the year weaker than other EM currencies against USD💲

4/n

Commodities: Surge in 20-21 till early 22.

Surge in energy ⚡️& agri commodity prices🌾in 20-21 due to:

👉 Post-Covid demand

👉 Supply constraints

👉 Liquidity infusion

👉 Russia-Ukraine war --> further surge 1H 2022

5/n

Surge in energy ⚡️& agri commodity prices🌾in 20-21 due to:

👉 Post-Covid demand

👉 Supply constraints

👉 Liquidity infusion

👉 Russia-Ukraine war --> further surge 1H 2022

5/n

Commodities: Correction in 2H of 2022

Inflation --> higher interest rates --> monetary tightening --> Demand moderation --> easing of supply

6/n

Inflation --> higher interest rates --> monetary tightening --> Demand moderation --> easing of supply

6/n

2022: World Inching Towards Normalcy

👉 Growth normalised in most economies in 2022

👉 Higher inflation, interest rates and energy prices to weigh on growth in 2023

👉Fiscal deficit also set to normalise for AEs, but likely to remain at elevated levels for EMEs

7/n

👉 Growth normalised in most economies in 2022

👉 Higher inflation, interest rates and energy prices to weigh on growth in 2023

👉Fiscal deficit also set to normalise for AEs, but likely to remain at elevated levels for EMEs

7/n

2022: World Inching Towards Normalcy

👉Agg. sovereign debt to GDP trending towards pre-pandemic levels

- supported by strong nominal GDP growth + narrowing fiscal deficit

👉EMEs debt continues to remain high

8/n

👉Agg. sovereign debt to GDP trending towards pre-pandemic levels

- supported by strong nominal GDP growth + narrowing fiscal deficit

👉EMEs debt continues to remain high

8/n

Headwinds to Global Growth

Inflation catapulted due to 👇

- supply chain disruption

- pent up demand

- excess savings

- tight labour markets

9/n

Inflation catapulted due to 👇

- supply chain disruption

- pent up demand

- excess savings

- tight labour markets

9/n

Headwinds to Global Growth

👉Response by Central banks

- Policy rates now at decadal highs

👉…and reducing balance sheets

- G4 Central banks are expected to reduce balance sheets by ~USD 2 trillion in CY23

10/n

👉Response by Central banks

- Policy rates now at decadal highs

👉…and reducing balance sheets

- G4 Central banks are expected to reduce balance sheets by ~USD 2 trillion in CY23

10/n

Counterbalance to Headwinds

👉Excess accumulated savings -> buffer for consumption against inflation

👉Unemployment % in major economies < pre-pandemic levels

👉HH debt as % of GDP trended lower after peaking during the pandemic -> may provide some support to consumption

11/n

👉Excess accumulated savings -> buffer for consumption against inflation

👉Unemployment % in major economies < pre-pandemic levels

👉HH debt as % of GDP trended lower after peaking during the pandemic -> may provide some support to consumption

11/n

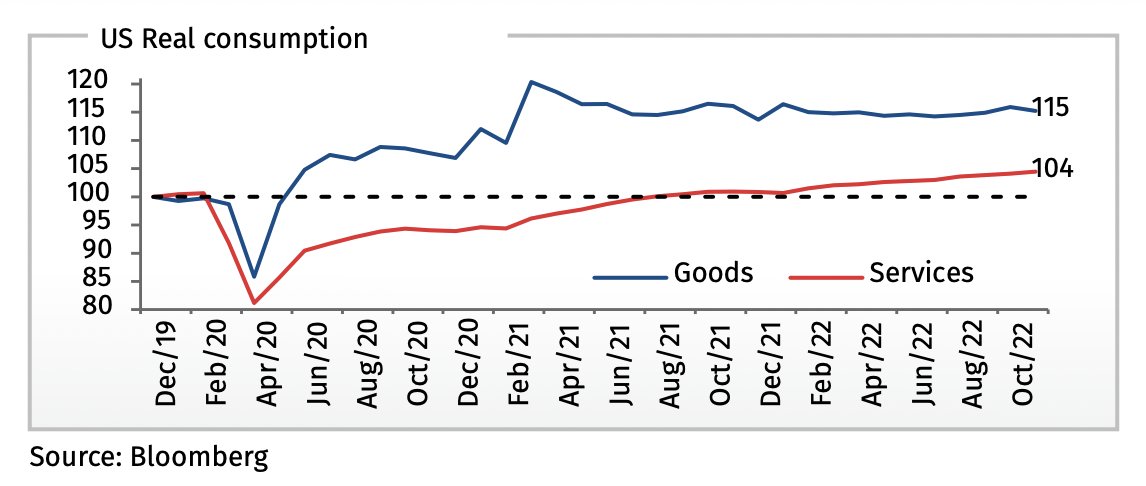

US Economy: Recovering Demand Amid a Tight Labour Market

👉Real consumption trending higher

👉Labour force participation fell, lower participation of age 55+

👉…but growth moderating

👉Mortgage rates rising sharply, now > pre-GFC levels (housing ~17% of US economy )

12/n

👉Real consumption trending higher

👉Labour force participation fell, lower participation of age 55+

👉…but growth moderating

👉Mortgage rates rising sharply, now > pre-GFC levels (housing ~17% of US economy )

12/n

China: Preparing for Near-Term Rebound, but LT Challenges Emerge

👉 Growth poised to recover after re-opening

👉 Avg age will rise + Working age population is likely to shrink -> impact on LT consumption growth

13/n

👉 Growth poised to recover after re-opening

👉 Avg age will rise + Working age population is likely to shrink -> impact on LT consumption growth

13/n

Euro Area: Under Pressure

👉Sharp rise in energy prices post the Ukraine war

👉Growth remains a challenge

- Retail sales are contracting YoY

- Composite PMI also in contraction zone

14/n

👉Sharp rise in energy prices post the Ukraine war

👉Growth remains a challenge

- Retail sales are contracting YoY

- Composite PMI also in contraction zone

14/n

Global Oil: Tug of War

👉 Volatile prices due to several uncertainties on both the demand and supply side

👉 Demand is still below pre-pandemic levels

👉 Supply inelasticity to price is increasing

15/n

👉 Volatile prices due to several uncertainties on both the demand and supply side

👉 Demand is still below pre-pandemic levels

👉 Supply inelasticity to price is increasing

15/n

Global Gas : Higher for Longer?

👉 CY22 gas prices touched all-time highs

👉 EU plans to reduce dependence on Russian gas (~40% of total gas demand in 2021)

👉 This will structurally alter global gas markets

16/n

👉 CY22 gas prices touched all-time highs

👉 EU plans to reduce dependence on Russian gas (~40% of total gas demand in 2021)

👉 This will structurally alter global gas markets

16/n

2023: India stands out

👎 Most economies are likely to experience a slowdown next year

👍 India’s 🇮🇳absolute and relative GDP growth remains attractive

17/n

👎 Most economies are likely to experience a slowdown next year

👍 India’s 🇮🇳absolute and relative GDP growth remains attractive

17/n

India: Emerging Trends #1

🛍️ D2C brands

- 350-400m online shoppers 🔼 by '25, from 150-180m

- E-com penetration 🔼 ~15% by FY27

- D2C market to reach ~US$60b in FY27, (~USD 12 bn in FY22)

- Grocery 🥣 & Apparel + Footwear 👗👟 largest categories

18/n

🛍️ D2C brands

- 350-400m online shoppers 🔼 by '25, from 150-180m

- E-com penetration 🔼 ~15% by FY27

- D2C market to reach ~US$60b in FY27, (~USD 12 bn in FY22)

- Grocery 🥣 & Apparel + Footwear 👗👟 largest categories

18/n

India: Emerging Trends #2

🧬 Biotech in Pharmaceutical

Conducive funding env. driving biotech adoption

~$460bn funding during 2017-21

~Estimated biologic market size of $580 bn by'26

Challenges

- Competition - small/emerging cos ~73% of dev pipeline

- Mfg. complexity

19/n

🧬 Biotech in Pharmaceutical

Conducive funding env. driving biotech adoption

~$460bn funding during 2017-21

~Estimated biologic market size of $580 bn by'26

Challenges

- Competition - small/emerging cos ~73% of dev pipeline

- Mfg. complexity

19/n

India: Emerging Trends #3

⚡️🚗 Electric vehicles

++ Govt. subsidies on BEV direct cashback, tax refund or lower purchase tax.

Sales penetration ~10% in CY22, forecasts to almost full BEV penetration by '40.

... but, energy security & supply chain challenges remain

20/n

⚡️🚗 Electric vehicles

++ Govt. subsidies on BEV direct cashback, tax refund or lower purchase tax.

Sales penetration ~10% in CY22, forecasts to almost full BEV penetration by '40.

... but, energy security & supply chain challenges remain

20/n

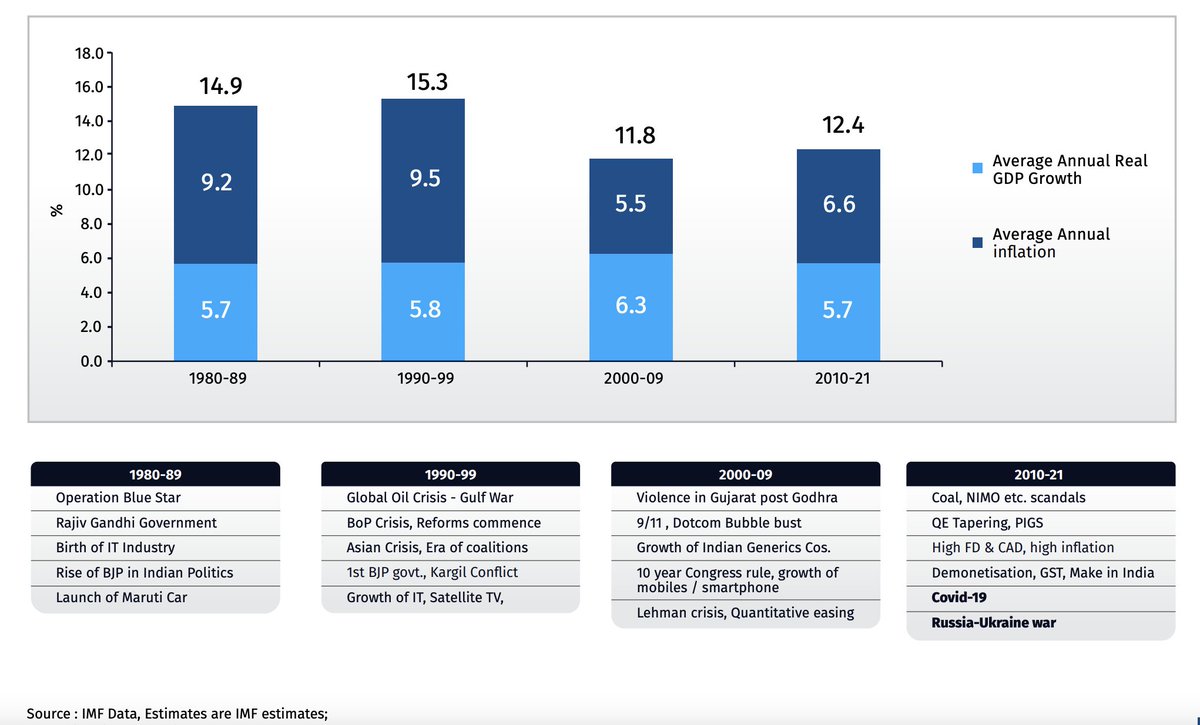

Indian Economy

Steady long-term drivers of resilience

👍 Highest growth likely over next 5y among all major economies

👍 Demographic advantage: Working age pop. likely to be highest globally in next 10y

👍 Total debt to GDP is the lowest amongst major global economies

22/n

Steady long-term drivers of resilience

👍 Highest growth likely over next 5y among all major economies

👍 Demographic advantage: Working age pop. likely to be highest globally in next 10y

👍 Total debt to GDP is the lowest amongst major global economies

22/n

Indian Economy: Structural growth drivers #1

- Macros -

👍 Thrust on infra, recovery in private capex & steady consumption

👍 Inflation likely to moderate in FY24; manageable levels of govt. borrowings

👎 Headwinds: Slowing global trade & Quantitative Tightening

23/n

- Macros -

👍 Thrust on infra, recovery in private capex & steady consumption

👍 Inflation likely to moderate in FY24; manageable levels of govt. borrowings

👎 Headwinds: Slowing global trade & Quantitative Tightening

23/n

Indian economy: Structural growth drivers #2

- Resurgence of Manufacturing -

👉 China+1 opportunity

👉 Favourable govt policies like PLI, reduction in taxes, tariff barriers, etc.

👉 Attractive FDI destination: Large market, competitive cost + favourable demographics

24/n

- Resurgence of Manufacturing -

👉 China+1 opportunity

👉 Favourable govt policies like PLI, reduction in taxes, tariff barriers, etc.

👉 Attractive FDI destination: Large market, competitive cost + favourable demographics

24/n

Indian economy: Structural growth drivers #3

- Private Capex prime for Pick Up -

👍 Improved corporate profitability & leverage

👍 High capacity utilization and reasonable demand outlook

👍 Banks b/s in good shape with low NPAs and strong capital adequacy

25/n

- Private Capex prime for Pick Up -

👍 Improved corporate profitability & leverage

👍 High capacity utilization and reasonable demand outlook

👍 Banks b/s in good shape with low NPAs and strong capital adequacy

25/n

Indian economy: Structural growth drivers #4

- Infrastructure Capex and Housing -

👉 Central govt thrust on capital spending especially on roads, railways & defense likely continue

👉 Higher affordability & RERA to support better housing demand

26/n

- Infrastructure Capex and Housing -

👉 Central govt thrust on capital spending especially on roads, railways & defense likely continue

👉 Higher affordability & RERA to support better housing demand

26/n

Indian economy: Structural growth drivers #5

- Consumption -

👉 Large potential with under penetration across major consumer categories

👉 HH debt remains relatively low compared to other markets

27/n

- Consumption -

👉 Large potential with under penetration across major consumer categories

👉 HH debt remains relatively low compared to other markets

27/n

Indian economy: Near-term risks

👉 Higher commodity prices can be a drag on external sector & corporate margins

👉Quantitative tightening by major central banks may impact capital flows to EMs

👉High inflation in AEs & monetary policy tightening -> impact on demand

28/n

👉 Higher commodity prices can be a drag on external sector & corporate margins

👉Quantitative tightening by major central banks may impact capital flows to EMs

👉High inflation in AEs & monetary policy tightening -> impact on demand

28/n

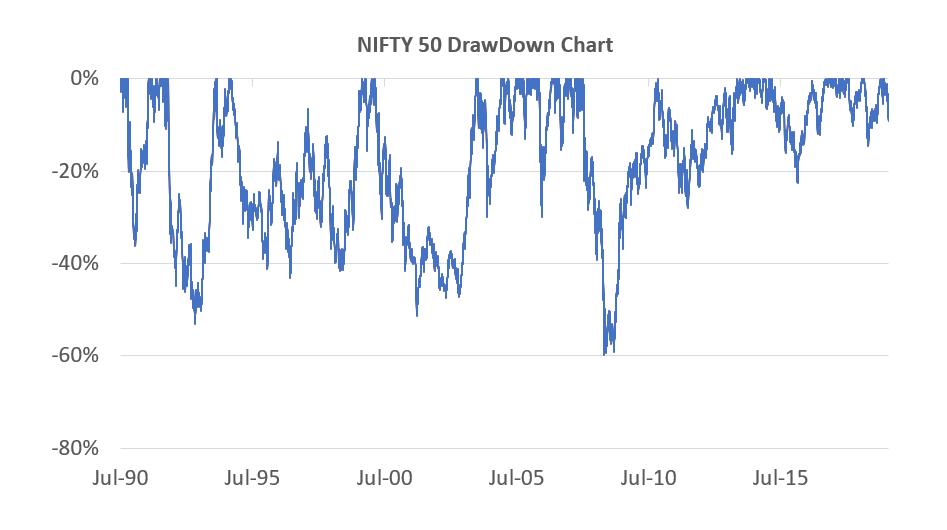

Indian equities: Outperforms Major Global Counterparts

#NIFTY50 delivered 7th consecutive year of +ve return, a first since the inception of the index!

29/n

#NIFTY50 delivered 7th consecutive year of +ve return, a first since the inception of the index!

29/n

Indian equities: Sectoral performance

👍 Utilities outperformed on better underlying demand-supply

👍Banking did well driven by improvement in credit offtake & NPA moderation

IT + Healthcare lagged;

👎 Consumer durables sector underperformed due to high input prices

30/n

👍 Utilities outperformed on better underlying demand-supply

👍Banking did well driven by improvement in credit offtake & NPA moderation

IT + Healthcare lagged;

👎 Consumer durables sector underperformed due to high input prices

30/n

Indian equities: Valuations

👉 #NIFTY trades at premium to its historical average partly driven by superior relative growth prospects

👉 Valuation dispersion continues to provide sector and stock-specific opportunities

31/n

👉 #NIFTY trades at premium to its historical average partly driven by superior relative growth prospects

👉 Valuation dispersion continues to provide sector and stock-specific opportunities

31/n

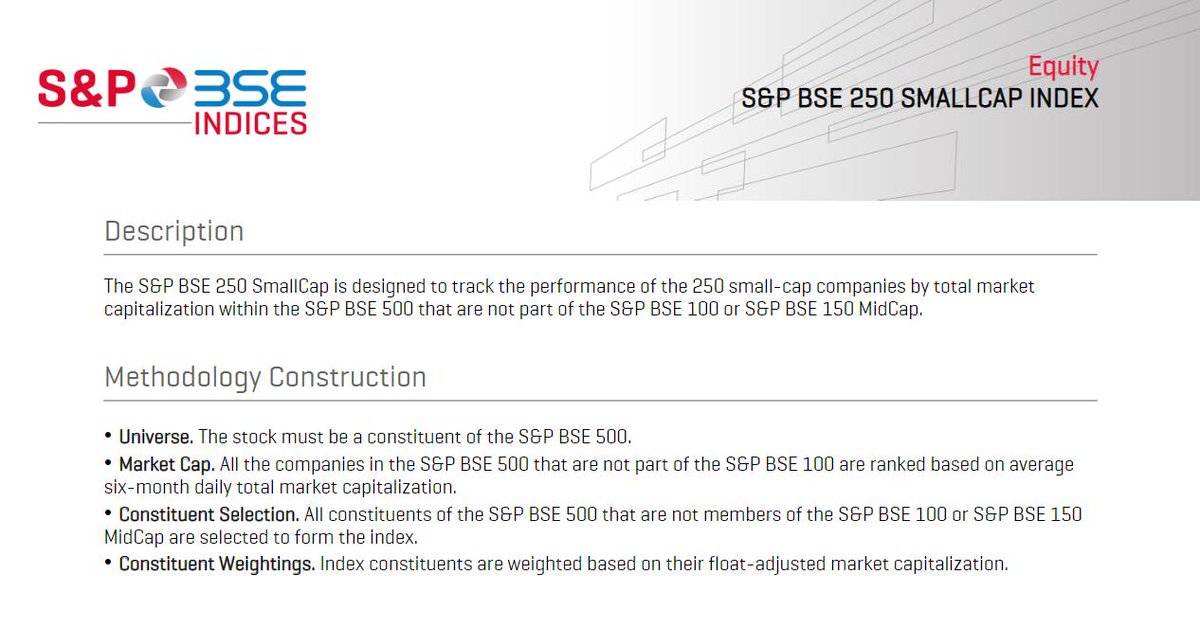

Indian equities: Broader Markets Valuation

👉 Mid Cap Index trades at ~30% premium to its historical average

👉 Small Cap Index trades at a lower premium

👉 Mid/Small have trailed on a medium-term timeframe

32/n

👉 Mid Cap Index trades at ~30% premium to its historical average

👉 Small Cap Index trades at a lower premium

👉 Mid/Small have trailed on a medium-term timeframe

32/n

India: Rising Retail Participation

👉 Large selling by FPIs during the year reduced FPI ownership

👉 Returns were supported by strong DII flows in mutual funds and insurance

👉 Rise in retail participation has resulted in a multifold increase in F&O volumes

33/n

👉 Large selling by FPIs during the year reduced FPI ownership

👉 Returns were supported by strong DII flows in mutual funds and insurance

👉 Rise in retail participation has resulted in a multifold increase in F&O volumes

33/n

India: Global Valuation

👉 Global markets have corrected and now trade at or below LT valuations

👉India’s 🇮🇳premium to global markets has expanded

34/n

👉 Global markets have corrected and now trade at or below LT valuations

👉India’s 🇮🇳premium to global markets has expanded

34/n

@HDFCMF's 2023 Year Book provides a detailed overview of 10 sectors.

Here, we give you prospects / Key Drivers / Risks of each in brief 👇

35/n

Here, we give you prospects / Key Drivers / Risks of each in brief 👇

35/n

Sector Overview: 🚗 Automobile OEMs

👉 2W/3W/PV could see rapid shift towards EV in the next 1-3yrs

👉 Infra push & govt capex augurs well for MHCV & tractor segment in 2023

👉 Impact of consumer inflation likely to weigh on consumer segments (2W & PV) growth in '23

36/n

👉 2W/3W/PV could see rapid shift towards EV in the next 1-3yrs

👉 Infra push & govt capex augurs well for MHCV & tractor segment in 2023

👉 Impact of consumer inflation likely to weigh on consumer segments (2W & PV) growth in '23

36/n

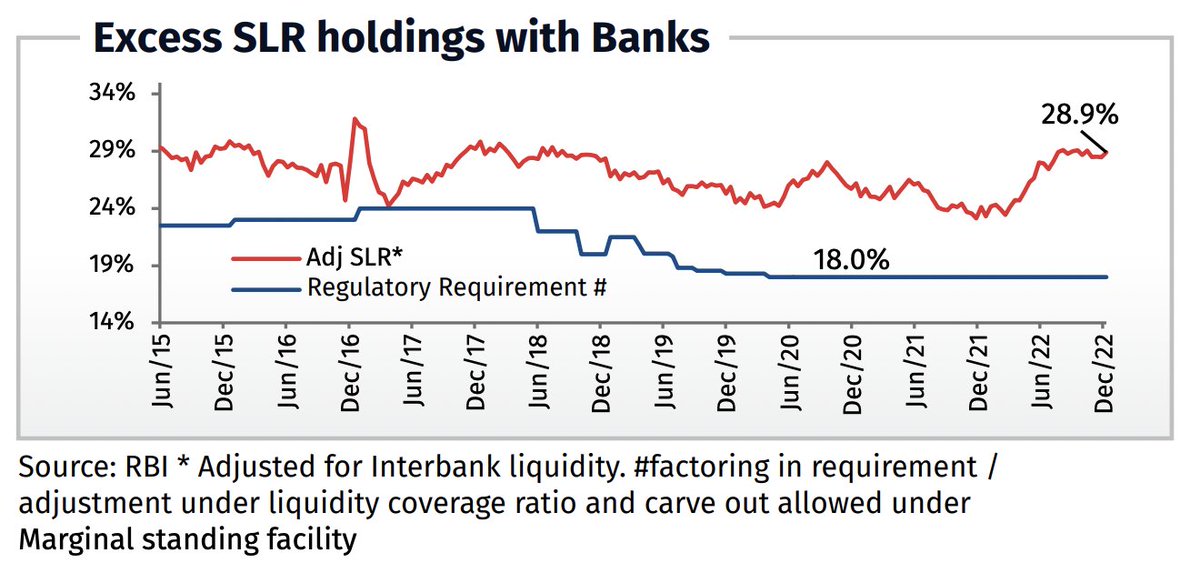

Sector Overview: 🏦 Banking & NBFCs

👉 India’s low System credit to GDP at 91% should drive higher credit growth over the next few years

👉Retail credit growth has been high 👏

👉 Several new listings of Fintech have increased the investment universe for BFSI

37/n

👉 India’s low System credit to GDP at 91% should drive higher credit growth over the next few years

👉Retail credit growth has been high 👏

👉 Several new listings of Fintech have increased the investment universe for BFSI

37/n

Sector Overview: Capital Goods

👉 Countries look to diversify supply chain --> pvt capex cycle improvement

👉 Improvement in public capex led by National Infrastructure pipeline

👉Key risks

Weak PLI, NIP scheme implementation, lower investments in core industries

38/n

👉 Countries look to diversify supply chain --> pvt capex cycle improvement

👉 Improvement in public capex led by National Infrastructure pipeline

👉Key risks

Weak PLI, NIP scheme implementation, lower investments in core industries

38/n

Sector Overview: Consumer Staples (FMCG)

👉 India Per capita consumption < below Asian peers. This opportunity = long-term growth driver

👉 Risks:

- Already high penetration in large categories (soaps, toothpaste etc)

- Rising share of private label brands / D2C

39/n

👉 India Per capita consumption < below Asian peers. This opportunity = long-term growth driver

👉 Risks:

- Already high penetration in large categories (soaps, toothpaste etc)

- Rising share of private label brands / D2C

39/n

Sector Overview: Infrastructure and Construction 🌉

👉HAM & BOT projects awards are rising, advantage for cos with strong b/s

👉 River linking & irrigation could become another big opportunity

👉 Bullet train 🚄contracts & Metros to drive order inflow in railways sector

40/n

👉HAM & BOT projects awards are rising, advantage for cos with strong b/s

👉 River linking & irrigation could become another big opportunity

👉 Bullet train 🚄contracts & Metros to drive order inflow in railways sector

40/n

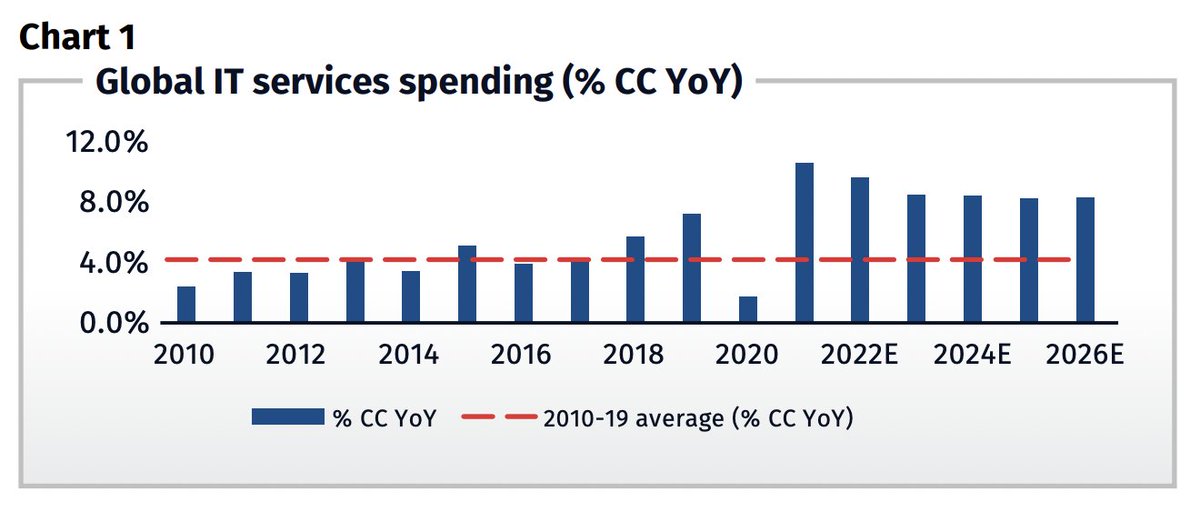

Sector Overview: IT Services 👩💻

- Near term: Weakness in developed markets poses downside risks

- Med term: Higher mix of digital services & offshoring to aid growth

- Lower employee churn (wrt CY21/22) + improvement in utilization -> margin downsides are behind.

41/n

- Near term: Weakness in developed markets poses downside risks

- Med term: Higher mix of digital services & offshoring to aid growth

- Lower employee churn (wrt CY21/22) + improvement in utilization -> margin downsides are behind.

41/n

Sector Overview: Metals 🪙

👉 Heavy dependence on the impact of tightening monetary policies

👉 High inflation and energy crisis in EU

👉 China expected to stabilize with lockdown restrictions easing

👉 Key risk is weak demand and weakening of metal prices

42/n

👉 Heavy dependence on the impact of tightening monetary policies

👉 High inflation and energy crisis in EU

👉 China expected to stabilize with lockdown restrictions easing

👉 Key risk is weak demand and weakening of metal prices

42/n

Sector Overview: Oil & Gas 🛢️

👉 Low competitive intensity in auto fuel retailing – margins have headroom to expand in the long run.

👉 Diversification by cos. towards petrochemical & natural gas to gradually reduce earnings volatility.

43/n

👉 Low competitive intensity in auto fuel retailing – margins have headroom to expand in the long run.

👉 Diversification by cos. towards petrochemical & natural gas to gradually reduce earnings volatility.

43/n

Sector Overview: 💊Pharmaceuticals

👉Better 2-y outlook vs 22/23 due to commercialization of complex generics & certain products losing exclusivities

👉 But, investment opportunities will be selective given cos’ idiosyncratic growth drivers & differing investment cycles

44/n

👉Better 2-y outlook vs 22/23 due to commercialization of complex generics & certain products losing exclusivities

👉 But, investment opportunities will be selective given cos’ idiosyncratic growth drivers & differing investment cycles

44/n

Sector Overview: Telecom 📶

👉 With increased 5G adoption, average data consumption per user could double compared to 4G

👉 Accelerated 5G adoption could be a lever of revenue growth as customers upgrades to higher data allowances.

45/n

👉 With increased 5G adoption, average data consumption per user could double compared to 4G

👉 Accelerated 5G adoption could be a lever of revenue growth as customers upgrades to higher data allowances.

45/n

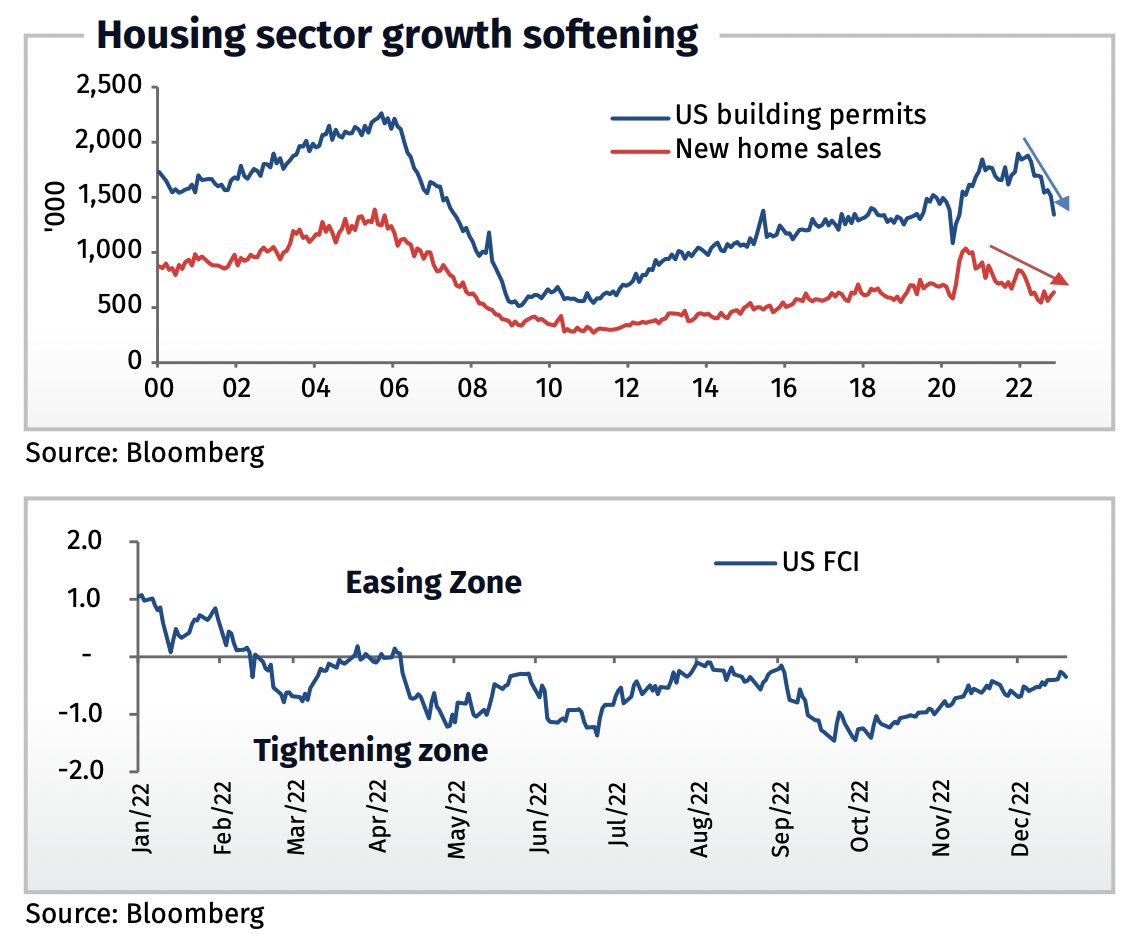

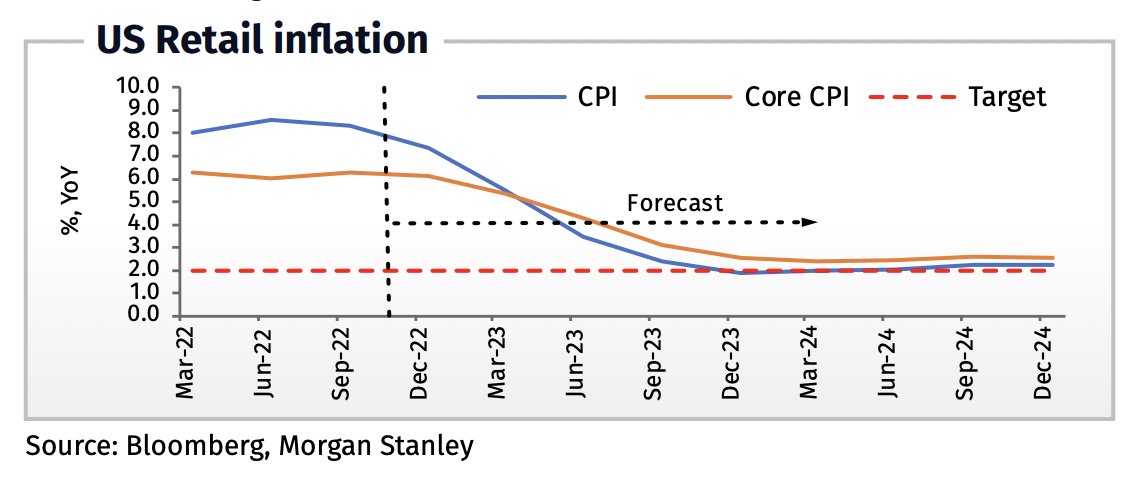

Global Inflation and Rates: Is the worst behind?

@HDFCMF thinks Global inflation has likely peaked:

- Broad-based decline in commodity prices in H2CY22

- Supply chain pressures have eased, freight costs are off their peak

- Global growth likely to slowdown in CY23

47/n

@HDFCMF thinks Global inflation has likely peaked:

- Broad-based decline in commodity prices in H2CY22

- Supply chain pressures have eased, freight costs are off their peak

- Global growth likely to slowdown in CY23

47/n

India 🇮🇳: Emerging Signs of Softening Inflation

👉 No. of items for which prices rose by more than 0.5% (MoM) is trending lower, reflecting slowing inflation momentum

👉 WPI has come off its highs, should ease input price pressure on CPI, albeit with a lag

48/n

👉 No. of items for which prices rose by more than 0.5% (MoM) is trending lower, reflecting slowing inflation momentum

👉 WPI has come off its highs, should ease input price pressure on CPI, albeit with a lag

48/n

RBI close to ending rate hiking cycle?

👉 Real policy rate at current levels has turned positive, now higher than the long-term avg; this should slowdown growth and inflation over time

👉 Currency pressure has eased

49/n

👉 Real policy rate at current levels has turned positive, now higher than the long-term avg; this should slowdown growth and inflation over time

👉 Currency pressure has eased

49/n

RBI close to ending rate hiking cycle?

👉 Inflation has come off its peak, likely to moderate within the target range of 2% - 6% in CY23

👉 But core CPI likely to remain at elevated levels although lower than 6%

👉 Direction of core CPI may weigh on RBI’s decision

50/n

👉 Inflation has come off its peak, likely to moderate within the target range of 2% - 6% in CY23

👉 But core CPI likely to remain at elevated levels although lower than 6%

👉 Direction of core CPI may weigh on RBI’s decision

50/n

Fiscal Deficit: Gradual fiscal consolidation path

👉 Healthy tax collections in FYTD23, > Budget Estimates

👉 Expenditure could rise -> higher fertilizer subsidies + extension of free food grain scheme in FY23

👉 Fisc. def to remain close to BE (~6.4% of GDP) for FY23

51/n

👉 Healthy tax collections in FYTD23, > Budget Estimates

👉 Expenditure could rise -> higher fertilizer subsidies + extension of free food grain scheme in FY23

👉 Fisc. def to remain close to BE (~6.4% of GDP) for FY23

51/n

Govt Borrowings

👉 Diversification of Investor Base likely to provide cushion against volatility

👉 Share of stable long-term buyers (eg insurance cos) rose, led to change in Gsec demand dynamics over last few yrs -> alternative source of demand for Gsec

52/n

👉 Diversification of Investor Base likely to provide cushion against volatility

👉 Share of stable long-term buyers (eg insurance cos) rose, led to change in Gsec demand dynamics over last few yrs -> alternative source of demand for Gsec

52/n

Other Debt Market Trends - 1

👉 Credit upgrade to downgrade ratio is near all-time highs

👉 Lower supply of corporate bonds (both AAA and non-AAA rated) has resulted in credit spreads of corporate bonds over Gsec falling sharply vis-à-vis long term avg

53/n

👉 Credit upgrade to downgrade ratio is near all-time highs

👉 Lower supply of corporate bonds (both AAA and non-AAA rated) has resulted in credit spreads of corporate bonds over Gsec falling sharply vis-à-vis long term avg

53/n

Other Debt Market Trends - 2

👉 In CY22, Gsec yield curve flattened as liquidity normalized and RBI raised rates

.. while longer-end yields remained anchored driven by robust demand by long term investors like Insurance, provident fund (PF), etc.

54/n

👉 In CY22, Gsec yield curve flattened as liquidity normalized and RBI raised rates

.. while longer-end yields remained anchored driven by robust demand by long term investors like Insurance, provident fund (PF), etc.

54/n

Key Drivers of Interest Rate Outlook

👉Growth

👉External Sector

👉Inflation

👉Monetary policy

👉Market borrowings

@HDFCMF says that with global monetary policy cycle likely to peak in 2023, yields are likely to trade in a range with a downward bias.

55/n

👉Growth

👉External Sector

👉Inflation

👉Monetary policy

👉Market borrowings

@HDFCMF says that with global monetary policy cycle likely to peak in 2023, yields are likely to trade in a range with a downward bias.

55/n

Risks to Interest Rates Outlook

👉Inflation

👉Consumption

-Build up of capacities with elevated prices can result in pick up of investments and capital spending

👉Supply chain pressures

- still higher than pre-pandemic levels + China COVID concerns

56/n

👉Inflation

👉Consumption

-Build up of capacities with elevated prices can result in pick up of investments and capital spending

👉Supply chain pressures

- still higher than pre-pandemic levels + China COVID concerns

56/n

What do you think about this? Tell us in replies.

♥️ and RT the first tweet if you liked this thread.

Follow @kuvera_in for more insights on investments.

—- Fin —-

57/57

♥️ and RT the first tweet if you liked this thread.

Follow @kuvera_in for more insights on investments.

—- Fin —-

57/57

• • •

Missing some Tweet in this thread? You can try to

force a refresh