Common enterprise is a real problem for the SEC in this case. And #XRPHolders, as amici curie, have contributed a lot on the issue.

https://twitter.com/utoday_en/status/1613550060783951872

Remember, initially the SEC argued that @Ripple was the common enterprise. Two things then happened: 1) Ripple forced the SEC to admit owning #XRP gives #XRPHolders ZERO rights or interest in Ripple and Ripple owes #XRPHolders absolutely nothing; and

2) #XRPHolders became amici a year and half BEFORE anyone else filed an amicus request and we submitted 3K affidavits stating that the majority of first time purchasers of #XRP were unaware of the company Ripple, thousands acquired #XRP for non-investment reasons,

we receive financial benefits from #XRP completely independent of Ripple and we utilize #XRP as a substitute for fiat - to name a few of the things we proved to the Court.

We also challenged its so-called Expert Witness - hired by the SEC to issue a report about #XRPHolders.

We also challenged its so-called Expert Witness - hired by the SEC to issue a report about #XRPHolders.

At the deposition of this so-called Expert, he/she was shown a Twitter 🧵 of mine during cross-examination by Ripple lawyers. I attached all of this to the amicus brief I submitted it to the Court. This alleged #XRPHolder Expert backtracked when confronted w/the Twitter🧵

This so-called Expert testified on cross that his/her opinion may have been different if he/she had been aware of the claims and evidence being submitted by me and my 75K friends.

Because of what we submitted (and Ripple lawyers forcing the SEC to concede #XRP provides no interest or rights in Ripple), this so-called Expert argued the Common Enterprise wasn’t Ripple after all, but the ENTIRE XRP Ecosystem, which includes all #XRPHolders and all exchanges.

Ripple filed a Daubert Challenge to this expert. I filed a request to also comment on this expert CONSIDERING HE/SHE ISSUED THIS REPORT WITHOUT INTERVIEWING A SINGLE #XRPHOLDER!

The judge denied my initial request BUT said I could reapply later, if this expert’s testimony was used for summary judgment.

BUT THE SEC ABANDONED ITS SO-CALLED EXPERT.

In its summary judgment brief the SEC didn’t rely on or cite to anything this alleged Expert said.

BUT THE SEC ABANDONED ITS SO-CALLED EXPERT.

In its summary judgment brief the SEC didn’t rely on or cite to anything this alleged Expert said.

THEREFORE I ASK, WHAT IS THE COMMON ENTERPRISE?

It can’t be Ripple and since the SEC abandoned its expert there is no “XRP Ecosystem” testimony before Judge Torres.

If you carefully read the SEC’s brief, it claims #XRP is the common enterprise itself. It actually says it.

It can’t be Ripple and since the SEC abandoned its expert there is no “XRP Ecosystem” testimony before Judge Torres.

If you carefully read the SEC’s brief, it claims #XRP is the common enterprise itself. It actually says it.

But guess what? The SEC ALSO claims that #XRP itself represents all the promises and inducements and efforts made by Ripple since 2013 until the present.

Do you realize what this means? It means the SEC is arguing #XRP itself satisfies both the second and third prongs of Howey.

Do you realize what this means? It means the SEC is arguing #XRP itself satisfies both the second and third prongs of Howey.

The SEC literally claims #XRP itself was, is, and always will be a security.

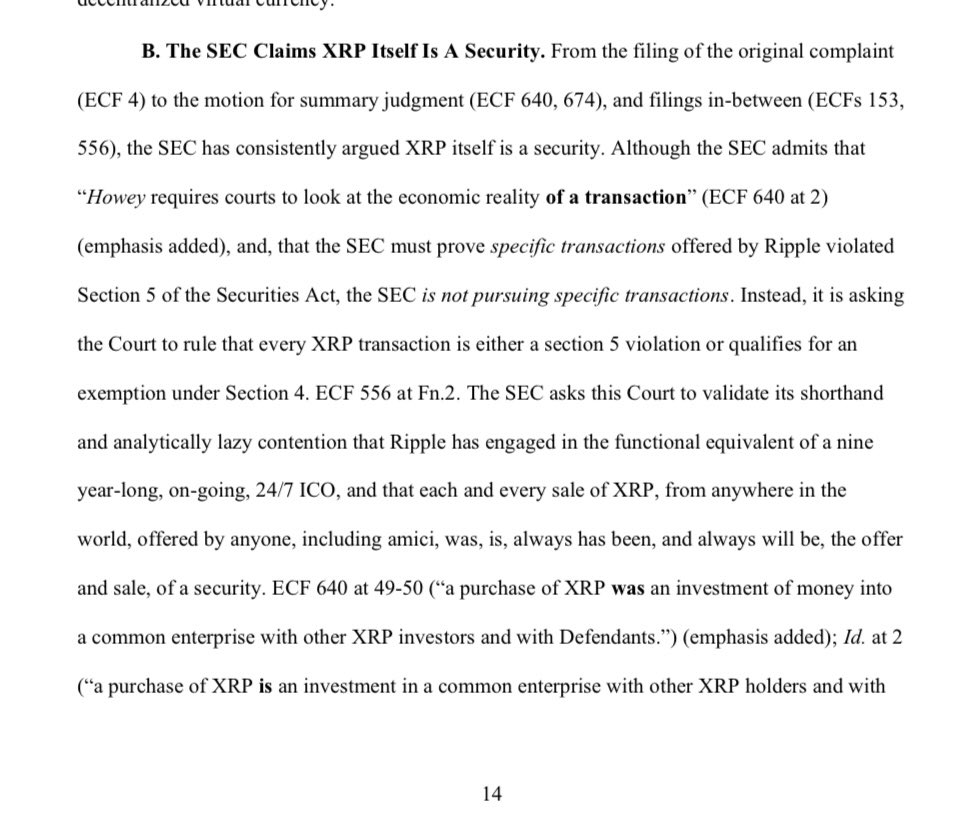

Read this section of the amicus brief I filed and how I show:

“The scope of the SEC's Howey argument has become

so stretched that it is truly indefinable, in space, or in time.”

Read this section of the amicus brief I filed and how I show:

“The scope of the SEC's Howey argument has become

so stretched that it is truly indefinable, in space, or in time.”

That’s not how a Howey analysis works and it certainly doesn’t make a token itself always a security no matter the circumstances.

People predicting the SEC will definitely win and that #XRP is doomed are overstating the SEC’s chances. The SEC’s allegations are stretched too far.

People predicting the SEC will definitely win and that #XRP is doomed are overstating the SEC’s chances. The SEC’s allegations are stretched too far.

• • •

Missing some Tweet in this thread? You can try to

force a refresh