#13 @wasabi_protocol

The Decentralized #NFT Options Protocol

In this thread

1) TLDR

2) What is Wasabi protocol

3) How does it work

4) What does it enable

5) What are the challenges

6) Summary

The Decentralized #NFT Options Protocol

In this thread

1) TLDR

2) What is Wasabi protocol

3) How does it work

4) What does it enable

5) What are the challenges

6) Summary

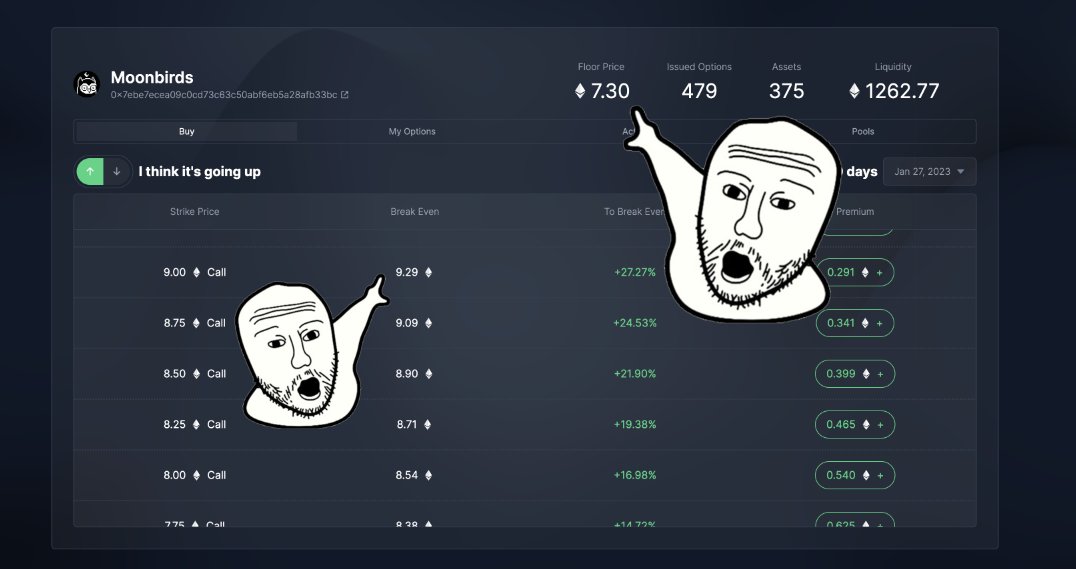

How does it work

So it basically works as a normal option.

Buy Option

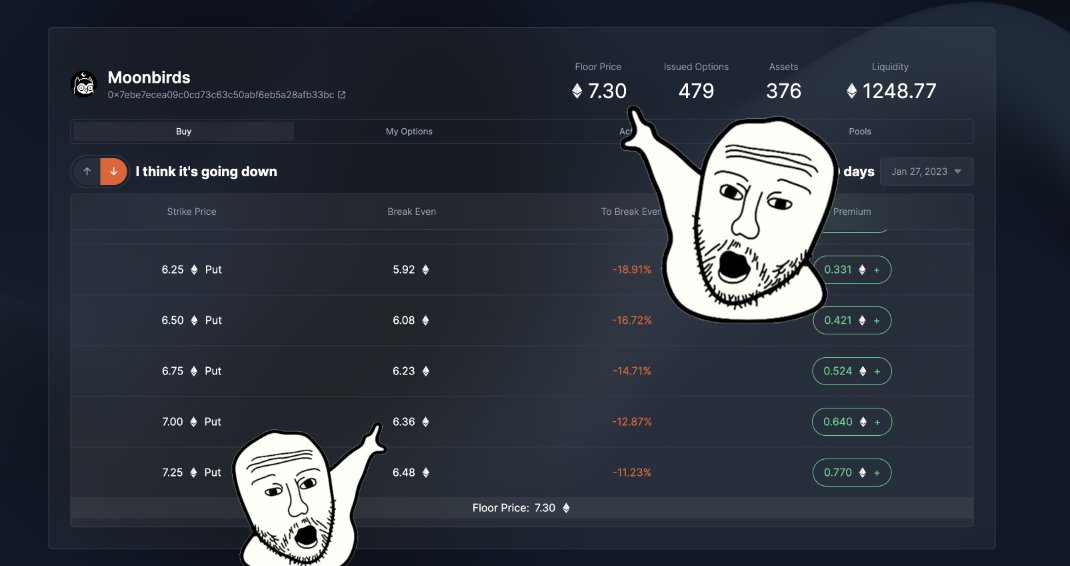

1. Put (i think going down)

2. Call (i think going up)

So it basically works as a normal option.

Buy Option

1. Put (i think going down)

2. Call (i think going up)

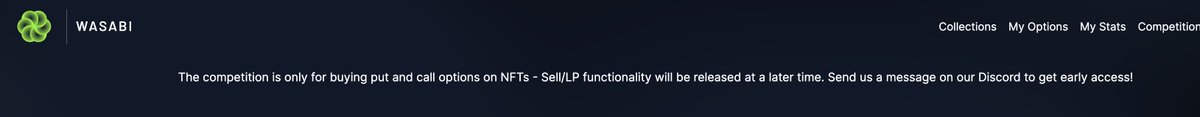

Sell option

1. Put (i think it will going up or remain unchanged *to earn premium*)

2. Call (i think it will go down or remain unchanged *to earn premium*)

1. Put (i think it will going up or remain unchanged *to earn premium*)

2. Call (i think it will go down or remain unchanged *to earn premium*)

Wasabi’s gitbook currently doesn’t state how is the “collateral pool works”. They stated it might be sell/LP. I’d imagine it might be using actual NFT as collateral or over collateral amount of ETH.

So wen/how would you use this protocol?

E.g. if i am bullish on moonbird. Which current floor price is 7.3 and i think it would be above 9.2(break even point) I can buy the option with “premium”0.29 and earn any profit above 9.2

E.g if it goes up to 15 you will earn 15-9.2=5.8

E.g. if i am bullish on moonbird. Which current floor price is 7.3 and i think it would be above 9.2(break even point) I can buy the option with “premium”0.29 and earn any profit above 9.2

E.g if it goes up to 15 you will earn 15-9.2=5.8

E.g if I am bearish on moonbird, floor price is 7.3 and i think it will drop below 6.36 (break even point) i can buy the option with 0.64eth premium and earn any profit if it drop below 6.36.

What does can wasabi enable

- Lower cost in hedging

- Lower to leverage on price speculation

- potential earn yield on your nft (depending on pool model)

- Lower cost in hedging

- Lower to leverage on price speculation

- potential earn yield on your nft (depending on pool model)

What are the challenges

Like all on chain options, I’d imagine there will be difficulty in matching maker (LP or NFT provider, option contract writer). If it were to use NFT as settle will there be enough liquidity?

Also how are the option priced? How do you set the premium?

Like all on chain options, I’d imagine there will be difficulty in matching maker (LP or NFT provider, option contract writer). If it were to use NFT as settle will there be enough liquidity?

Also how are the option priced? How do you set the premium?

Summary

Options for #NFT will be interesting to use,I look forward to how the pool is structured and the price of the option. It will be interesting to see how the team merge option, which is typically not a option friendly market with NFTs which is a very retail heavy market.

Options for #NFT will be interesting to use,I look forward to how the pool is structured and the price of the option. It will be interesting to see how the team merge option, which is typically not a option friendly market with NFTs which is a very retail heavy market.

Thank you again for reading, if you made it till here u are a true fren.

I am currently looking for some group/community to join to chat about crypto even more n meetin frens. lmk or dm me if you have any good ones!

I am currently looking for some group/community to join to chat about crypto even more n meetin frens. lmk or dm me if you have any good ones!

sub me

2lambroz.substack.com

2lambroz.substack.com

@phtevenstrong

@DegenSpartan

@thedailydegenhq

@DAdvisoor @rektdiomedes @crypto_linn @crypthoem

@alpha_pls

@sabocrypto

@korpi87 @ViktorDefi

@DeFi_educator @PastryEth @Gojo_Crypto @TaikiMaeda2

@CryptoShiro_ @DegenCamp @crypto_condom @CryptoDragonite

@Crypt0_Andrew @monosarin

@DegenSpartan

@thedailydegenhq

@DAdvisoor @rektdiomedes @crypto_linn @crypthoem

@alpha_pls

@sabocrypto

@korpi87 @ViktorDefi

@DeFi_educator @PastryEth @Gojo_Crypto @TaikiMaeda2

@CryptoShiro_ @DegenCamp @crypto_condom @CryptoDragonite

@Crypt0_Andrew @monosarin

• • •

Missing some Tweet in this thread? You can try to

force a refresh