Missed some of the recent moves that happened?

1 way that will help gain an edge is to follow whales/smart money and check what they're up to.

Here's a list of the top 10 + 1 wallets on @DeBankDeFi to see what they're up to!

1 way that will help gain an edge is to follow whales/smart money and check what they're up to.

Here's a list of the top 10 + 1 wallets on @DeBankDeFi to see what they're up to!

Some of the key findings:

▶️Some are taking part in APE staking.

▶️Common farms include Convex, Beefy, GMX.

▶️Majority of funds still on Ethereum.

▶️1 is net short USDT, another is net short VST.

▶️2 wallets have SUDO-ETH positions.

▶️Some are taking part in APE staking.

▶️Common farms include Convex, Beefy, GMX.

▶️Majority of funds still on Ethereum.

▶️1 is net short USDT, another is net short VST.

▶️2 wallets have SUDO-ETH positions.

▶️Some are in liquid staking derivative farms (stMatic, beFTM, wstETH)

▶️1 is active in TreasureDAO ecosystem.

▶️1 has been in Canto since the beginning, compounding.

▶️1 is active in TreasureDAO ecosystem.

▶️1 has been in Canto since the beginning, compounding.

Total $ Value combined = $136M

80% of it is on ETH, 7% on Arbitrum. The anomaly is Canto due to a large whale having majority of funds there.

Do keep in mind, I'm pretty sure they have other wallets as well so this is just scratching the surface.

Lets dive in!

80% of it is on ETH, 7% on Arbitrum. The anomaly is Canto due to a large whale having majority of funds there.

Do keep in mind, I'm pretty sure they have other wallets as well so this is just scratching the surface.

Lets dive in!

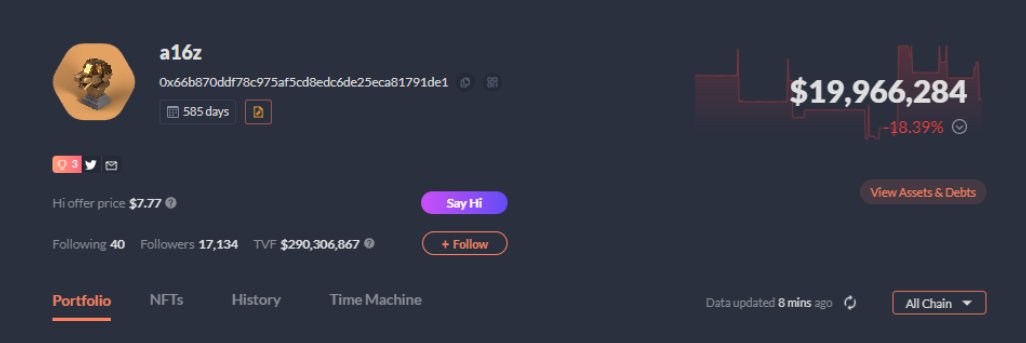

▶️Playing around with NFT loans on MAYC/BAYC

▶️Created a Sudoswap pool for Otherdeeds

▶️Readjusted some Univ3 LP positions

▶️Borrowing some MAYC/BAYC now, assuming its for Sewer pass mint. Heavy interactions on the NFT side of things.

▶️Created a Sudoswap pool for Otherdeeds

▶️Readjusted some Univ3 LP positions

▶️Borrowing some MAYC/BAYC now, assuming its for Sewer pass mint. Heavy interactions on the NFT side of things.

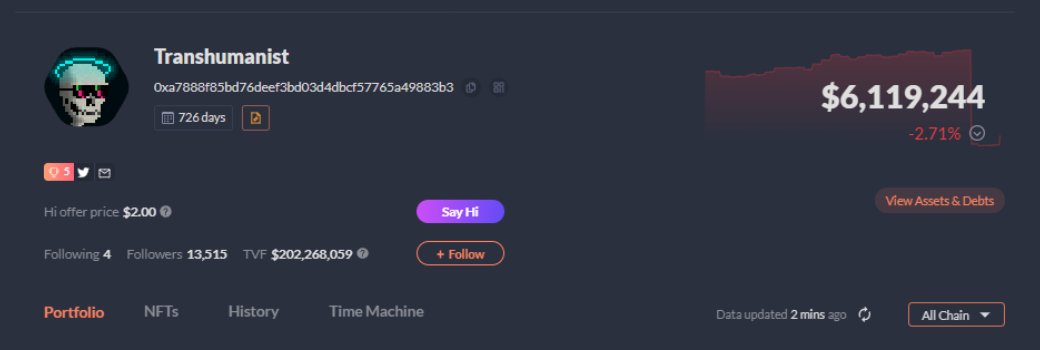

▶️Shorting small position of ETH on GMX.

▶️Claiming and sending APE from APEstaking to Binance (to dump ig)

▶️Farming and dumping on Thena, Concentrator, Velodrome, Wombat, Vector, Gearbox.

▶️Claiming and sending APE from APEstaking to Binance (to dump ig)

▶️Farming and dumping on Thena, Concentrator, Velodrome, Wombat, Vector, Gearbox.

▶️Claiming, dumping/sending to CEX to dump.

▶️Entered Dopex wstETH SSOV

Incredibly managing a ton of positions.

▶️Entered Dopex wstETH SSOV

Incredibly managing a ton of positions.

▶️Deposited alot of ETH into BendDAO.

▶️Majority in stables, recently sending alot of USD to Binance (max bidding maybe).

▶️Deposited USDC, borrowed USDT and swapped to USDC and sent to Binance.

Currently net short $7M USDT.

▶️Majority in stables, recently sending alot of USD to Binance (max bidding maybe).

▶️Deposited USDC, borrowed USDT and swapped to USDC and sent to Binance.

Currently net short $7M USDT.

▶️Farming on Convex, Frax Staking, Liquity, Vesta and JPEG, JonesDAO and Synthetix.

▶️Recently entered cvxFXS-FXS farms

▶️Claiming and dumping most farm assets to ETH and USDC.

Looks like net short VST, borrowed VST against gOHM/DPX and swapped to USDC.

▶️Recently entered cvxFXS-FXS farms

▶️Claiming and dumping most farm assets to ETH and USDC.

Looks like net short VST, borrowed VST against gOHM/DPX and swapped to USDC.

▶️Farming mostly in StakeDAO, Aura and Convex. Recently exited Gearbox.

▶️Recently bought some SDT.

▶️Actively trading NFTs such as DigiDaigaku, Moonbirds, Otherdeeds, big BLUR user.

▶️Has assets in Moonbeam but was affected by the nomad hack.

▶️Recently bought some SDT.

▶️Actively trading NFTs such as DigiDaigaku, Moonbirds, Otherdeeds, big BLUR user.

▶️Has assets in Moonbeam but was affected by the nomad hack.

#6️⃣ YFImaxi (more like ETHmaxi)

0x50664ede715e131f584d3e7eaabd7818bb20a068

$19.9M

Has a ton of $LIDO he accumulated back in mid-late 2022, has not sold a single token but still at a loss.

0x50664ede715e131f584d3e7eaabd7818bb20a068

$19.9M

Has a ton of $LIDO he accumulated back in mid-late 2022, has not sold a single token but still at a loss.

▶️Mainly staking ETH with Lido, farming on Convex, has a SUDO-ETH LP position.

▶️Farm rewards are all converted into ETH.

▶️Converted some ETH into cbETH

▶️Sold some CloneX and Azukis.

▶️Farm rewards are all converted into ETH.

▶️Converted some ETH into cbETH

▶️Sold some CloneX and Azukis.

▶️Main farms are Lido ETH staking and Matic-stMATIC on Beefy.

▶️Also has some MAGIC staked in TreasureDAO.

▶️Actively trading NFTs such as Pudgy Penguins, BAKC, Magic NFTs, Pixels.

▶️Also has some MAGIC staked in TreasureDAO.

▶️Actively trading NFTs such as Pudgy Penguins, BAKC, Magic NFTs, Pixels.

#8️⃣ Miyazaki

0xdb9d281c3d29baa9587f5dac99dd982156913913

$2M

▶️Main farms include Giddy & FTM-beFTM on Beefy.

▶️Heavy Aavegotchi player.

Has not been really active.

0xdb9d281c3d29baa9587f5dac99dd982156913913

$2M

▶️Main farms include Giddy & FTM-beFTM on Beefy.

▶️Heavy Aavegotchi player.

Has not been really active.

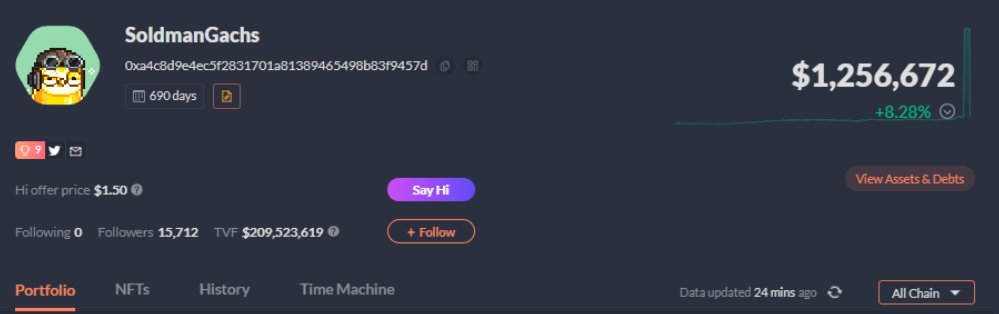

@SoldmanGachs @DrSoldmanGachs ▶️Big MAGIC believer, participating in APE staking as well and compounding it.

▶️Actively interacting with games on TreasureDAO ecosystem.

▶️Been scooping alot of OnChainChimps and shilling on his Twitter.

▶️Actively interacting with games on TreasureDAO ecosystem.

▶️Been scooping alot of OnChainChimps and shilling on his Twitter.

https://twitter.com/1433683439023058950/status/1615362495631462400

▶️Farming ChickenBonds, GLP, ApeStaking and ETH on Lido.

▶️Minted alot of Sewer Passes.

▶️Alot of ETH trades.

▶️Minted alot of Sewer Passes.

▶️Alot of ETH trades.

▶️Has been farming on Canto and compounding since the early days.

▶️Main farms are Jpeg, Convex and of course on Canto.

▶️Recently entered clevCVX-CVX pool on Clever.

▶️Staking some MEOW on Gumball.

▶️Main farms are Jpeg, Convex and of course on Canto.

▶️Recently entered clevCVX-CVX pool on Clever.

▶️Staking some MEOW on Gumball.

That's a wrap! Hope you gain some insight, whale watching will help you find golden opportunities you might have never heard of.

If you enjoyed this thread:

RT the tweet below and follow @c4dotgg where I update news, launches and projects daily!

If you enjoyed this thread:

RT the tweet below and follow @c4dotgg where I update news, launches and projects daily!

https://twitter.com/CJCJCJCJ_/status/1616436535649345537

Also some taggerinos of big brains:

@crypthoem

@0xCrypto_doctor

@crypto_linn

@Chinchillah_

@Slappjakke

@DAdvisoor

@defi_mochi

@WinterSoldierxz

@rektdiomedes

@TheDeFinvestor

@eli5_defi

@VirtualKenji

@Subli_Defi

@LouisCooper_

@alpha_pls

@ThorHartvigsen

@DeFi_Cheetah

@crypthoem

@0xCrypto_doctor

@crypto_linn

@Chinchillah_

@Slappjakke

@DAdvisoor

@defi_mochi

@WinterSoldierxz

@rektdiomedes

@TheDeFinvestor

@eli5_defi

@VirtualKenji

@Subli_Defi

@LouisCooper_

@alpha_pls

@ThorHartvigsen

@DeFi_Cheetah

• • •

Missing some Tweet in this thread? You can try to

force a refresh