Cardano's Reward Sharing Scheme and CIP 50

Staking is the bedrock of #Cardano.

We are one of the most decentralized chain with 3000+ pools and 25+ MAV.

How do we improve decentralization and security? What's CIP - 50?

Let's dive into it

#CardanoCommunity

1/13

Staking is the bedrock of #Cardano.

We are one of the most decentralized chain with 3000+ pools and 25+ MAV.

How do we improve decentralization and security? What's CIP - 50?

Let's dive into it

#CardanoCommunity

1/13

Rewards Sharing Scheme:

Cardano rewards stakeholders for securing the protocol.

You can 'pool' resources, which a staking pool operator runs.

The rewards-sharing scheme aims to bring a state where the stake is decentralized and distributed to favorable honest actors.

2/13

Cardano rewards stakeholders for securing the protocol.

You can 'pool' resources, which a staking pool operator runs.

The rewards-sharing scheme aims to bring a state where the stake is decentralized and distributed to favorable honest actors.

2/13

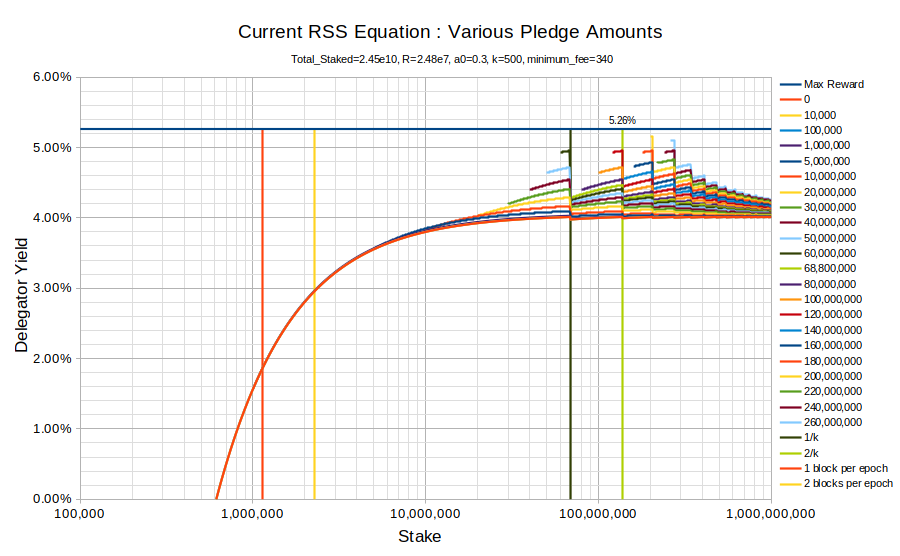

The current RSS puts a cap on max reward for a pool for decentralization and incentivizes operators (SPOs) to pledge their Ada.

As higher Pledged SPOs are more aligned with the system's welfare, pledge is preferable.

The system is stable and is out-performing its peers

3/13

As higher Pledged SPOs are more aligned with the system's welfare, pledge is preferable.

The system is stable and is out-performing its peers

3/13

Let's also understand the key parameters of the RSS:

Min Pool Fees: A fixed cost of 340 A directed to SPO from delegator rewards for every epoch with at least one block.

It disincentivize Sybil pools, i.e., creating small, no-pledge pools isn't a viable attack.

4/13

Min Pool Fees: A fixed cost of 340 A directed to SPO from delegator rewards for every epoch with at least one block.

It disincentivize Sybil pools, i.e., creating small, no-pledge pools isn't a viable attack.

4/13

Pledge Influence Factor (a0):

It incentivizes the SPO to put a stake in the system and to yield higher rewards for his delegators.

If a0 is increased, the importance of the pledge increases.

Curr a0 = 0.3

5/13

It incentivizes the SPO to put a stake in the system and to yield higher rewards for his delegators.

If a0 is increased, the importance of the pledge increases.

Curr a0 = 0.3

5/13

The problem:

Min Pool fee drops delegator's reward for small SPOs to <2% while bigger pools reward ~3.5% ROA.

This creates a disincentivize to stake with small pools

6/13

Min Pool fee drops delegator's reward for small SPOs to <2% while bigger pools reward ~3.5% ROA.

This creates a disincentivize to stake with small pools

6/13

The importance of Pledge isn't as pronounced below 10M stake and only marginal above that.

So no one pledges much and a0 is just marginally effective.

7/13

So no one pledges much and a0 is just marginally effective.

7/13

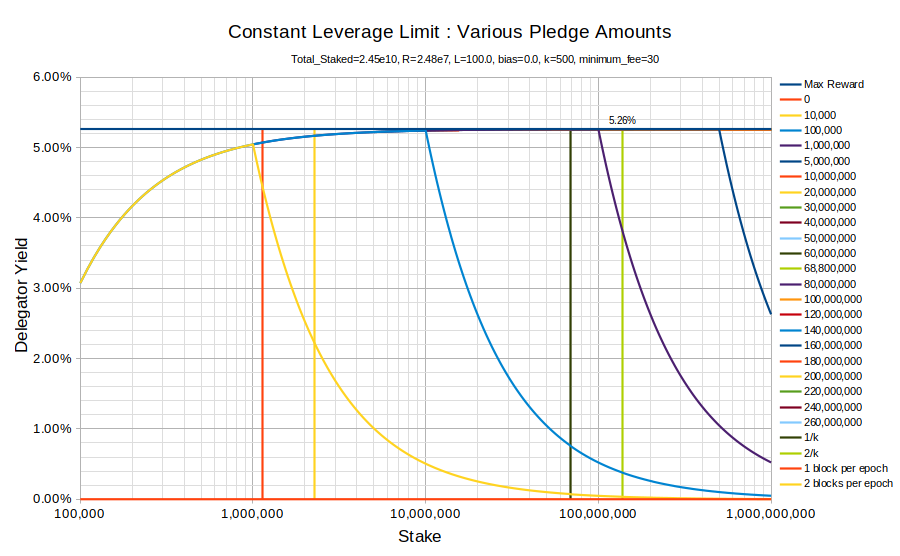

So what's CIP - 50?

It's one of the more popular CIPs working on this

It's a complete rehaul of Cardano RSS and is dubbed - RSS v2.0.

Introduces a new parameter, Leverage - L, that measures the stake-to-pledge ratio and replaces a0.

github.com/cardano-founda…

8/13

It's one of the more popular CIPs working on this

It's a complete rehaul of Cardano RSS and is dubbed - RSS v2.0.

Introduces a new parameter, Leverage - L, that measures the stake-to-pledge ratio and replaces a0.

github.com/cardano-founda…

8/13

L can range from 10,000 to 1.

L's value of 100 would require pools to pledge 1% of the delegated stake, and 1 would require all pools to be 100% pledged.

So at L=100, a pool with 5M Ada delegated would need to have a minimum of 50K Ada pledged.

9/13

L's value of 100 would require pools to pledge 1% of the delegated stake, and 1 would require all pools to be 100% pledged.

So at L=100, a pool with 5M Ada delegated would need to have a minimum of 50K Ada pledged.

9/13

This increases pledges' importance and incentivizes multi-pool operators to consolidate their stakes.

With the anti-Sybil mechanism through Pledge, we can reduce the min pool fees to <30 or 0.

This gives smaller pools a better fighting chance.

10/13

With the anti-Sybil mechanism through Pledge, we can reduce the min pool fees to <30 or 0.

This gives smaller pools a better fighting chance.

10/13

This change allows for a near-equal rewards rate for all Ada holders and removes the major variations due to choosing a different pool.

Along with CIP-50, wallets and explorers have to showcase pools based on their leverage, allowing the discovery of high-pledged pools.

11/13

Along with CIP-50, wallets and explorers have to showcase pools based on their leverage, allowing the discovery of high-pledged pools.

11/13

This can all help Cardano become further decentralized!

Note: CIP - 50 is a WIP and isn't formally verified yet.

- fin -

If you enjoyed reading this, follow us and support us in spreading the knowledge and wisdom of Cardano.

Follow @CardanoSpot for more such content!

12/13

Note: CIP - 50 is a WIP and isn't formally verified yet.

- fin -

If you enjoyed reading this, follow us and support us in spreading the knowledge and wisdom of Cardano.

Follow @CardanoSpot for more such content!

12/13

https://twitter.com/CardanoSpot/status/1616515753318187008

• • •

Missing some Tweet in this thread? You can try to

force a refresh