My sunday (finctional) story.

#SinatureBank #Binance #HydraMarketplace #Swift #DOJ

We all remember the big announcement DOJ did just few days ago. We all were expecting a huge result, also because CZ has teasered a big FUD against Binance will happen soon

#BTC #ETH #FSN #XRP

#SinatureBank #Binance #HydraMarketplace #Swift #DOJ

We all remember the big announcement DOJ did just few days ago. We all were expecting a huge result, also because CZ has teasered a big FUD against Binance will happen soon

#BTC #ETH #FSN #XRP

before. Something that could bring the crypto space in trouble. Instead they announced the arrest of someone nobody in the space knew before, Anatoly Legkodymov. The owner of Hydra Marketplace. Of what? Yes, right. Almost nobody knew him or his company before last tuesday night

before they arrested him in Miami.

The DOJ said about Hydra following:

“Bitzlato’s largest counterparty in cryptocurrency transactions was Hydra Market (Hydra), an anonymous, illicit online marketplace for narcotics, stolen financial information,

financemagnates.com/cryptocurrency…

The DOJ said about Hydra following:

“Bitzlato’s largest counterparty in cryptocurrency transactions was Hydra Market (Hydra), an anonymous, illicit online marketplace for narcotics, stolen financial information,

financemagnates.com/cryptocurrency…

fraudulent identification documents, and money laundering services that was the largest and longest running darknet market in the world,” the DOJ said.

Why that matters? Where is the FUD against Binance? Well, read between the lines.

"On Tuesday, Binance was named as one of

Why that matters? Where is the FUD against Binance? Well, read between the lines.

"On Tuesday, Binance was named as one of

the three largest counterparties for crypto exchange Bitzlato"

protos.com/the-deep-ties-…

That's a huge red flag. Why? Because of regulation. Binance has introduced the KYC process, where you need to confirm your identity to trade on this plattform. Usually compliance has an eye

protos.com/the-deep-ties-…

That's a huge red flag. Why? Because of regulation. Binance has introduced the KYC process, where you need to confirm your identity to trade on this plattform. Usually compliance has an eye

on transactions happening in their network (banks like CEX) and need to report those to the "authorities". In case DOJ can proof that Binance didn't monitore those transactions or didn't report them, that's a huge red flag and big finding, because their KYC doesn't work.

It seems not only Binance was involved, so the bad news related to SWIFT could be related to that issue here. It's the only way to close the way of money launderers using crypto to convert their money in legal fiat.

What is KYC? Check Binance informations about that.

What is KYC? Check Binance informations about that.

binance.com/en/blog/ecosys…

In case I'm right here, the DOJ can put Binance and other CEX under general suspicion. That's very bad.

I was reading that Signature Bank is a bank focused on the crypto industry and operating $350B in Swift transactions per Quarter! I need to verify

In case I'm right here, the DOJ can put Binance and other CEX under general suspicion. That's very bad.

I was reading that Signature Bank is a bank focused on the crypto industry and operating $350B in Swift transactions per Quarter! I need to verify

that number yet. We also know that not many banks out there want to deal with crypto exchanges and to operate such volume, a big bank would be required!

Binance announced to find alternatives. Sorry folks to say that, nothing is impossible, but the chance is really small if not

Binance announced to find alternatives. Sorry folks to say that, nothing is impossible, but the chance is really small if not

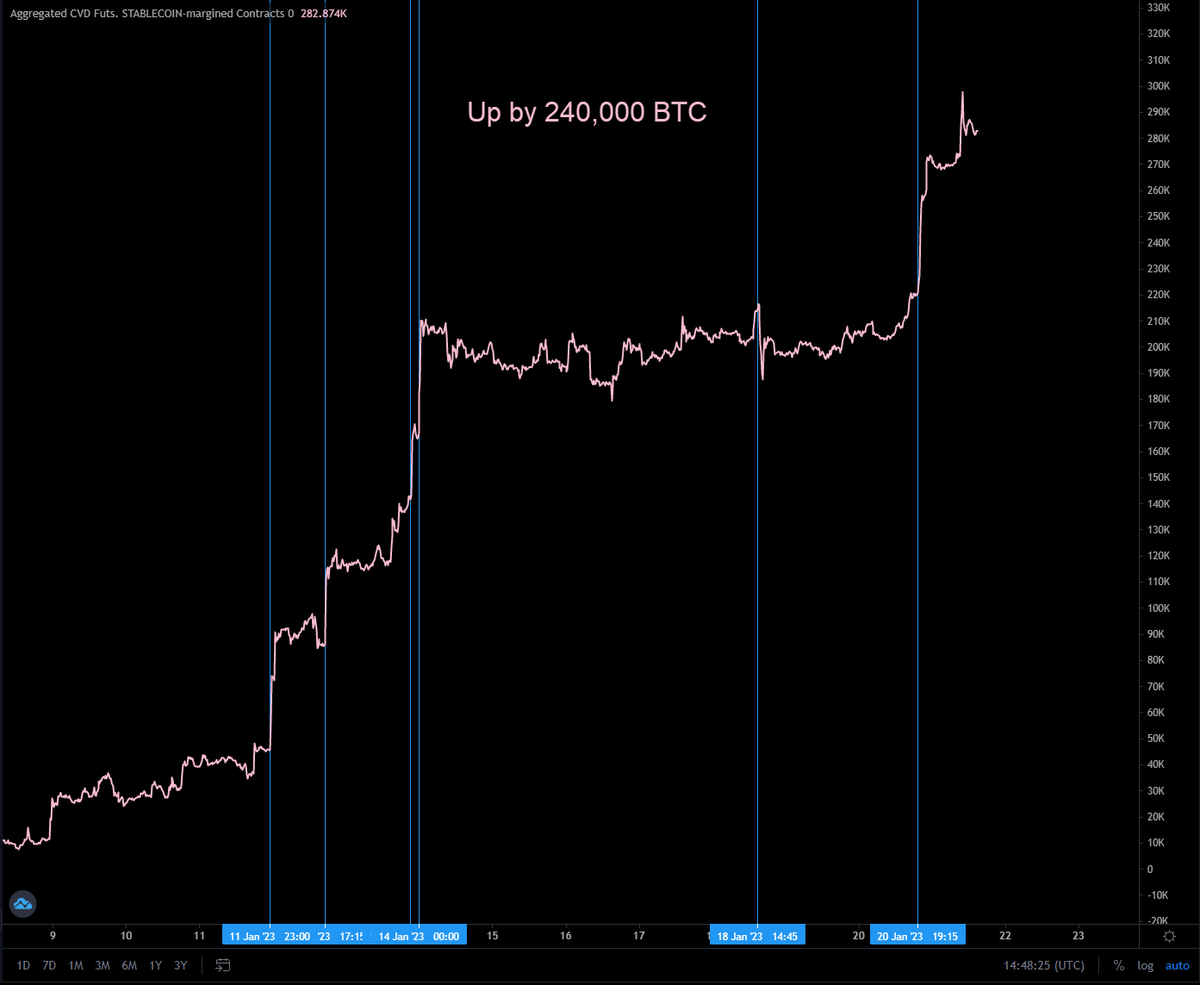

even tiny. Was that the main motivator of our current rally? Front running the news? It wouldn't surprise me at all. We know that BUSD was playing here a bigger role. But who knows.

Btw why a limit of $100k? Also money launderers use different ways to complete their operations.

Btw why a limit of $100k? Also money launderers use different ways to complete their operations.

Big amounts would alarm the tax agency anyway. So algo trading, tiny amounts, convert in fiat and use swift to send their money to different bank accounts in different countries. Many banks lock your account when they notice transactions related to crypto.

Like it happened to me last year with my Visa card. One call and everything was fine. But money laudering and crypto is unfortunately a well known topic in the compliance departments of every bank. Smal amounts are hard to detect. Takes time and man power. Something banks

don't want to spend. My 50 Cents.

• • •

Missing some Tweet in this thread? You can try to

force a refresh