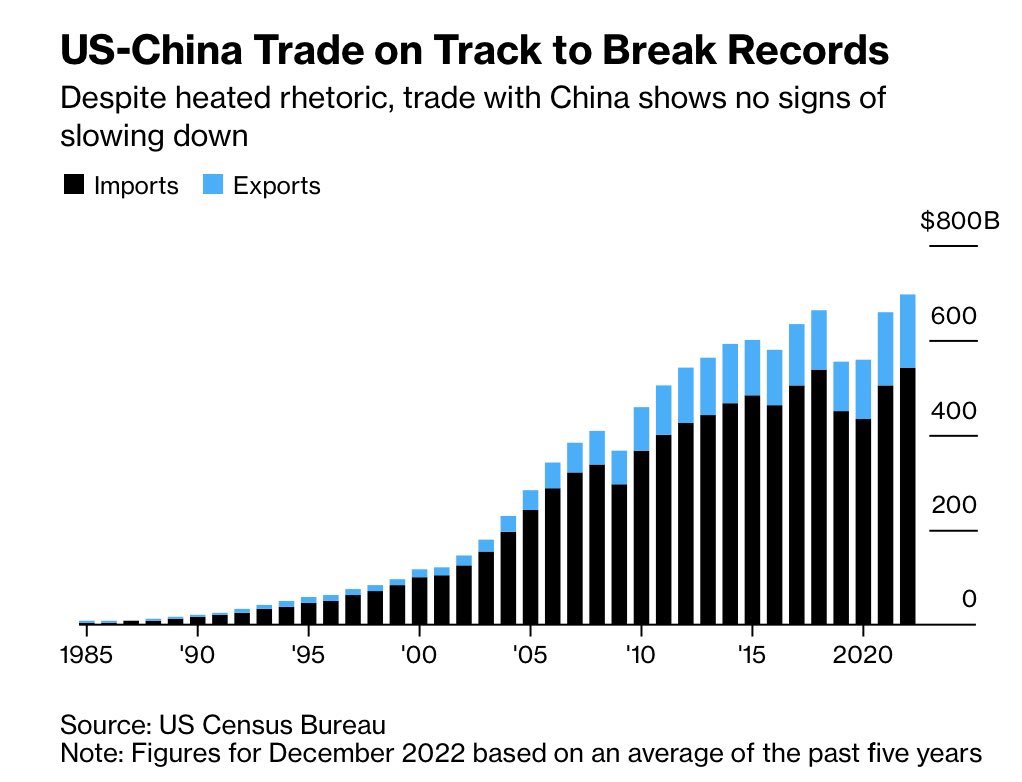

#Modinomics and #NewIndia #Intellectuals keep harping that US is against China along with all that Rhetoric but then the DATA says otherwise…

Meanwhile...

https://twitter.com/TheFactFindr/status/1622656781548912640?s=20&t=0NUZoNzHLobKTDAcsAUhQQ

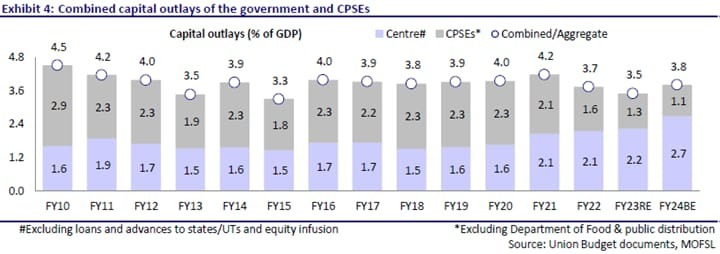

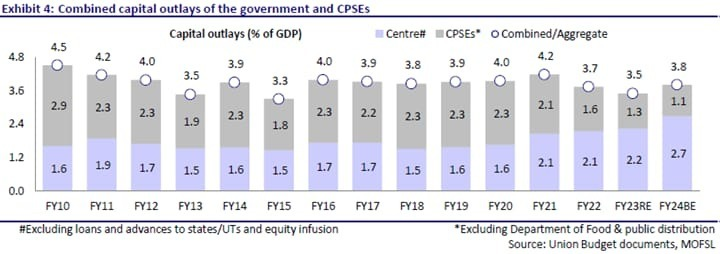

And See how that flows into Earnings

https://twitter.com/TheFactFindr/status/1622657039196622849?s=20&t=0NUZoNzHLobKTDAcsAUhQQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh