#SHOCKER !!

#Budget2023 #CAPEX growth of 30% Year over Year is just a game of #Smoke & #Mirrors (the hallmark of #Modinomics) .... if you recall, I mentioned that "Devil Lies in the Detail"

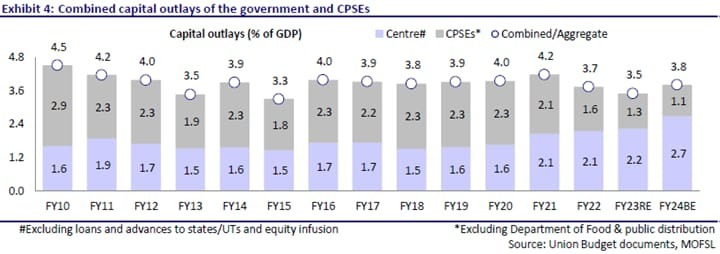

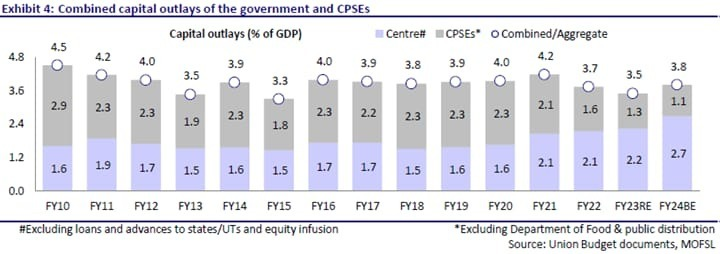

Entire Story in 1 Chart. Combines Central Govt & PSU Capex excluding dirty tricks.

#Budget2023 #CAPEX growth of 30% Year over Year is just a game of #Smoke & #Mirrors (the hallmark of #Modinomics) .... if you recall, I mentioned that "Devil Lies in the Detail"

Entire Story in 1 Chart. Combines Central Govt & PSU Capex excluding dirty tricks.

@nsitharaman budget numbers for CAPEX includes items below

1) 50yr Loans to the States (much of this is consumption by state & double counted)

2) Loans to Food Corp India (Rations & MSP)

3) Capital Infusion is Loss making PSUs to pay Salaries & O/p Losses (BSNL, Air India)

1) 50yr Loans to the States (much of this is consumption by state & double counted)

2) Loans to Food Corp India (Rations & MSP)

3) Capital Infusion is Loss making PSUs to pay Salaries & O/p Losses (BSNL, Air India)

These 3 items are NOT Capex .... so when does an Apples to Apples comparison, these adjustments needs to be made...

In short Central Govt & Off-balance sheet or PSU Capex is ONLY 3.8% of GDP (Lower than pre-covid) vs say 4.5% of GDP in FY10

In short Central Govt & Off-balance sheet or PSU Capex is ONLY 3.8% of GDP (Lower than pre-covid) vs say 4.5% of GDP in FY10

I wrote a THREAD on this concept earlier. See this THREAD

https://twitter.com/TheFactFindr/status/1622528430230364160

And I explained why LISTED companies might be witnessing strong Order Inflows even while INDUSTRY wide orders have STAGANTED in a while, See this THREAD

https://twitter.com/TheFactFindr/status/1617501233329352705

#NewIndia Intellectuals will argue that one should look at Absolute level of capex.

NOT correct since one needs to take into consideration higher per capita requirement & INFLATION.

Hence Every economic parameter is expressed as % of GDP (eg. GDP Growth, CAD, Fiscal Deficit)

NOT correct since one needs to take into consideration higher per capita requirement & INFLATION.

Hence Every economic parameter is expressed as % of GDP (eg. GDP Growth, CAD, Fiscal Deficit)

#NewIndia Intellectuals will argue that one should look at Off-balance sheet spending by the previous government.

ANS: This is precisely why this exercise considers EBR (Extra Budgetary Resources) by the PSUs. Eg, Railways/NHAI borrowing for Capex.

#MODINOMICS #SmokeAndMirrors

ANS: This is precisely why this exercise considers EBR (Extra Budgetary Resources) by the PSUs. Eg, Railways/NHAI borrowing for Capex.

#MODINOMICS #SmokeAndMirrors

ONE more thing... We all know that the Govt Tax Growth has been stellar with Raising GST rates, introducing 40% New Products into GST & removing the "Deductions" in your Income Tax or Introducing Tax on EPFO interest, Interest from Debentures, Dividend Tax... #MODINOMICS

As a consequence, our TAX/GDP ratio is at a LIFE-TIME HIGH... if our GDP has grown 50% in Nominal Terms, our TAX has growth has been 100% figuratively speaking

QUESTION: if Govt Capex/GDP is lower than Pre-2014, So where the RECORD Tax/GDP going ?

#MODINOMICS #SmokeAndMirrors

QUESTION: if Govt Capex/GDP is lower than Pre-2014, So where the RECORD Tax/GDP going ?

#MODINOMICS #SmokeAndMirrors

• • •

Missing some Tweet in this thread? You can try to

force a refresh