Oilytics Weekly Chart of the Day recap: Week 6

With Russia’s invasion of Ukraine coming close to 1 year anniversary at the end of this month, the diesel market has mean reverted to levels seen this time last year. Diesel cracks remain $10+ from the seasonal range. (1/5)

Asian refinery runs of the 4 main countries (China + India + Japan + Korea) surged above 25MMBD only for the 3rd time ever. The December runs came in at 25.07MMBD (+0.4MMBD y/y) and just 0.1MMBD shy of the record high seen in Nov 2021. (2/5)

Aggregate Open Interest continues to surge in the new year. Especially for Nymex WTI which is now at the highest level since June 2022. Similarly, for Brent but they remain ~20% lower than the 2021 peak. In products, ICE Gasoil OI is hitting the highest OI since March 2022. (3/5)

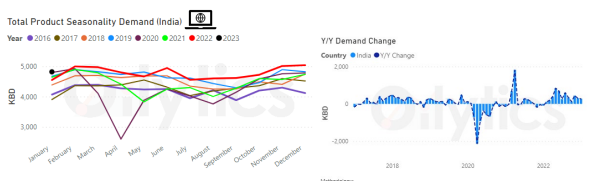

India was the first country to report its 2023 demand numbers. Even though total January demand saw a m/m dip from the record high in December, it remains 6% higher y/y. Road fuels such as Diesel and Gasoline, they are up by 13-14% y/y (4/5)

Global oil and gas prices have converged to its narrowest level since August 2021. If we look at European Gas/LNG/Oil/Diesel, they are now in the range of $85-$110, with crude being the cheapest and diesel the most expensive (5/5)

• • •

Missing some Tweet in this thread? You can try to

force a refresh