📢 It’s going to get incredibly easy for dApps to start launching their chains with the rollout of @cosmos ’ ICS & @terra_money ’s Interchain Alliance.

But will #LUNA surpass #ATOM as the main hub, with feather and alliance?

Let’s find out! ⬇️

But will #LUNA surpass #ATOM as the main hub, with feather and alliance?

Let’s find out! ⬇️

@cosmos @terra_money 1/ Alliance

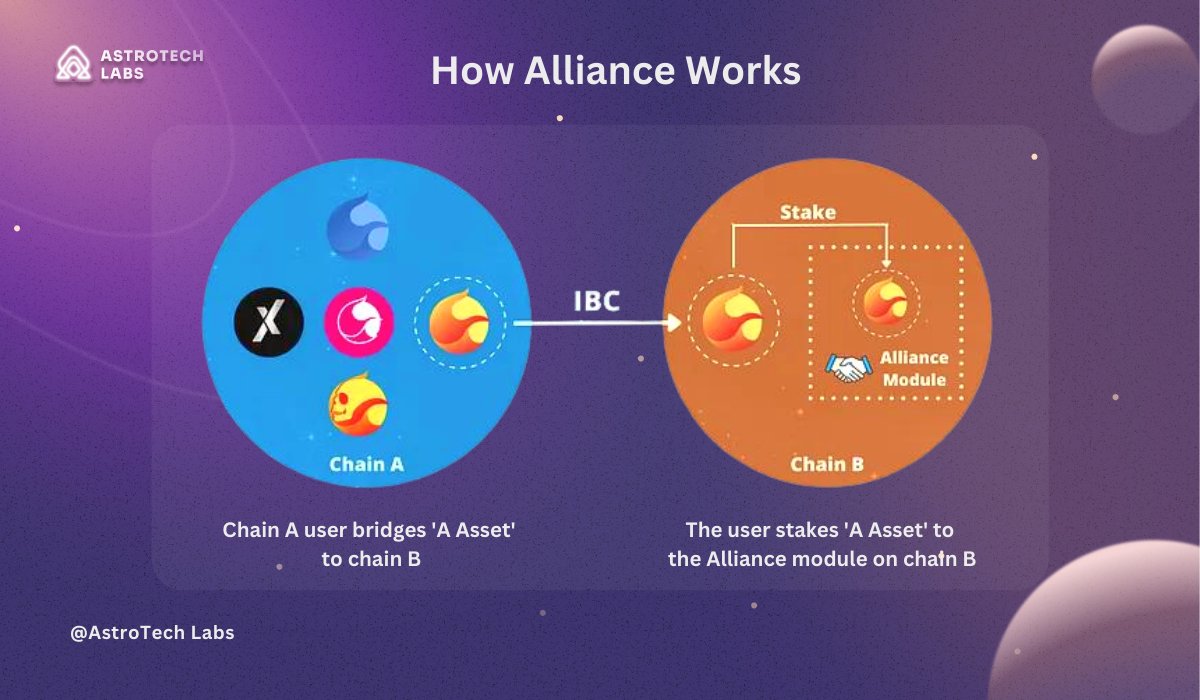

🤝 It is an open-source @cosmos SDK module, that aims to boost economic activity across #Cosmos chains by leveraging interchain staking to form economic alliances and foster innovation, user adoption, and cross-chain collaboration.

🤝 It is an open-source @cosmos SDK module, that aims to boost economic activity across #Cosmos chains by leveraging interchain staking to form economic alliances and foster innovation, user adoption, and cross-chain collaboration.

@cosmos @terra_money 2/ Cont.

An economic alliance can be formed by staking the asset of a larger chain, such as #LUNA, on a smaller chain like White Whale. This results in increased staking rewards for users of the larger chain and a boost in users and activity for the smaller chain.

An economic alliance can be formed by staking the asset of a larger chain, such as #LUNA, on a smaller chain like White Whale. This results in increased staking rewards for users of the larger chain and a boost in users and activity for the smaller chain.

@cosmos @terra_money 3/ Feather

🪶 Feather offers a solution for launching customized blockchains with seamless plug-and-play simplicity. By leveraging the alliance module, Feather chains would be secured by #LUNA.

🪶 Feather offers a solution for launching customized blockchains with seamless plug-and-play simplicity. By leveraging the alliance module, Feather chains would be secured by #LUNA.

@cosmos @terra_money 4/ Cont.

🎯 Feather aims to simplify the complicated and resource-intensive process of launching an L1 #Blockchain to the level of deploying a smart contract.

It would serve as a replacement for @cosmos ' ICS.

🎯 Feather aims to simplify the complicated and resource-intensive process of launching an L1 #Blockchain to the level of deploying a smart contract.

It would serve as a replacement for @cosmos ' ICS.

@cosmos @terra_money 5/ Feather's assistance to developers:

• Enabling devs to launch chains using simple deployment script and client.

• Validators across ecosystem can keep an eye on newly launched chains & spin up nodes to support them.

• New chain is automatically supported by ecosystem tools

• Enabling devs to launch chains using simple deployment script and client.

• Validators across ecosystem can keep an eye on newly launched chains & spin up nodes to support them.

• New chain is automatically supported by ecosystem tools

@cosmos @terra_money 6/ Station Wallet and Finder

💰 By adding support for all @cosmos chains and adding ICA functionality, these tools viz., @terra_money station wallet and finder can be adopted by new chains, which also benefit from a large user base.

💰 By adding support for all @cosmos chains and adding ICA functionality, these tools viz., @terra_money station wallet and finder can be adopted by new chains, which also benefit from a large user base.

@cosmos @terra_money 7/ By integrating Feather, Alliance, and Station Wallet, developers will find it much easier to set up their #Blockchain and specify their own rules, assisting in giving the following resolution:

@cosmos @terra_money 8/ Cont.

✅Lowering the cost of bootstrapping security for New L1s.

✅Lowering the cost of development.

✅User & liquidity fragmentation.

✅Diversifying staking yield across the @cosmos

✅Lowering the cost of bootstrapping security for New L1s.

✅Lowering the cost of development.

✅User & liquidity fragmentation.

✅Diversifying staking yield across the @cosmos

@cosmos @terra_money 9/ Challenge

⚠️ Receiving support from the @cosmos community could be challenging due to the losses suffered by investors during the #Lunacrash followed by the #SEC lawsuit. Restoring trust in the community may prove to be a difficult task.

⚠️ Receiving support from the @cosmos community could be challenging due to the losses suffered by investors during the #Lunacrash followed by the #SEC lawsuit. Restoring trust in the community may prove to be a difficult task.

@cosmos @terra_money 10/ Conclusion

💡 The Interchain Alliance has a promising future ahead with plans to expand and support key ecosystems, opening up endless possibilities.

However, it remains to be seen whether it can effectively work alongside #Cosmos ’ ICS and #Osmosis ' Mesh Security.

💡 The Interchain Alliance has a promising future ahead with plans to expand and support key ecosystems, opening up endless possibilities.

However, it remains to be seen whether it can effectively work alongside #Cosmos ’ ICS and #Osmosis ' Mesh Security.

• • •

Missing some Tweet in this thread? You can try to

force a refresh