1) ⚠️ FA CLASSES PART 3 HOMEWORK REVIEW⚠️

You were given the assignment to review 2 projects based on ''market cap'' only.

• $FRM

• $AXS

Here's my review on how I work to make a project pass our ''FA analysis'' 🧵 👇

You were given the assignment to review 2 projects based on ''market cap'' only.

• $FRM

• $AXS

Here's my review on how I work to make a project pass our ''FA analysis'' 🧵 👇

https://twitter.com/CryptoGirlNova/status/1628095970545373185

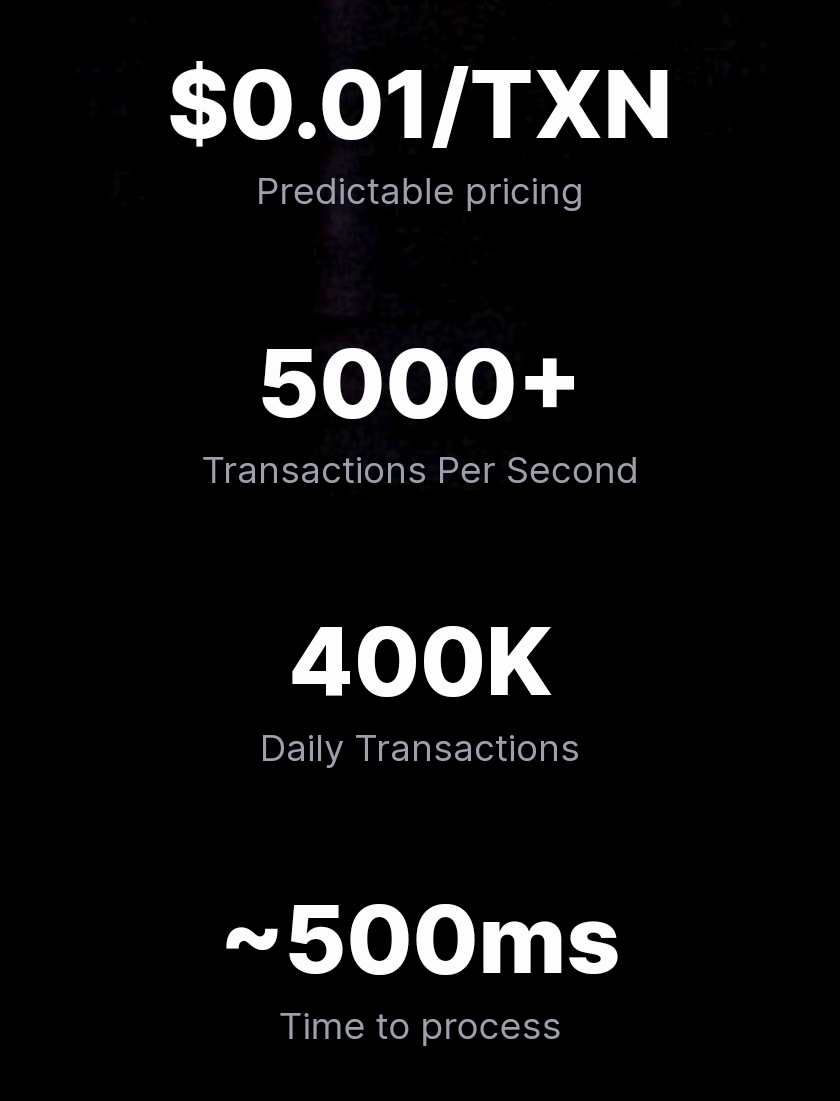

2) $FRM

#Ferrum currently has a market cap of 5.6 million dollars and a fully diluted valuation of 16.1 million dollars.

This means around 35% of the supply is currently in circulation.

#Ferrum currently has a market cap of 5.6 million dollars and a fully diluted valuation of 16.1 million dollars.

This means around 35% of the supply is currently in circulation.

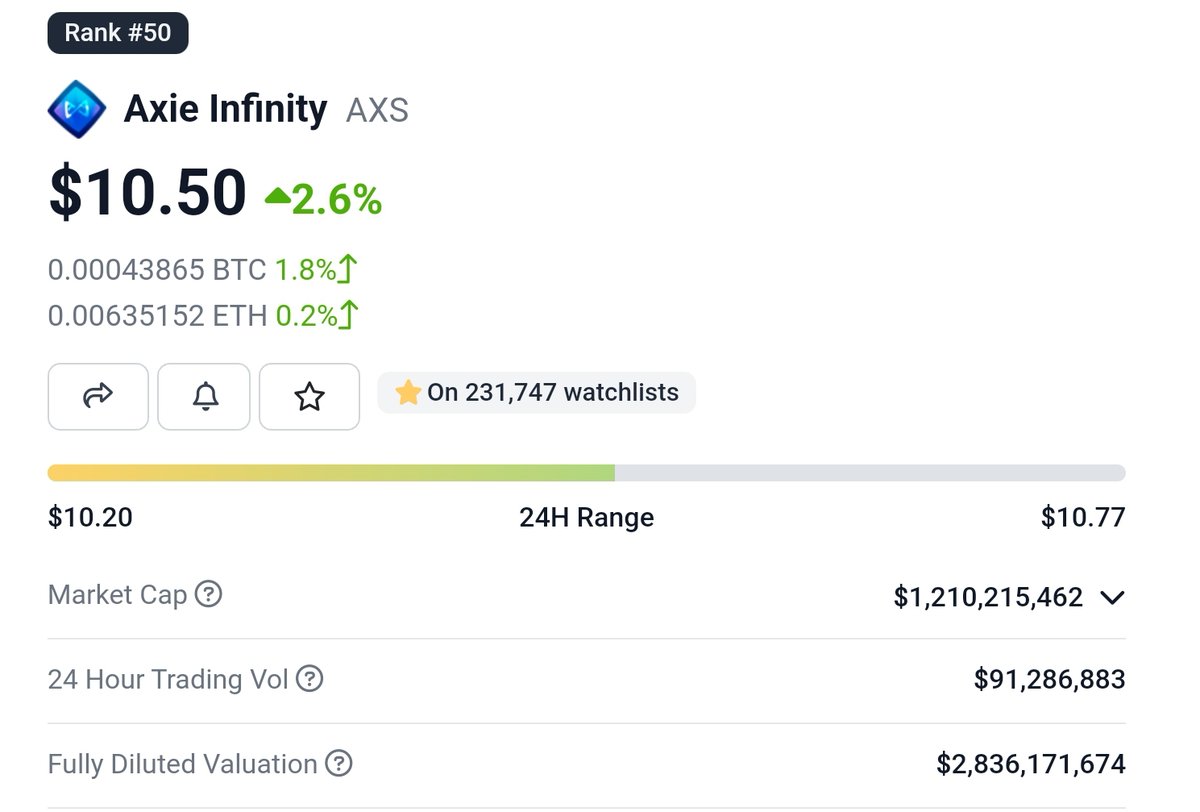

3) $AXS

#Axie currently has a market cap of 1.2 billion dollars and a fully diluted valuation of 2.8 billion dollars.

This means around 43% of the supply is currently in circulation.

#Axie currently has a market cap of 1.2 billion dollars and a fully diluted valuation of 2.8 billion dollars.

This means around 43% of the supply is currently in circulation.

4) We have 2 things to consider:

• The market cap valuation.

• The fully diluted valuation.

$FRM only has a market cap of 5.6 million while $AXS has a market cap of 1.2 billion.

$FRM has a slightly lower circulating supply ratio than #$AXS.

• The market cap valuation.

• The fully diluted valuation.

$FRM only has a market cap of 5.6 million while $AXS has a market cap of 1.2 billion.

$FRM has a slightly lower circulating supply ratio than #$AXS.

5) Even when we take the full release of all tokens into account however, $FRM still only has a 16m market cap.

When we take the full release of all tokens into account, $AXS has a market cap of 2.8 billion.

When we take the full release of all tokens into account, $AXS has a market cap of 2.8 billion.

6) Lower or higher valuations on its own doesn't say a lot.

They only mean anything if you put the scope and target audience of the project into account.

They only mean anything if you put the scope and target audience of the project into account.

7) $FRM is an interoperability project looking to connect blockchains.

Experience has taught us that their valuation is criminally undervalued to its potential.

$AXS is a play to earn game.

Although it's a really popular one, in the end it's still a really basic looking game.

Experience has taught us that their valuation is criminally undervalued to its potential.

$AXS is a play to earn game.

Although it's a really popular one, in the end it's still a really basic looking game.

8) While we can debate on its future potential or not it's hard to argue the potential return on investment of a game with a 2.8 billion being larger than an interoperability focused protocol with just 16m.

Looking at the fully diluted value that is.

⏩ $FRM has my vote here.

Looking at the fully diluted value that is.

⏩ $FRM has my vote here.

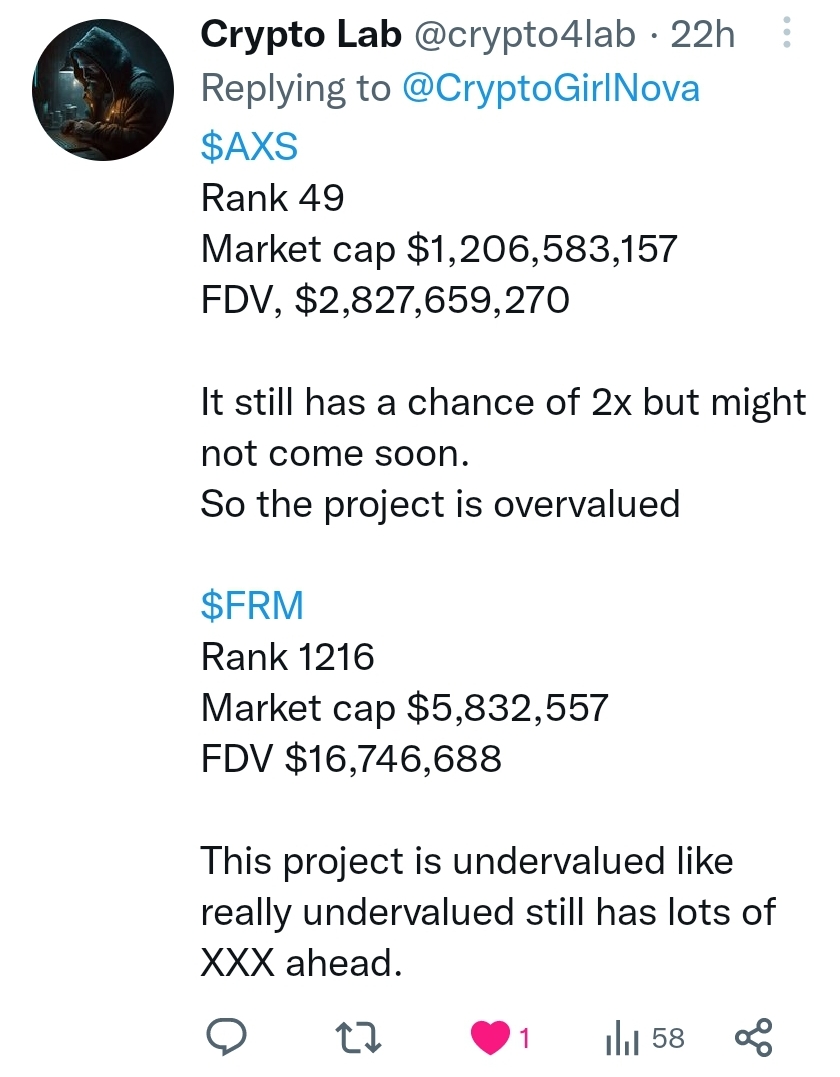

9) Shoutout for taking the effort and posting your findings:

@crypto4lab

@WhoCares2203

@Thelolagirl_

@Dinnchi7

There are others who have posted excellent results but I like to rotate shoutouts every week.

(can only post 4 images in a tweet).

@crypto4lab

@WhoCares2203

@Thelolagirl_

@Dinnchi7

There are others who have posted excellent results but I like to rotate shoutouts every week.

(can only post 4 images in a tweet).

10) If you like these classes make sure to put on your notifications for the next upcoming ''FA SERIES''.

Know-how and analysis on tokenomics is next.

Stay tuned ⏰

Nova out 💟

Know-how and analysis on tokenomics is next.

Stay tuned ⏰

Nova out 💟

• • •

Missing some Tweet in this thread? You can try to

force a refresh