As #silver sentiment collapses again and the equities have been left for dead, let's look at the big picture.

#silver is a supply deficit play. 3 things to know:

1) 73% of mined silver is a byproduct of copper/zinc/lead/gold. CapEx is declining in 2023. /1

#silver is a supply deficit play. 3 things to know:

1) 73% of mined silver is a byproduct of copper/zinc/lead/gold. CapEx is declining in 2023. /1

In other words, the companies producing silver don't care about silver. There won't be a supply response to higher silver demand.

Also, there are very few primary silver miners as AISC is about $20 and high-quality deposits are very rare. /2

Also, there are very few primary silver miners as AISC is about $20 and high-quality deposits are very rare. /2

As a result, silver supply peaked in 2016, driven by the 2010-2013 metals CapEx binge.

(Data from SilverInsititute) /3

(Data from SilverInsititute) /3

Peru isn't exactly stable. Production was down 7.6% in 2022 and we've seen quite a few operational suspensions in 2023. Rather than walk through all of them here, read this: /5

https://twitter.com/PauloMacro/status/1621012147919794177?s=20

3) Industrial demand is growing quickly and has secular tailwinds (cough cough gov stimmies) .

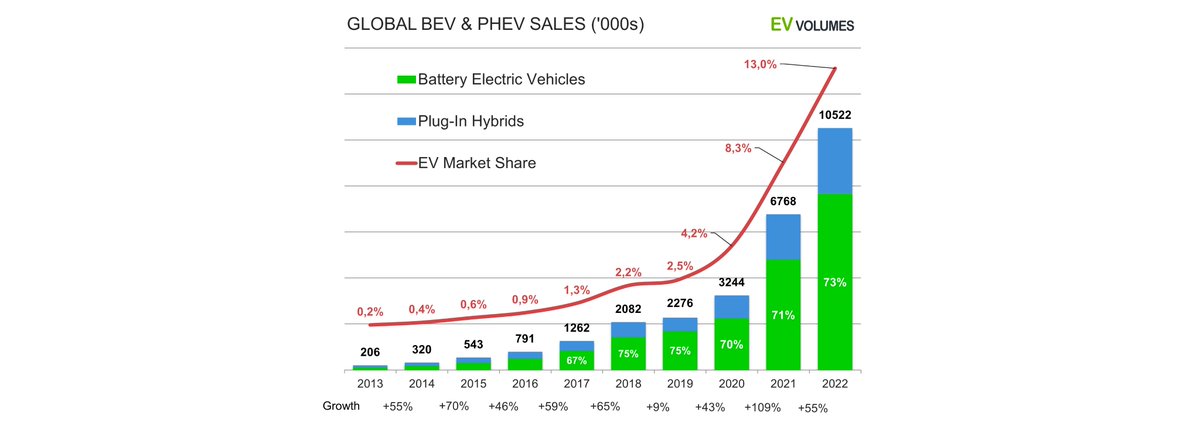

EVs use about 1.5 oz/car (avg .8 oz for ICE). The growth rate is insane. (ev-volumes.com) /6

EVs use about 1.5 oz/car (avg .8 oz for ICE). The growth rate is insane. (ev-volumes.com) /6

Solar is also growing like crazy and many in the space indicate we've reached the limit of thrifting (using less ag/panel) and that the new tech in China actually uses more silver. /7

nrel.gov/docs/fy23osti/…

nrel.gov/docs/fy23osti/…

And so many more. EV chargers? Phones? TVs? 5G? Silver.

Summary: Industrial demand has secular tailwinds and supply doesn't have an effective supply response.

While the DXY and interest rates may cause speculators to dump some contracts, they are sideshows. /8

Summary: Industrial demand has secular tailwinds and supply doesn't have an effective supply response.

While the DXY and interest rates may cause speculators to dump some contracts, they are sideshows. /8

Sure, there's a monetary call options here. But the real thesis here is supply deficit driven, IMO.

I think there's a heck of an opportunity setting up again, just as there was in August. /9

I think there's a heck of an opportunity setting up again, just as there was in August. /9

https://twitter.com/aschmidt2930/status/1568615521368608776?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh