[1/🧵] Beautifully crafted thread. 👍

Even though I mostly agree with everything expressed, there are some mistakes made based on terminology starting with the word "token".

A thread (🧵) about my opinions, which are hopefully more uplifting. 👇

Even though I mostly agree with everything expressed, there are some mistakes made based on terminology starting with the word "token".

A thread (🧵) about my opinions, which are hopefully more uplifting. 👇

https://twitter.com/rippleitinNZ/status/1631880913587159042

[2/10] Let's start with a definition of "token" and see if we can locate a suitable statement in the #web.

What is a token ❓

❝ A crypto token is a representation of an asset or interest that has been tokenized on an existing cryptocurrency's blockchain. ❞

What is a token ❓

❝ A crypto token is a representation of an asset or interest that has been tokenized on an existing cryptocurrency's blockchain. ❞

[3/10] Even if the distinctions are small, claiming that #XRP is a token is strictly incorrect since #XRP cannot be a token.

Because #XRP has no issuer, it cannot exist as a tokenized representation of anything.

Because #XRP has no issuer, it cannot exist as a tokenized representation of anything.

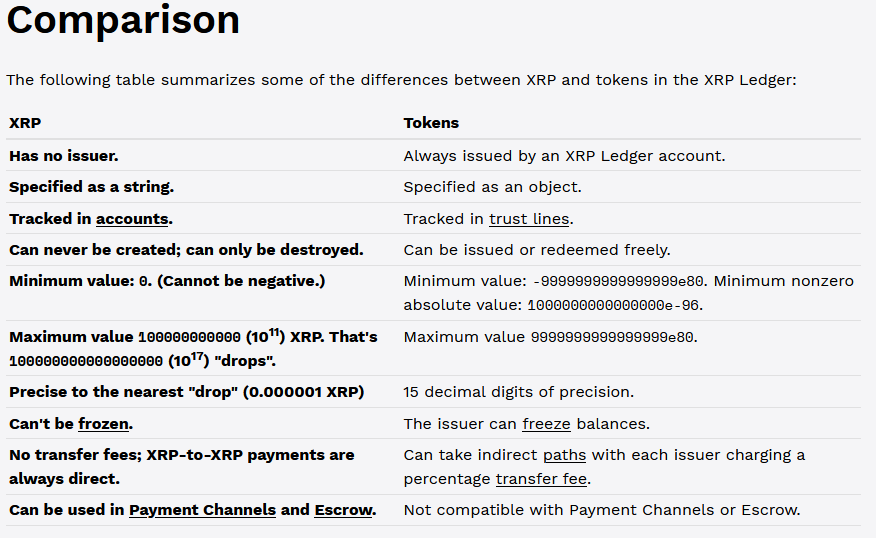

[4/10] The differences on #XRPL are far more fundamental than on other #blockchains.

Have a peek at this comparison chart for a high-level overview:

Have a peek at this comparison chart for a high-level overview:

[5/10] Let's go over the past postings and begin with this statement:

▶️ Escrow and Payment Channels are exclusive to #XRP, the native cryptocurrency, as long as the Amendment for #XLS34d has not passed.

▶️ Escrow and Payment Channels are exclusive to #XRP, the native cryptocurrency, as long as the Amendment for #XLS34d has not passed.

https://twitter.com/rippleitinNZ/status/1631880918314131458?s=20

[6/10] According to the docs, #XRP is the currency used to auto-bridge between illiquid trade pairings & to deepen #liquidity for tokens on the #DEX

I must acknowledge, though, that I could locate no source stating that XRP must be used exclusively there.

I must acknowledge, though, that I could locate no source stating that XRP must be used exclusively there.

https://twitter.com/rippleitinNZ/status/1631880920625209344?s=20

[7/10] #Pathfinding may, in principle, be utilized to avoid the auto-bridge function, but only with liquid pairings.

. . .

. . .

[8/10] . . .

Because #XRP is the ledger's native currency, the #XRPL will always pick the most direct and liquid "route," which is a straight #XRP-to-#XRP payment that does not require any paths, minimizing complexity and processes for leveraging #liquidity.

Because #XRP is the ledger's native currency, the #XRPL will always pick the most direct and liquid "route," which is a straight #XRP-to-#XRP payment that does not require any paths, minimizing complexity and processes for leveraging #liquidity.

[9/10] One last distinction between #XRP & a token is that no one can prevent me from sending you XRP by default, whereas transferring me tokens is impossible without first establishing a #trustline.

Because of this, XRP is more "free" and superior than any other token on #XRPL

Because of this, XRP is more "free" and superior than any other token on #XRPL

[10/10] That was fun! 😇

I have nothing further to say because his 🧵 speaks for itself ❤️

You must act if you want the price of #XRP to rise and ...

... ❝ build projects that use XRP natively, support those projects and add value! ❞ — @rippleitinNZ

I have nothing further to say because his 🧵 speaks for itself ❤️

You must act if you want the price of #XRP to rise and ...

... ❝ build projects that use XRP natively, support those projects and add value! ❞ — @rippleitinNZ

https://twitter.com/rippleitinNZ/status/1631880939453431808?s=20

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh