While it's CEO is busy gaslighting #Celsius creditors, a reminder of what BTTF is:

WTF is a BNK TO THE FUTURE, a bAnk with no A in its name?

Here's the crash course:

WTF is a BNK TO THE FUTURE, a bAnk with no A in its name?

Here's the crash course:

Apparently he's going around suggesting that BTTF is choicer than Wulfy. He was saying something about available liquidity, and he's been busy making fun of the #HASH token.

So it sounds like he's saying that BTTF and its mighty BFT token, are a better choice.

So it sounds like he's saying that BTTF and its mighty BFT token, are a better choice.

OK since we will never see a real financial statement from BTTF, because they don't exist, k, that's why he can not show us one.

A real audit might include:

• Brief overview

• Headquarter/Geographical Presence

• Revenue (Global/Regional/Country level)

A real audit might include:

• Brief overview

• Headquarter/Geographical Presence

• Revenue (Global/Regional/Country level)

• Employees

• Market share analysis

• Product/service portfolio

• SWOT analysis

• Production locations and capacity

• Average Selling Price (ASP) of product or services

• Key News (Mergers and Acquisitions, New product launches, Geographical expansion, etc.)

Yeah, right.

• Market share analysis

• Product/service portfolio

• SWOT analysis

• Production locations and capacity

• Average Selling Price (ASP) of product or services

• Key News (Mergers and Acquisitions, New product launches, Geographical expansion, etc.)

Yeah, right.

"BnkToTheFuture is a Cayman Island-based equity crowdfunding platform that allows investors and individuals to invest in financial and technology deals."

owler.com/company/bnktot…

owler.com/company/bnktot…

"Bnk To The Future is the longest standing company in Bitcoin and the world's first regulated crypto securities business"

ky.linkedin.com/company/bnktot…

ky.linkedin.com/company/bnktot…

"Bnk To The Future is the longest standing insolvent company in Bitcoin and the world's first Dixon regulated crypto securities business"

Fantastic plastic, let's have a look at what the Teaboy will provide you with, when, he has your claim.

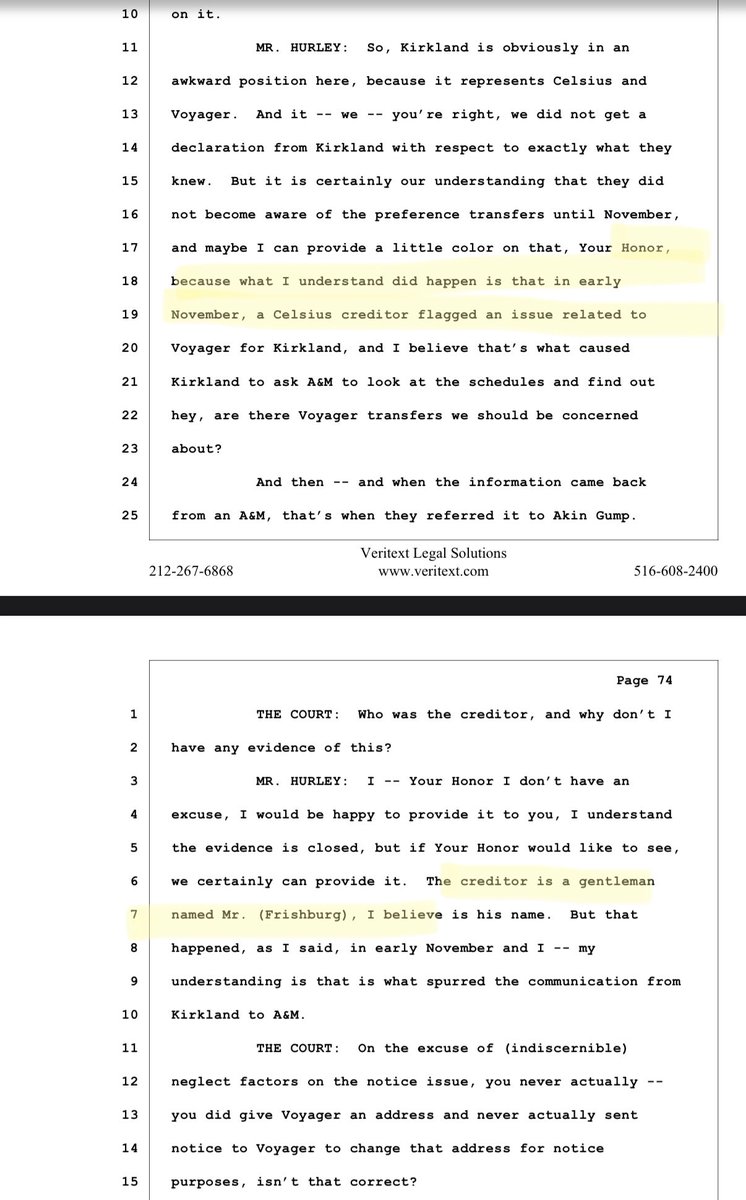

Fiduciary duties?! Bah! Humbug! What's Due Diligence he says, 9 months in the DATA room, and he only saw CRIME after the fact! Trust!

Told his BTTF victims it's A, OK, gang!

Fiduciary duties?! Bah! Humbug! What's Due Diligence he says, 9 months in the DATA room, and he only saw CRIME after the fact! Trust!

Told his BTTF victims it's A, OK, gang!

Months after the fact, he's crying over 289 #BTC he's accusing Alex of stealing. The dude did not know they were gone to begin with, but he knows who took them.

Remembers to take out a loan in the middle of a bank run, but he forgot about his $8m collateral.

Fricking genius.

Remembers to take out a loan in the middle of a bank run, but he forgot about his $8m collateral.

Fricking genius.

K, just need a quick pacifier, cause some really big ass numbers are coming up...

So anyway, here's the Galactic-sized funding market that's flying past BTTFs window at the speed of light, roughly the same speed as your investments with BTTF are devaluing, as they bleed out in fees.

Growth is acccceeeeleeerraaatttiiinnngggggg

Is it a bird!? Is it a plane?! NO! It's the market leaving BTTF behind!!!!

zooooooooommmmmmmm

and

whooooosssssssssssssssssss

Is it a bird!? Is it a plane?! NO! It's the market leaving BTTF behind!!!!

zooooooooommmmmmmm

and

whooooosssssssssssssssssss

Yahoo Finance forecasts that the crowdfunding market size will increase by USD 264.09 billion wing-wangs

yahoo.com/now/crowdfundi…

yahoo.com/now/crowdfundi…

k, k so where is the Legendary Cayman Islands Teaboy Guild with their Juggernaut BTTF?

Latest stats listing the 15 biggest crackers in the market, real go getter companies kicking ass, and taking plenty of names, for their mailing list and stuffs.

Latest stats listing the 15 biggest crackers in the market, real go getter companies kicking ass, and taking plenty of names, for their mailing list and stuffs.

Cause that's what real working profitable legit, companies do, they build their communities, brick by brick.

1. Chuffed-org Pty Ltd.

2. CircleUp Network Inc.

3. ConnectionPoint Systems Inc.

4. Crowdcube Ltd.

5. Crowdfunder Inc.

6. DonorsChoose

1. Chuffed-org Pty Ltd.

2. CircleUp Network Inc.

3. ConnectionPoint Systems Inc.

4. Crowdcube Ltd.

5. Crowdfunder Inc.

6. DonorsChoose

7. Fundable LLC

8. GGF Global Ltd.

9. GoFundMe Inc.

10. Indiegogo Inc.

11. Ioby Inc.

12. Ketto Online Ventures Pvt. Ltd.

13. Kickstarter PBC

14. Kiva Microfunds

15. Patreon Inc.

Wait, what? Where's the first to be found?

8. GGF Global Ltd.

9. GoFundMe Inc.

10. Indiegogo Inc.

11. Ioby Inc.

12. Ketto Online Ventures Pvt. Ltd.

13. Kickstarter PBC

14. Kiva Microfunds

15. Patreon Inc.

Wait, what? Where's the first to be found?

BTTF don't exist, they are so small, meek and ridiculous that NO ONE will touch them with a forty-foot pole.

BTTF where your money goes to subside Dicko's vest.

BTTF will never get my claim. Never.

BTTF where your money goes to subside Dicko's vest.

BTTF will never get my claim. Never.

He can not multitask, it's either 100% on Twitter or he's down on the street corner hustling funding rounds, but for some reason this Global leader, can't do both?

Doesn't anyone find that strange?

Doesn't anyone find that strange?

Like can't your missus go and land some deals, while you hang out with your bros on Spaces all day, jerking off?

Not her job? Don't you have an acquisition department or what ya call it, a toiletries section, where you shop deals?

Who's the CAO?

Not her job? Don't you have an acquisition department or what ya call it, a toiletries section, where you shop deals?

Who's the CAO?

As this billion dollar market laughs its way past BTTF, the tea boy who would be Bnker, who can't afford the multi-million dollar licenses charged by the broker-dealers, he depends on like a Meth head, remain out of reach.

Thus, he needs you to 'gift' him your claim.

Thus, he needs you to 'gift' him your claim.

Transitional period, means he could not afford the millions needed for the broker-dealer compliance, because the #Celsius Series B funding round was too small, too many overheads. So he shitballed his BTTF clients, by blaming Alex & #Celsius, expecting them to look the other way.

BTTF does not 'generate money' it pays for everything using its onboarded clients funds, through the guise of fees. To pay the millions of dollars, needed for Broker-Dealers licenses. Outside the US, they will onboard dead rats, and ransack their tiny little rat coffins.

Regulation is BTTF's greatest enemy, because it cost them millions, on account of been offshore.

Who in their right mind is going to hand over their claim to that?

You'll be on your way to Van Diemen's Land in no time.

Who in their right mind is going to hand over their claim to that?

You'll be on your way to Van Diemen's Land in no time.

I leave you with the market, BTTF has sunk to the bottom in.

According to Statista, the worldwide crowdfunding segment is projected to grow by 2.46% between 2023 and 2027, resulting in a market volume of US$1.21bn in 2027

statista.com/outlook/dmo/fi…

According to Statista, the worldwide crowdfunding segment is projected to grow by 2.46% between 2023 and 2027, resulting in a market volume of US$1.21bn in 2027

statista.com/outlook/dmo/fi…

Fundera reports that the crowdfunding market is projected to grow to $300 billion by 2030

fundera.com/resources/crow…

fundera.com/resources/crow…

Mordor Intelligence provides an analysis of the crowdfunding market, which is segmented by product type (reward-based crowdfunding, equity crowdfunding, donation, and other product types) and end-user applications

mordorintelligence.com/industry-repor…

mordorintelligence.com/industry-repor…

Grand View Research, the global crowdfunding market size was estimated at USD 1.67 billion in 2022, expected to reach USD 1.88 billion in 2023. Expected to grow at a compound annual growth rate of 16.7% from 2023 to 2030 to reach USD 5.53 billion by 2030

grandviewresearch.com/industry-analy…

grandviewresearch.com/industry-analy…

Mordor Intelligence fights back with reports that the crowdfunding market is poised to grow at a CAGR of 16% by 2027

mordorintelligence.com/industry-repor…

mordorintelligence.com/industry-repor…

Statista projects that the worldwide crowdfunding segment will grow by 2.46% between 2023 and 2027, resulting in a market volume of US$1.21bn in 2027

statista.com/outlook/dmo/fi…

statista.com/outlook/dmo/fi…

Polaris Market Research states that the global crowdfunding market share was valued at USD15.47 billion in 2021 and is expected to grow at a CAGR of 16.1% during the forecast period

polarismarketresearch.com/industry-analy…

polarismarketresearch.com/industry-analy…

Crowdfunding Industry Statistics 2021: Trends, Data, & Market Growth [Infographic] by Fundera

fundera.com/blog/crowdfund…

fundera.com/blog/crowdfund…

Technavio estimates that the crowdfunding market will grow by USD 264.09 billion from 2023 to 2027, with a CAGR of 16%

technavio.com/report/crowdfu…

technavio.com/report/crowdfu…

The list goes on and on and on, but you will never see the BTTF name. #CEL81 #Celsius @CelsiusNetwork @CelsiusUcc

• • •

Missing some Tweet in this thread? You can try to

force a refresh